A Spectacularly Underappreciated 15 Years

The Big Picture

APRIL 28, 2025

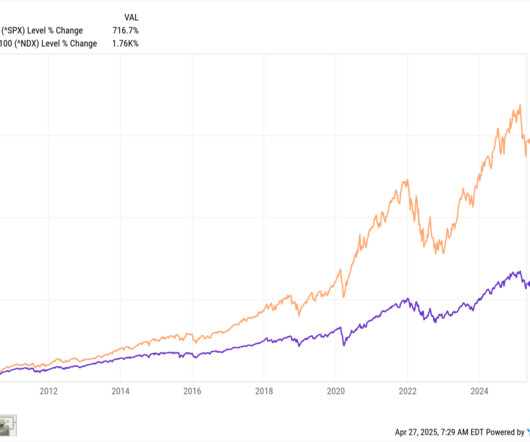

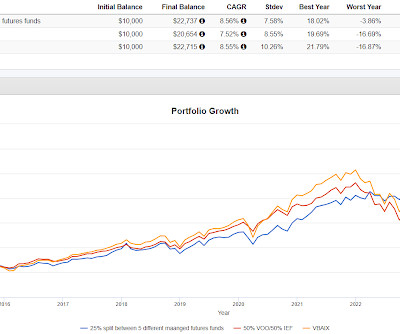

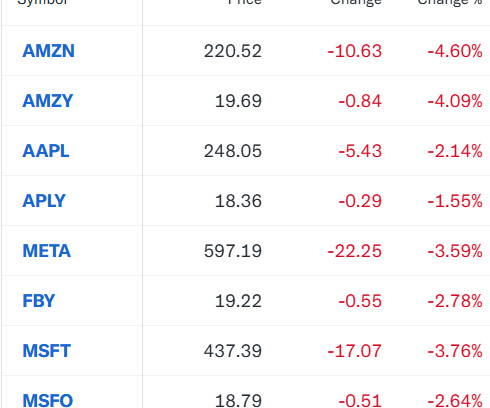

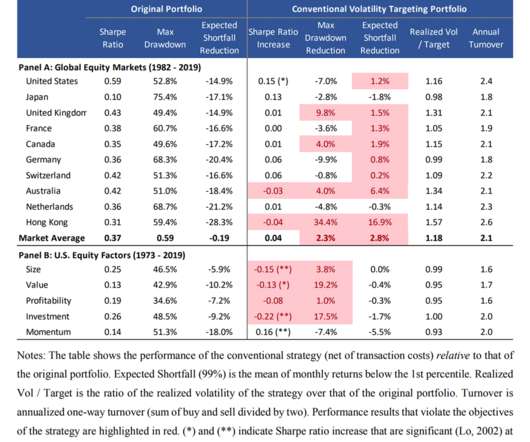

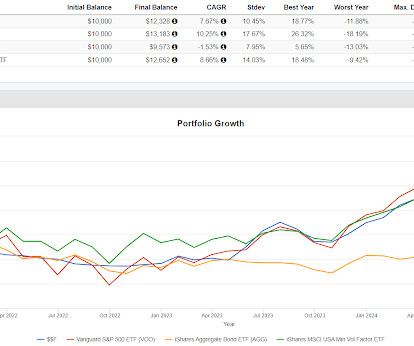

Q1 2020 down 34% in the pandemic. Financial Repression was the rallying cry for underperforming managers. is not what risk managers call a rational trading day. See also Lazy Portfolios rolling returns. 2015 gain of only 1.4% -2018 drop of 4.4%, including a Q4 drop of nearly 20%. -Q1 2022 down 18% for the year.4

Let's personalize your content