The 5 Pillars of Retirement Planning You Should Be Aware of

WiserAdvisor

MARCH 13, 2024

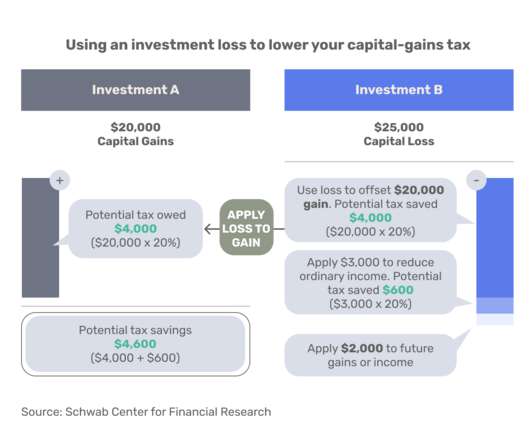

Achieving financial freedom in retirement requires meticulous planning, dedicated effort, and strategic management. Within this framework, the concept of the five pillars of retirement planning emerges as a valuable strategy. Diversification lies at the heart of investment planning.

Let's personalize your content