Join The Bond Market Resistance!

Random Roger's Retirement Planning

APRIL 22, 2024

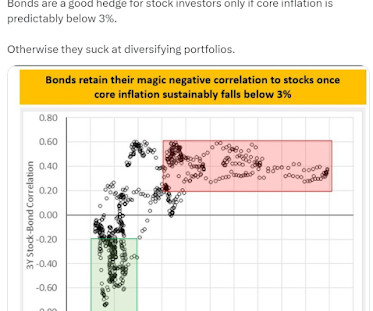

This blog has pretty much evolved into 100 ways to build a portfolio without bonds. The article devoted a good amount of space to bond market math, focusing on the pain of owning the iShares 20+ Year Treasury ETF (TLT) and bond funds in general. There is nothing that says TLT must get back to the $171 dollars it traded at in 2020.

Let's personalize your content