Question #1 for 2025: How much will the economy grow in 2025? Will there be a recession in 2025?

Calculated Risk

JANUARY 5, 2025

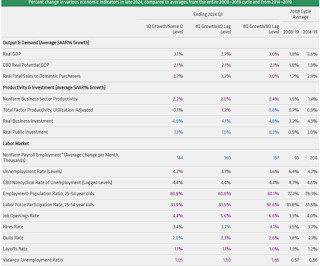

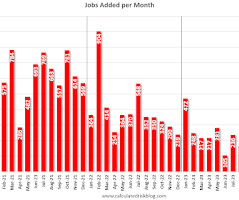

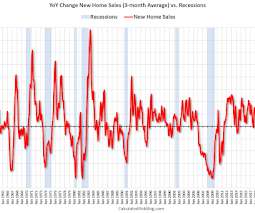

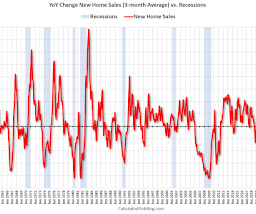

How much will the economy grow in 2025? A year ago, I argued that "the economy will avoid recession" in 2024, and that a soft landing was the likely outcome. 2008 0.1% -2.5% Here are the Ten Economic Questions for 2025 and a few predictions: Question #1 for 2025: How much will the economy grow in 2025? Q4-over-Q4).

Let's personalize your content