MiB: Colin Camerer on Neuroeconomics

The Big Picture

NOVEMBER 15, 2024

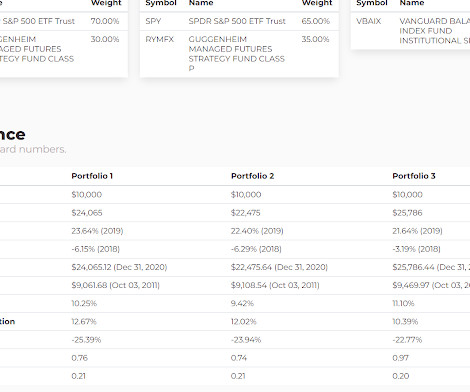

Camerer won the MacArthur Fellow (Genius award) in 2013. He is the portfolio manager of the Return Stacked ETF Suite, manging 800 million in ETF assets. He is a member of the American Academy of Arts and Sciences and holds fellowship at the Econometric Society and the Society for the Advancement of Economic Theory.

Let's personalize your content