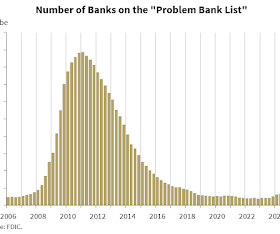

FDIC: Number of Problem Banks Decreased in Q4 2024

Calculated Risk

FEBRUARY 25, 2025

percent) from 2023. The increase primarily occurred due to one-time events in 2023 and 2024 that led to lower noninterest expense (down $8.5 The increase primarily occurred due to one-time events in 2023 and 2024 that led to lower noninterest expense (down $8.5 percent, down 8 basis points from 2023. billion, up $14.1

Let's personalize your content