5 Ways to Protect Your Finances in 2025 from a Recession

WiserAdvisor

JUNE 24, 2025

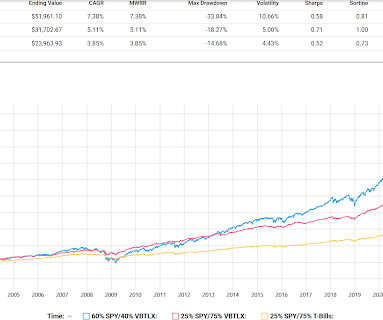

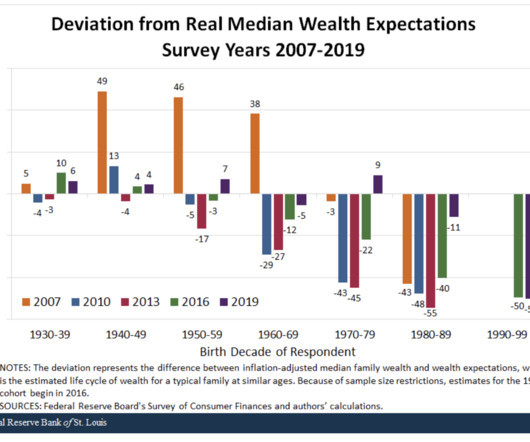

You hear the word recession and might be reminded of the Great Recession from late 2007 to mid-2009. Once you have a number, multiply it by six. The red numbers in your portfolio are only losses on paper. But what if you are in your 60s or 70s and getting ready to retire? You need to skip the fun stuff for now.

Let's personalize your content