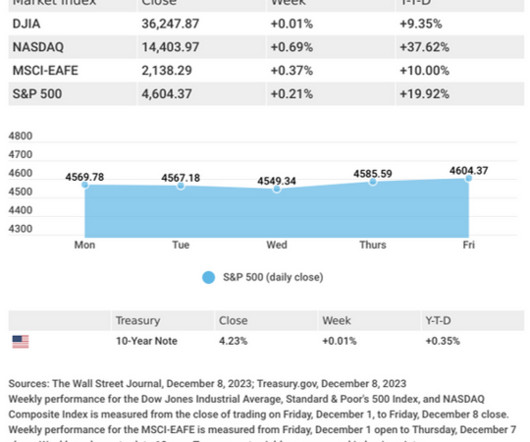

Weekly Market Insights – December 11, 2023

Cornerstone Financial Advisory

DECEMBER 11, 2023

jump in productivity represented the fastest pace since the third quarter of 2020. 5 This Week: Key Economic Data Tuesday: Consumer Price Index (CPI). Source: Econoday, December 8, 2023 The Econoday economic calendar lists upcoming U.S. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc.,

Let's personalize your content