Impact of New $15M 'Permanent' Estate/Gift Tax Exemption

Wealth Management

JULY 7, 2025

Explore how the new $15 million federal estate tax exemption affects lifetime transfer planning and strategies for high-net-worth clients.

Wealth Management

JULY 7, 2025

Explore how the new $15 million federal estate tax exemption affects lifetime transfer planning and strategies for high-net-worth clients.

Abnormal Returns

JULY 7, 2025

Podcasts Michael Batnick talks with Jason Wenk, CEO of Altruist, about the changing custody landscape. (youtube.com) Jeff Bernier talks with Larry Swedroe about the the evolving role of alternative assets like private credit and reinsurance in modern portfolios. (youtube.com) Barry Ritholtz talks with Kate Moore, chief investment officer at Citi Wealth.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Calculated Risk

JULY 6, 2025

The first graph shows the unemployment rate by four levels of education (all groups are 25 years and older) through June 2025. Note: This is an update to a post from several years ago. Unfortunately, this data only goes back to 1992 and includes only three recessions (the stock / tech bust in 2001, and the housing bust/financial crisis, and the 2020 pandemic).

The Big Picture

JULY 5, 2025

The weekend is here! Pour yourself a mug of Colombia Tolima Los Brasiles Peaberry Organic coffee, grab a seat outside, and get ready for our longer-form weekend reads: • JPMorgan’s Risky, 5-Day Dash to Help Warner Bros. Split in Two : Offering creditors a deal that would leave them with billions less than they were owed, despite the notes having an investment-grade rating.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JULY 7, 2025

Zephyr's Ryan Nauman and FolioBeyond's Dean Smith cover the changing landscape of fixed income investing, the impact of tariffs, the importance of managing drawdown risk, and adapting investment strategies to modern market conditions.

Abnormal Returns

JULY 6, 2025

Also on the site this week. Newer, cheaper, better isn't always. (abnormalreturns.com) Make sure you stay on top of everything on Abnormal Returns. Sign up for our (free) daily e-mail newsletter. (abnormalreturns.com) Are you a financial advisor? Sign up for our (free) weekly advisor-focused newsletter. (newsletter.abnormalreturns.com) Top clicks this week Most investors don't understand the yield on option strategy ETFs.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Big Picture

JULY 7, 2025

I had a fun conversation with Adam Gower, who runs Gower Crowd — a real estate capital sourcing firm that “builds digital marketing platforms for real estate sponsors.” He also hosts a podcast, The Real Estate Market Watch ( Apple , Spotify , YouTube ). Discussing risk, noise, and uncertainty from a real state perspective led to a fun conversation.

Wealth Management

JULY 7, 2025

As 401(k) plan formation explodes, banks may step in to serve the market. JPMorgan's success offers a model, but challenges remain for new entrants.

Abnormal Returns

JULY 6, 2025

Markets Why we need to remind ourselves about market lessons over and over again. (tker.co) After Datadog ($DDOG), the next stocks that could be headed into the S&P 500. (sherwood.news) Trading Dark pools are taking market share and the exchanges are not happy about it. (barrons.com) Jane Street has been suspended from trading in India's stock market.

Calculated Risk

JULY 5, 2025

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. • FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores • Freddie Mac House Price Index Declined in May; Up 2.2% Year-over-year • Fannie and Freddie: Single Family Serious Delinquency Rates Decreased in May • Asking Rents Mostly Unchanged Year-over-year This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

The Big Picture

JULY 5, 2025

Good conversation with Sammy Azzous: Barry blends behavioral finance with data analysis to uncover some of the most common (and costly) investing mistakes — and how to steer clear of them. Tune in for actionable takeaways on failing better, managing market noise, and navigating the world of financial “experts.” Plus, Barry explains why the childhood advice “Don’t take candy from strangers” also holds true for grown-up investors.

Wealth Management

JULY 7, 2025

Bill Ramsay, the founder of Financial Symmetry, grew his RIA Edge 100 RIA firm organically with shared employee ownership and an internship program that has led to a young, invested team.

Nerd's Eye View

JULY 7, 2025

Welcome to the July 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that CRM provider Wealthbox has sold a majority stake in itself to PE firm Sixth Street, marking a new phase in its growth from having a customer base primarily concentrated among small and midsize RIA firms

Calculated Risk

JULY 5, 2025

This will be a very light week for economic data. -- Monday, July 7th -- No major economic releases scheduled. -- Tuesday, July 8th -- 6:00 AM ET: NFIB Small Business Optimism Index for June. -- Wednesday, July 9th -- 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. 2:00 PM: FOMC Minutes , Meeting of June 17-18 -- Thursday, July 10th -- 8:30 AM: The initial weekly unemployment claims report will be released.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Trade Brains

JULY 6, 2025

Debt can be a fantastic asset for driving business growth when handled correctly, but if it’s not managed well, it can take a serious toll on a company’s financial stability. In this article, we’ll look at four fundamentally strong companies that keep their debt levels low, showcasing their financial discipline and minimizing risk. 1. KNR Construction KNR Constructions Ltd, incorporated in 1995, is a Hyderabad-based infrastructure project development company providing EPC services in segments su

Wealth Management

JULY 7, 2025

Merit Financial Advisors, with $19.94B in assets, agrees to sell a minority stake to Constellation Wealth Capital as it prepares for future growth.

Getting Your Financial Ducks In A Row

JULY 7, 2025

Photo credit: jb We’ve discussed here in the past about how it is a perfectly legal maneuver to make a non-deductible contribution to a traditional IRA and then at some point later convert the same contribution to your Roth IRA (see Is it Really Allowed? for more). If you have no other IRA accounts, this conversion to Roth can be a tax-free event, especially if there has been no growth or gains on the investments in the account.

Calculated Risk

JULY 7, 2025

Altos reports that active single-family inventory was up 2.7% week-over-week. Inventory is now up 36.6% from the seasonal bottom in January and is still increasing. Usually, inventory is up about 20% from the seasonal low by this week in the year. So, 2025 is seeing a larger than normal pickup in inventory. The first graph shows the seasonal pattern for active single-family inventory since 2015.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Abnormal Returns

JULY 7, 2025

Markets You can't be a long-term investor if you aren't an optimist. (optimisticallie.com) You never could have predicted the stock market's first half 2025 performance. (mrzepczynski.blogspot.com) Crypto Crypto projects need revenue. (tomtunguz.com) CoreWeave ($CRWV) is buying miner Core Scientific ($CORZ). (theblock.co) Private equity Some endowment fund are doubling down on private equity.

Wealth Management

JULY 7, 2025

The filing comes as Ark’s eight actively managed ETFs have seen more than $3 billion in net outflows over the past 12 months, with $2 billion pulled from ARKK alone.

Trade Brains

JULY 5, 2025

Several fundamentally strong companies are catching investor interest with strong fundamentals and low stock prices. These firms, priced under Rs. 250, have impressive order books, one even reaching Rs. 1.21 lakh crore. Despite their solid business, they’re trading at discounts of up to 38 percent. This makes them attractive picks for those looking to add value stocks to their watchlist.

Calculated Risk

JULY 6, 2025

Weekend: • Schedule for Week of July 6, 2025 Monday: • No major economic releases scheduled. From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 22 and DOW futures are down 112 (fair value). Oil prices were up over the last week with WTI futures at $66.50 per barrel and Brent at $68.30 per barrel. A year ago, WTI was at $84, and Brent was at $89 - so WTI oil prices are down about 21% year-over-year.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

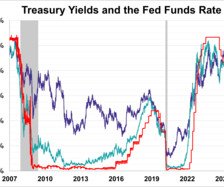

Advisor Perspectives

JULY 7, 2025

The yield on the 10-year note ended July 3, 2025 at 4.35%. Meanwhile, the 2-year note ended at 3.88% and the 30-year note ended at 4.86%.

Wealth Management

JULY 7, 2025

As communications become more dynamic and digital interactions more complex, static captures are increasingly out of step with the needs of modern compliance and the expectations of U.S. regulators.

Trade Brains

JULY 6, 2025

Finding fast-growing companies is great but finding ones that grow without taking on much debt is even better. These five mid-cap companies are doing just that. They’re growing strong while keeping their borrowings low, making them safer and more stable. Why Growth + Low Debt Matters When a company’s revenue keeps growing every year, it shows that the business is expanding and doing well.

XY Planning Network

JULY 7, 2025

XYPN LIVE is the full-day exhibit hall experience you won’t find anywhere else. That’s because every industry innovator in the Exhibit Hall has been hand-picked by our team, so you don’t have to independently vet each new technology that comes onto the scene—that’s our job. If you’re looking for ways to dig deeper and maximize your current tech stack—or you’re looking for your next great partner as you scale—the XYPN LIVE Exhibit Hall is designed for you.

Speaker: Cheryl J. Muldrew-McMurtry

Remote finance teams are rewriting how the back-office runs—and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats have become more than just “growing pains”. They’re now liabilities. The challenge isn’t just team distribution, but building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Advisor Perspectives

JULY 7, 2025

U.S. stocks are no longer the best-performing asset class this year. Gold and foreign stocks are the best performers.

Alpha Architect

JULY 7, 2025

This paper explores how value, momentum, low-risk, and size factors explain differences in corporate bond returns across firms and over time. What Factors Drive Corporate Bond Returns? was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Trade Brains

JULY 7, 2025

The following is a list of four stocks that witnessed notable price movements during Monday’s trading session, following significant bulk deal transactions executed on the stock exchanges on 4th July. These fluctuations reflect investor sentiment and market reactions to the large-scale buying or selling activities observed during the period. Dreamfolks Services Limited With a market cap of Rs. 963 crores, the stock moved down by nearly 7 percent on BSE, falling to Rs. 177.6 on Monday.

Diamond Consultants

JULY 7, 2025

Part two of the series “UBS at a Crossroads” explores the possible outcomes and implications for UBS advisors and their businesses. When a firm as globally powerful as UBS begins to show cracks in the foundation, the result is not chaos, but quiet unrest. Advisors don’t panic. They observe. They listen. They assess. And then they begin to consider their options.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Let's personalize your content