Four Quadrant Portfolio Check Up

Random Roger's Retirement Planning

MARCH 12, 2025

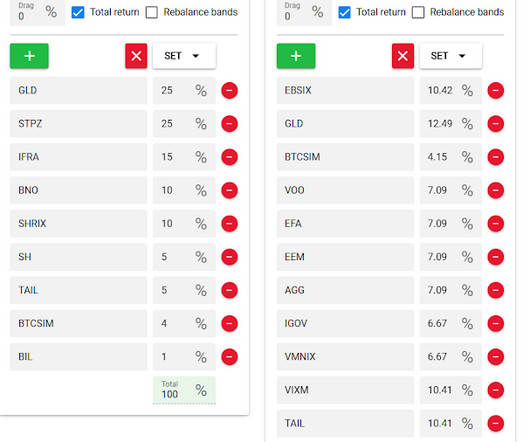

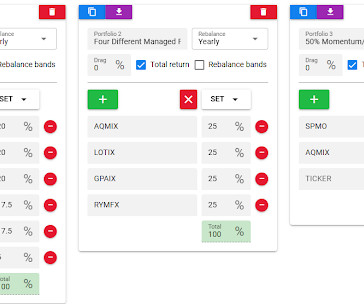

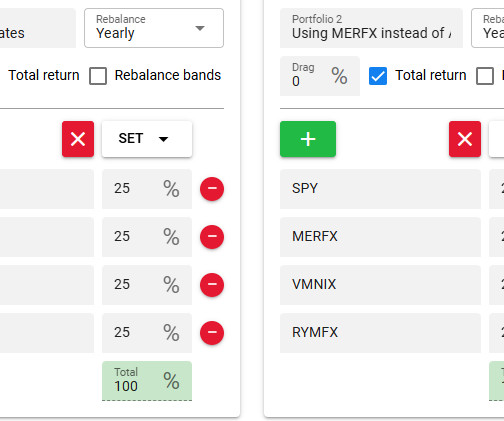

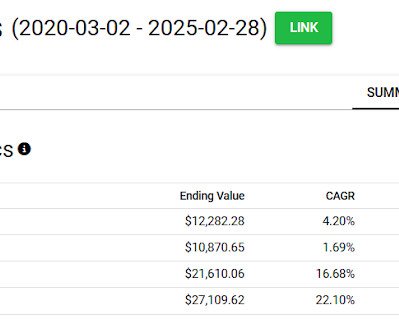

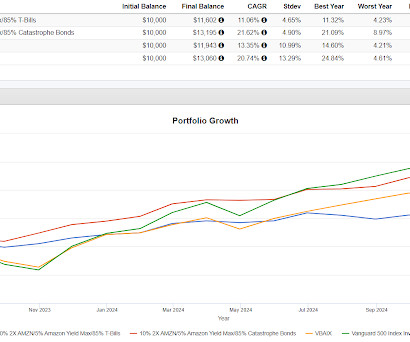

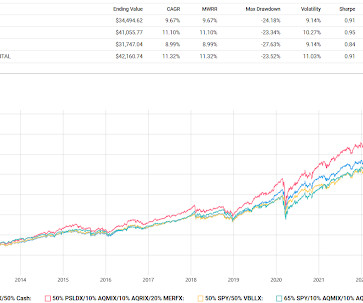

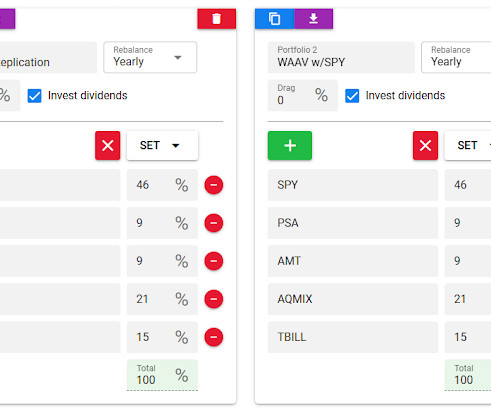

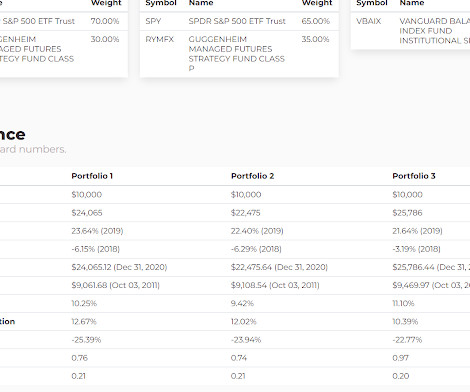

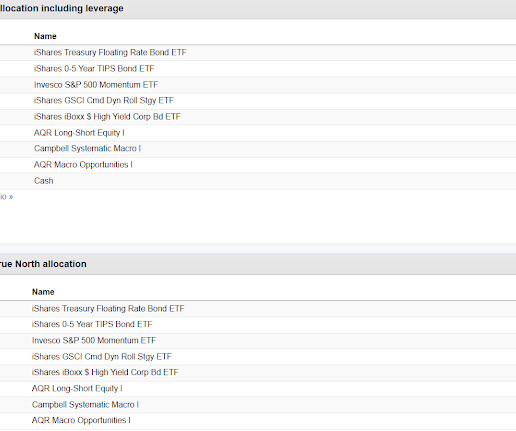

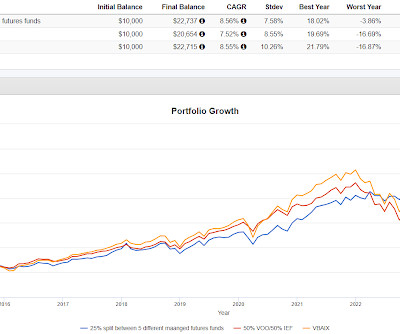

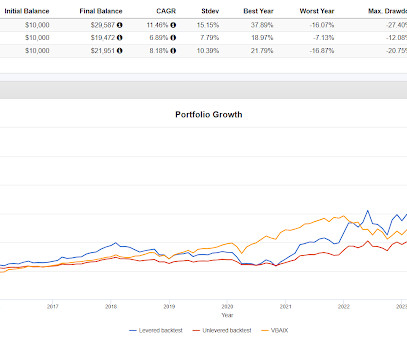

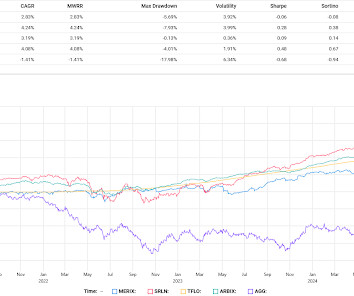

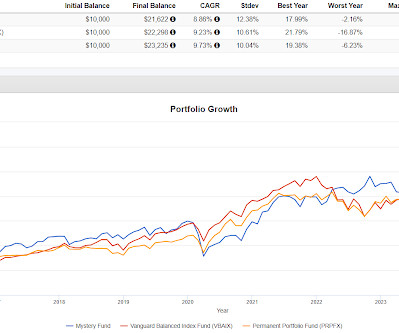

Let's dig in some more on Permanent Portfolio quadrant style. Next is the allocation for the United States Sovereign Wealth Fund ETF that I made up a few days ago and next to that is my most recent attempt from November to recreate the Cockroach Portfolio which is managed by Mutiny Funds. That is a very specialized type of result.

Let's personalize your content