Does Return Stacking With Managed Futures Work?

Random Roger's Retirement Planning

APRIL 7, 2024

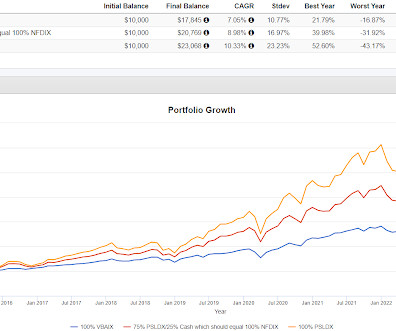

Let's have a little fun with a difference of opinion about how to incorporate managed futures into a portfolio between to big proponents, Corey Hoffstein from ReturnStacked ETFs and Andrew Beer who runs the iMPG DBi Managed Futures Strategy ETF (DBMF). Both of them talk about how to add managed futures to a portfolio.

Let's personalize your content