DOL Opens Door for Crypto in 401(k)s

Wealth Management

MAY 28, 2025

The Department of Labor rescinded its 2022 guidance cautioning against cryptocurrency in 401(k) plans, reaffirming a neutral stance on digital assets in retirement accounts.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MAY 28, 2025

The Department of Labor rescinded its 2022 guidance cautioning against cryptocurrency in 401(k) plans, reaffirming a neutral stance on digital assets in retirement accounts.

Nerd's Eye View

DECEMBER 18, 2024

For investment management services, documenting the entire client engagement – such as onboarding, reviewing and recommending portfolio adjustments in line with collected suitability information, opening and funding accounts, conducting periodic reviews, and rebalancing – can help clearly evidence the services provided.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

DECEMBER 9, 2024

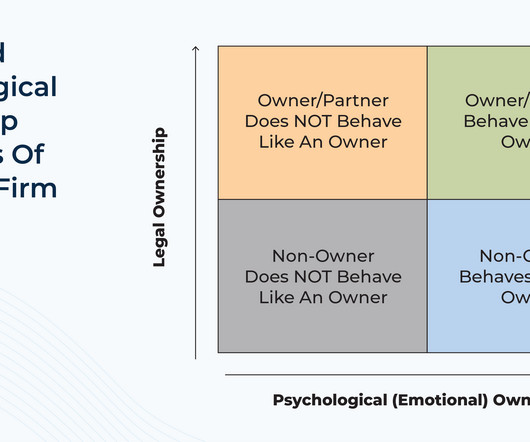

Team members who feel a sense of emotional ownership can be a tremendous asset to the firm, driving productivity, innovation, and leadership. Mentoring legal owners to fully embrace their roles can also guide them toward greater accountability and leadership within the firm.

Nerd's Eye View

FEBRUARY 26, 2025

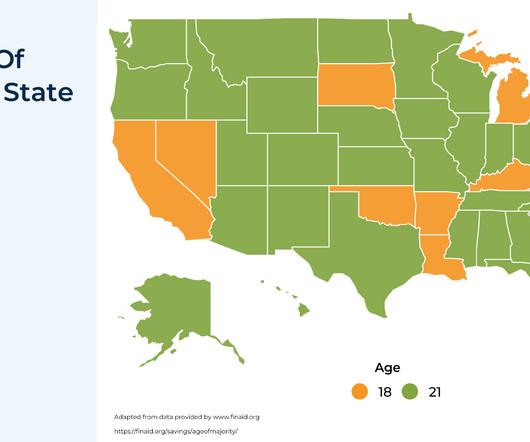

However, once a child reaches the age of majority, they may not always be in a position to manage assets responsibly. In these cases, parents may wish to adjust how gifted assets are structured to better align with their family's long-term goals. Read More.

Wealth Management

AUGUST 5, 2025

Brian Marchiel August 5, 2025 4 Min Read Donny DBM/iStock/Getty Images Plus The unified managed account has undergone a quiet but powerful evolution over the past two decades as managed accounts continue their journey to client centricity. From Product Convenience to Coordinated Accounts UMA 1.0 Yet progress here remains slow.

Wealth Management

JULY 17, 2025

based accounting firm, is taking a page from large registered investment advisors by bringing together taxes and wealth management. Minopoli, who is also a partner in the new RIA, had previously been the chief investment officer of a team managing a $30 billion portfolio for the Knights of Columbus Asset Advisors.

Nerd's Eye View

JANUARY 9, 2025

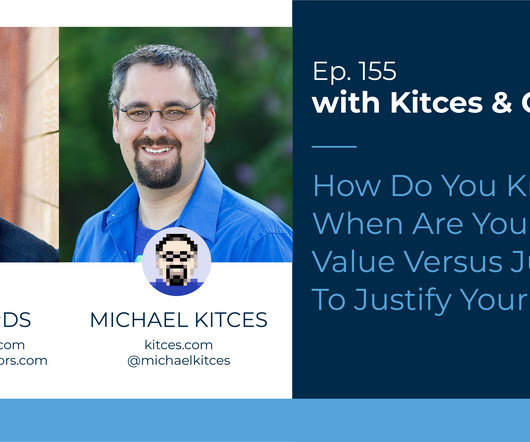

On the other hand, the term "financial advice" often refers to much more than asset allocation and wealth management. This principle extends across many aspects of a firm's value proposition, from client newsletters to account log-in frequency to other common metrics of interest.

Calculated Risk

MARCH 4, 2025

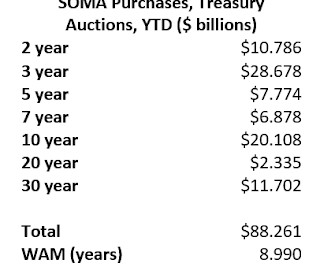

The reason, of course, is that the Federal Reserve funded the bulk of these long-term fixed rate assets with increases in interest-bearing very short-term liabilities mainly depository institution deposits (reserves) and repos --with interest rates tied to the federal funds rate. release, and is available in the FRED database.

Wealth Management

JULY 2, 2025

But it faces stiff competition: just last week, JPMorgan Asset Management — which ranks as the fastest-growing asset manager — launched its first active high-yield ETF with a $2 billion investment from a mystery anchor. Active is 10% of ETF assets now — lots of room to grow.” Junk-bond ETFs have attracted roughly $11.6

Wealth Management

AUGUST 4, 2025

David Bodamer , Editorial Director , WealthManagement.com August 4, 2025 3 Min Read GeoWealth, a Chicago-based turnkey asset management platform, raised $38 million in Series C funding led by Apollo. Morgan Asset Management also participated in the Series C funding. 4, 2025) 11 Investment Must Reads for This Week (Aug.

Calculated Risk

JUNE 12, 2025

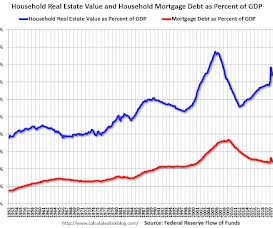

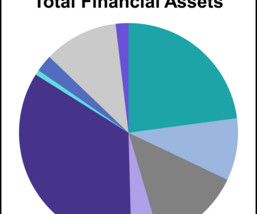

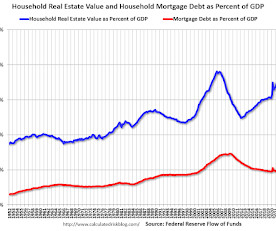

The Federal Reserve released the Q4 2024 Flow of Funds report today: Financial Accounts of the United States. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household debt increased 1.9

Nerd's Eye View

DECEMBER 17, 2024

Fran is the CEO of Toler Financial Group, an RIA based in Silver Spring, Maryland, that oversees nearly $200 million in assets under management for 280 client households. Welcome to the 416th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Fran Toler.

Nerd's Eye View

JUNE 25, 2025

Such clients could include diligent savers (particularly those with additional savings outside of retirement accounts) or those who have received a windfall, such as from a workplace liquidity event or an inheritance. changes to the client's spending, real rate of return, or retirement date) and psychological risks (e.g.,

Advisor Perspectives

JUNE 18, 2025

But what about the assets? What does Uncle Sam actually own, and which asset is the largest? When we think of the U.S. government's finances, we often focus on the massive debt.

Nerd's Eye View

MARCH 12, 2025

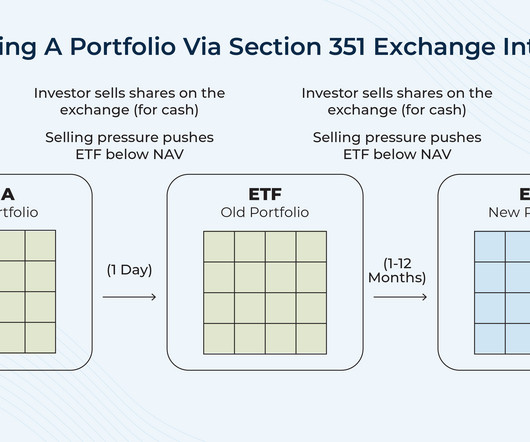

Following the long run-up in the US equity markets since the bottom of the 2008–2009 financial crisis, many investors with taxable investment accounts have likely found themselves with high embedded gains in their portfolios. While the gains signal portfolio growth, they also create challenges for ongoing management.

Calculated Risk

MARCH 11, 2025

Most of these gains in Treasury and Agency MBS assets were funded with increases in very short duration interest-bearing Federal Reserve liabilities, mainly deposits of depository institutions (reserves) and Reverse Repos. of marketable Treasury bills outstanding at the end of February, and Treasury bills accounted for a measly 4.7%

Wealth Management

JUNE 26, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all businessmen around table RPA Operating On The Record Keepers’ Efficient Frontier Operating On The Record Keepers’ Efficient Frontier by Warren Cormier (..)

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo Brennan’s experience is indicative of many young advisors working in the RIA space. Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B

Wealth Management

JUNE 26, 2025

Between 2014 and 2024, Mason transferred client funds into his own accounts and those of the two entities without clients’ authorization, according to the SEC. Mason, who ran Rubicon Wealth Management, a registered investment advisor in Gladwyne, Pa., He pleaded guilty to all of the criminal charges.

Calculated Risk

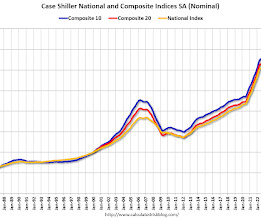

DECEMBER 31, 2024

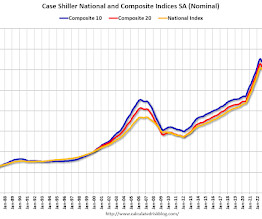

Luke, CFA, Head of Commodities, Real & Digital Assets. Accounting for seasonal adjustments shows a broader rally across the country. Two markets have dominated the top ranks with New York leading all markets the past six months and San Diego the six months prior.

Financial Symmetry

APRIL 14, 2025

Each of these account types has its pros and cons, which I have outlined below. Once you open this account, it functions the same way as every other bank account does for deposits and withdrawals, and you can order a debit card for your child once they get older for spending purposes.

Clever Girl Finance

DECEMBER 23, 2024

As a freelancer, youre your own boss, accountant, and financial planner all rolled into one. Be sure two open separate bank accounts e.g. your personal bank accounts should be separate from your business bank accounts. Keep funds separate Maintain separate accounts for your personal emergency fund and business savings.

Darrow Wealth Management

FEBRUARY 9, 2025

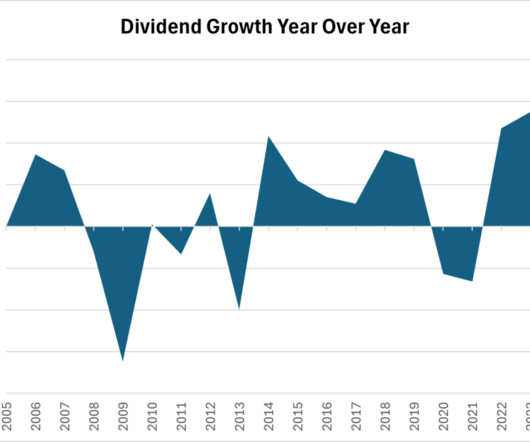

When investing in dividend stocks, bonds, or funds, a higher dividend yield may make an asset look more attractive, but this metric alone doesn’t make a worthwhile investment. In another words, if your asset allocation is 60% stocks and 40% bonds, the current weighted average yield is 2.19%. Also consider state tax implications.

The Big Picture

JANUARY 8, 2025

Fulltranscript below. ~~~ About this weeks guest: Matt Hougan, Chief Investment Officer at Bitwise Asset Management discusses the best ways to responsibly manage crypto assets. His firm runs over $10 billion in client crypto assets. He’s the chief investment officer at Bitwise Asset Management. What is Bitcoin?

Wealth Management

AUGUST 1, 2025

based independent broker/dealer which has 3,000 advisors and $305 billion in assets, for a purchase price of about $2.7 On an earnings call Thursday evening, President and CFO Matt Audette said his firm expects to move Commonwealth assets onto the LPL platform in the fourth quarter of 2026, a little later than its original timeframe.

Tobias Financial

JUNE 18, 2025

At Tobias Financial Advisors, the security of your assets and peace of mind are of utmost importance. Victims are coerced into transferring funds or purchasing gift cards to “secure” their accounts, often under high pressure and with emotionally charged language. Key Steps You Can Take: Pause before acting.

Wealth Management

JULY 31, 2025

These options can be integrated alongside ETFs, mutual funds, SMAs and direct indexing within a single tax-managed custodial account. Related: Zephyrs Adjusted for Risk: Growth Strategies at Gabelli Funds Earlier this year, SMArtX partnered with BondBloxx to construct and distribute multi-asset model portfolios to financial advisors.

Wealth Management

JULY 30, 2025

Despite accounting for the majority of most GPs’ compensation, carried interest (carry) is often overlooked in estate planning conversations. Treating it like any other asset overlooks its unique structure and timing. Its value is uncertain, its mechanics are complex and its future is clouded by political attention.

Calculated Risk

MARCH 13, 2025

The Federal Reserve released the Q4 2024 Flow of Funds report today: Financial Accounts of the United States. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household debt increased 3.1

The Big Picture

DECEMBER 4, 2024

The fund runs 15 ETFs and manages nearly 3 billion in assets. First one maybe about a decade ago, but you’ve really seen it with mutual fund ETF conversions, separate account ETF conversions, and what we’re announcing is an open enrollment. Most of it just assumes you’re in a separate account.

Nerd's Eye View

AUGUST 6, 2025

highest -yielding cash sweeps, lower-cost investment products) to attract advisors and their clients to the platform to pay the fee (and thus grow their own assets). In turn, custodians would be incentivized to better 'stock the shelves' of their custodial platform with unique offerings (e.g.,

Wealth Management

AUGUST 12, 2025

These loans are particularly attractive because they: Allow clients to lend any amount, regardless of the borrower’s credit or assets. Serve as a wealth transfer vehicle, especially when used to finance appreciating assets like real estate. 12, 2025) 11 Investment Must Reads for This Week (Aug. Susie earned her B.S.

Nerd's Eye View

DECEMBER 4, 2024

For firms with high-net-worth clientele, one way to do this is to offer alternative investments, such as private equity, private debt, or hedge funds, which may offer clients the ability to invest in a more diverse range of assets. generally those with over $200,000 of income or $1 million in net worth) are allowed to invest in private funds.

Harness Wealth

NOVEMBER 12, 2024

Fully Utilize Tax-Advantaged Retirement and Savings Accounts There are multiple steps you can take using retirement accounts to reduce your taxable income. Contribute to Tax-Advantaged Retirement Accounts Do your best to fully contribute to one or multiple tax-advantaged retirement accounts, such as 401(k), 403(b), or IRAs.

Financial Symmetry

AUGUST 12, 2025

This week, we get into a topic that confuses many investors: deciding which type of Roth account—Roth IRA, Roth 401(k), or the Mega Backdoor Roth 401(k)—is the best option for their needs. The Vanilla Classic One of the most common questions financial professionals hear every summer is “Which Roth account is right for me?”

Nerd's Eye View

NOVEMBER 22, 2024

Also in industry news this week: Why the announced acquisition of RIA custodian TradePMR by retail brokerage firm Robinhood could prove to be a boon for RIAs on TradePMR's platform, who could receive a wave of referrals from Robinhood's massive base of next-generation retail clients How Morningstar is cutting the "Medalist Ratings" of thousands of (..)

Darrow Wealth Management

APRIL 21, 2025

While a Roth conversion may never make sense for some individuals, for others, early retirement years may be the best time to convert pre-tax accounts to tax-free Roth. This approach typically provides greater benefits to those who have significant assets and high taxable income in retirement.

Calculated Risk

FEBRUARY 25, 2025

Luke, CFA, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. After accounting for seasonal adjustments, our National Index pushed forward to achieve a 19th consecutive all-time high, Luke continued. National home prices have risen by 8.8% San Francisco is now 11.0%

The Big Picture

NOVEMBER 26, 2024

Full transcript below. ~~~ About this week’s guest: Matt Hougan, Chief Investment Officer at Bitwise Asset Management discusses the best ways to responsibly manage crypto assets. His firm runs over $10 billion in client crypto assets. How can investors get exposure to the space? Matt Hougan : Yeah. All of them.

Trade Brains

JULY 4, 2025

8,104 crore, while the rest of the states combined accounted for Rs. A key highlight of the quarter was the improvement in asset quality. The monthly accretion rate of PAR 15+ to Assets Under Management (AUM) has shown a steady decline across most states, indicating improved collection efficiency and stronger borrower discipline.

Harness Wealth

APRIL 17, 2025

As Gio Bartolotta, Partner at GoJo Accountants , explains “ordinary” means the expense must be common and accepted within your trade or business, while “necessary” indicates it should help or be appropriate for running operationsnot necessarily indispensable.

Wealth Management

JUNE 27, 2025

He began his career in public accounting at Coopers & Lybrand, LLC. Michael was instrumental during AssetMark’s leveraged buyout transition to Genstar in 2013, its sale to Huatai Securities in 2016, its IPO in 2019, and its sale to GTCR in 2024.

Wealth Management

JULY 31, 2025

Wealth managers will play a considerable role in helping current asset holders plan and facilitate this unprecedented reallocation of wealth. A lack of accountability and a clear AI decision-making framework are two key factors limiting AI adoption today. Raymond James Practice Mercer Advisors Lands $1.2B

Wealth Management

JULY 2, 2025

Advisor-facing agents auto-populate account forms, flag missing items, and confirm custodian requirements on the fly—all without human intervention. What would normally require a lengthy back-and-forth of data entry, PDF uploads, manual reviews, and e-signature coordination becomes near-instant. This isn’t automation for automation’s sake.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content