Three Things – Exponential AI

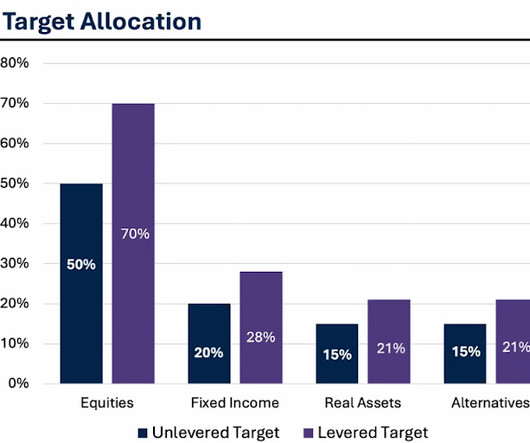

Discipline Funds

MAY 28, 2025

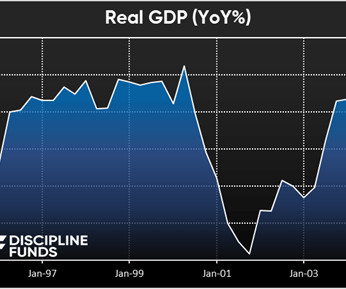

For example, I am not a tax expert, but I know enough about taxes and how they relate to personal finance that I can quickly resolve almost any tax related issue and answer questions that might have otherwise relied on an expert. The Nasdaq Bubble is an interesting case study in how this could all play out over time.

Let's personalize your content