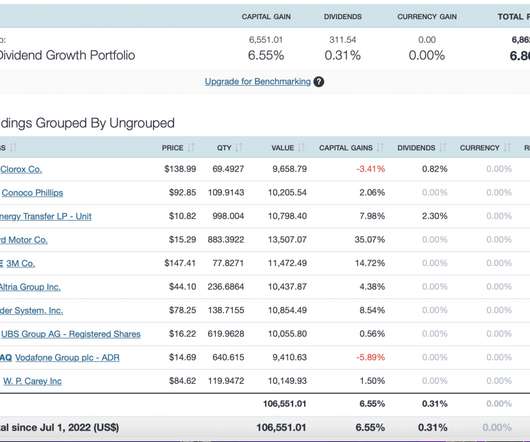

Top 10 Dividend Growth Portfolio

Dear Mr. Market

AUGUST 5, 2022

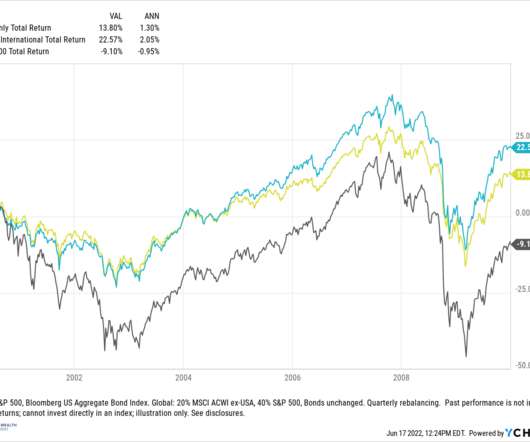

We’re currently seeing one of the largest disparities in valuations between growth and value stocks which in our opinion presents a very appealing opportunity for dividend seeking investors. On some quarters, where there may not be changes to any holdings within the portfolio, we may dive more in depth on a specific company or two.

Let's personalize your content