Three Things – Macro Thoughts

Discipline Funds

JULY 30, 2025

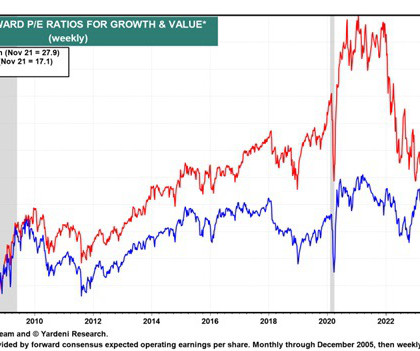

For example, tech stocks have generated 8% per year since January 2000. But the risks should be communicated so investors can build appropriately corresponding financial plans and portfolios. Getting back on point though – this is always the problem with crazy high valuations/expectations.

Let's personalize your content