Health Savings Accounts – The Other Retirement Plan

The Chicago Financial Planner

OCTOBER 21, 2021

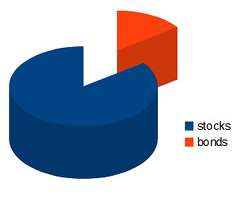

Saving for retirement is a major undertaking for most of us. Health savings accounts (HSA) provide another vehicle to save for retirement. An HSA can serve as an additional retirement savings vehicle on top of your IRA or 401(k) to help cover healthcare and other retirement expenses. Qualified medical expenses .

Let's personalize your content