Build a Resilient Investment Strategy With The All Weather Portfolio

Validea

JUNE 2, 2025

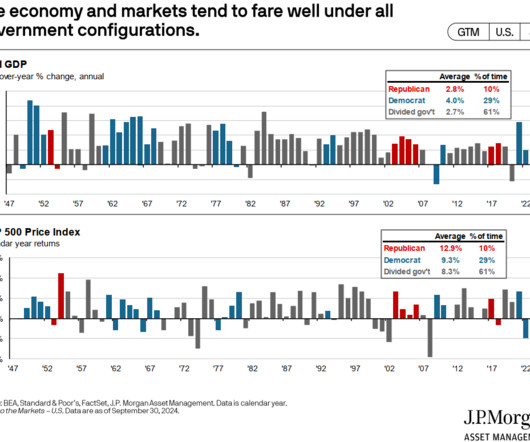

Investors looking for a diversified portfolio that performs well in all market conditions have long been drawn to the All Weather Portfolio, a strategy pioneered by Ray Dalio of Bridgewater Associates. The portfolio allocates across U.S. equities, gold, commodities, and long-duration and intermediate-term Treasury bonds.

Let's personalize your content