The 60/40 Portfolio is Back! *after not going away

The Big Picture

APRIL 19, 2023

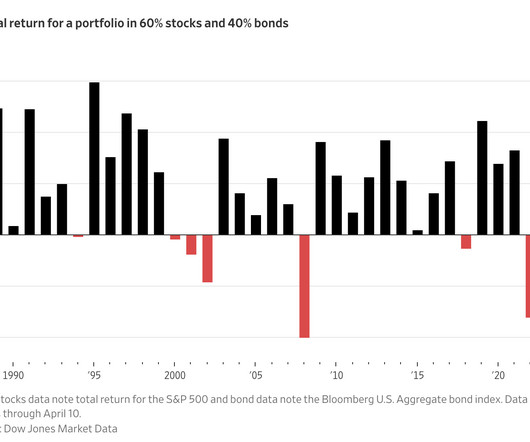

Despite the headline, the Wall Street Journal chart (above) reveals 2022 as the exception that proves the point: Prior selloffs — 2000-03 and 2008-09 — were all equity driven. Morningstar, April 17, 2023 ) _ 1, The caveat being 60/40 reflects a fairly moderate risk tolerance, and higher equity allocations (e.g.,

Let's personalize your content