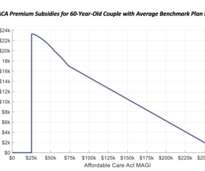

Tax Planning and Health Insurance Premium Subsidies under the Affordable Care Act

Advisor Perspectives

NOVEMBER 14, 2022

A matter that can have large impacts on the marginal tax rates faced by individuals who obtain health insurance coverage through the ACA exchanges is the reduction of the tax credits (or subsidies) for health insurance coverage as incomes increase.

Let's personalize your content