The WealthStack Podcast: The Evolution of Financial Advisors as Risk Managers

Wealth Management

JULY 22, 2022

Rick Bookstaber and Dr. Ashby Monk discuss the importance of understanding risk.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 22, 2022

Rick Bookstaber and Dr. Ashby Monk discuss the importance of understanding risk.

Nerd's Eye View

JANUARY 22, 2024

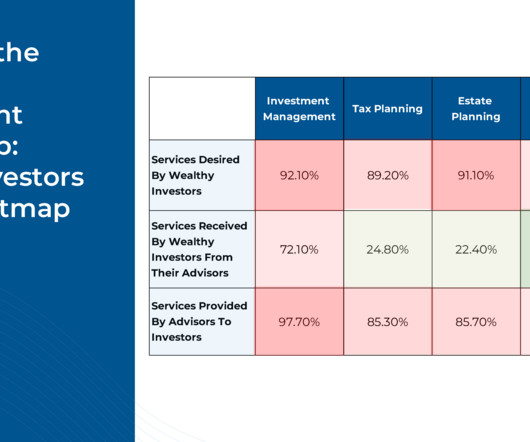

In the early days of wealth management, a financial advisor's value proposition was relatively explicit, typically focusing on a limited range of portfolio management activities (e.g., selling and trading) or on sales-oriented advice that centered on implementing insurance products.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Carson Wealth

JANUARY 8, 2025

While some individuals manage their finances independently or utilize automated platforms, the personalized guidance of a financial advisor may offer distinct advantages. One study found that an advisor-managed portfolio could produce an additional 3% value add annually over a self-managed (DIY) portfolio.

Nerd's Eye View

JANUARY 24, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that while overall financial advisor headcount remains relatively flat, the RIA channel continues to gain share in terms of both headcount (as brokers break away to start their own independent firms and aspiring advisors seek (..)

Carson Wealth

FEBRUARY 4, 2025

Understanding Tax Compliance and Risk Management Ultra-high-net-worth individuals face unique tax challenges, including high rates and ever-changing complex tax codes. If managed improperly or inefficiently, tax issues could significantly erode your familys wealth and even lead to legal complications.

Zoe Financial

MARCH 21, 2025

What Do Financial Advisors Do? Published: March 21st, 2025 Reading Time: 6 minutes Written by: The Zoe Team Managing wealth involves more than just investingit requires careful planning, strategic decision-making, and a long-term vision. What Does a Financial Advisor Do?

Wealth Management

JUNE 12, 2025

Related: RIAs Focused on ETFs with Specialized Strategies, Risk Management in Q1 “The commonality for 70% of infrastructure is that these are generally industries that are regulated,” he said. His infrastructure team, which includes analysts in New York, Europe and Asia, is trying to identify and understand regulatory risks.

Nerd's Eye View

MARCH 15, 2023

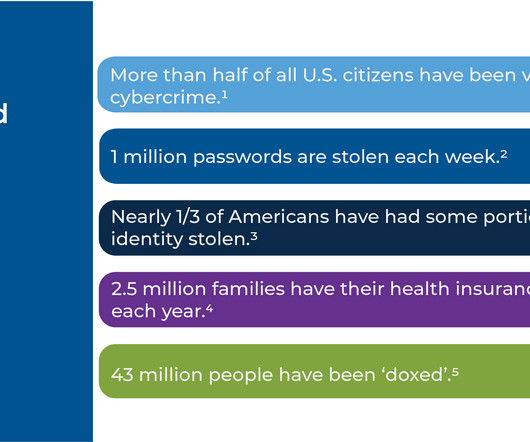

Risk management is a key part of many financial advisors’ value propositions. For instance, ensuring clients maintain the proper insurance coverage based on their needs is an important part of the financial planning process. when tagged online pictures can be used to identify an individual’s location).

BlueMind

OCTOBER 25, 2022

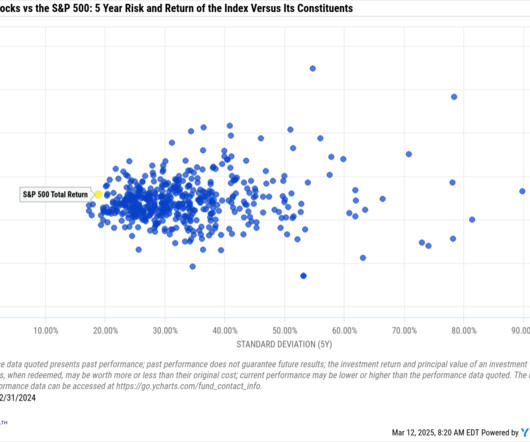

However, amid these fears, it has become difficult for financial advisors to explain to clients that taking appropriate risks is deemed necessary in order to ensure your portfolio has the growth potential to reach your financial goals. Related: How to Determine Your Client’s Risk Capacity!

Indigo Marketing Agency

DECEMBER 19, 2022

As a financial advisor, your job requires you to stay on top of leading industry information, the evolving ways to connect with clients, and new strategies for managing money. That’s why we’ve identified the top 41 financial influencers we believe will greatly impact the industry in 2023. Ron Carson. Samantha Russell.

Indigo Marketing Agency

APRIL 28, 2023

Financial Advisor Bio Most financial advisors haven’t completely filled out their LinkedIn profiles. Writing a LinkedIn bio for financial advisors can be the most difficult type of writing, yet a great bio is critical when attracting prospects online. Do you simplify their financial picture?

BlueMind

DECEMBER 23, 2022

The following is a collection of some of the best movies and dramas that may interest financial advisors and provide some life lessons for you to bear in mind as you progress in your career as a financial advisor. . You will Like: How Advisors Deal With High Net Worth Clients. The Wolf Of Wall Street (2013).

Zoe Financial

MARCH 21, 2025

What Do Financial Advisors Do? Published: March 21st, 2025 Reading Time: 6 minutes Written by: The Zoe Team Managing wealth involves more than just investingit requires careful planning, strategic decision-making, and a long-term vision. What Does a Financial Advisor Do?

Yardley Wealth Management

JANUARY 21, 2025

Risk Management and Insurance Another reason why talking to a financial planner is worth it involves risk management. Exploring the Benefits of Financial Planning appeared first on Yardley Wealth Management, LLC.

MainStreet Financial Planning

FEBRUARY 7, 2024

Ramona Johanneson from Arthur J Gallagher Risk Management joins our Chalk Talk series to give us the state of the insurance industry, starting with our largest investment, our home. Ramona Johanneson is an Area Vice President/Producer handling new business for the brokerage of Arthur J Gallagher Risk Management.

Abnormal Returns

MARCH 13, 2023

peterlazaroff.com) Daniel Crosby talks with Eben Burr, who is the President of Toews, about risk management. thinkadvisor.com) What clients need to know about firing a financial advisor. (kitces.com) Peter Lazaroff talks SECURE Act 2.0 with Plancorp's Brian King. kindnessfp.com)

NAIFA Advisor Today

JANUARY 28, 2025

As a Retirement Income Certified Professional and a Life and Annuities Certified Professional, John advises clients on retirement planning, investment planning, and risk management. He serves as a NAIFA leader and has held several leadership roles at the local, state, and national levels.

Carson Wealth

JANUARY 23, 2025

Benefits of Bucketing There are several benefits of using the bucketing method of financial planning, including: Simplicity and clarity: Easily visualize your financial plan and understand the role of each asset. Risk management: Helps align investments with time horizons to help minimize market risks.

Carson Wealth

JULY 3, 2024

Identifying these risks early and having a plan to mitigate them can save your business from significant setbacks. Conduct a risk assessment to identify potential risks and their impact on your business. Consulting a financial advisor can help you optimize your retirement plan based on your financial goals.

WiserAdvisor

JUNE 13, 2025

Finally, working with a trusted financial advisor can make a big difference. An advisor can help you stay focused during market swings and avoid making emotional decisions that could hurt your long-term progress. Mistake #4: Not setting clear financial goals Saving for “someday” in the future isn’t enough.

WiserAdvisor

SEPTEMBER 8, 2022

Interest rate risk, inflation risk, recession risk, and others can surface from time to time and affect your investments as well as peace of mind. This is why portfolio risk management can be very critical. However, it is crucial to understand how to manage portfolio risk and what can trigger it.

International College of Financial Planning

JULY 10, 2023

This blog post will discuss the various aspects of being an investment advisor in India, including career prospects, roles and responsibilities, qualifying exams, necessary qualifications, job opportunities, and salary potential.

Darrow Wealth Management

MARCH 13, 2025

Unfortunately, most executives and insiders have less flexibility to reduce risk on a concentrated position of company stock. The situational nature of planning to diversify one large position cannot be over-emphasized, so it’s important to work with a financial advisor who has experience in this area.

Indigo Marketing Agency

JANUARY 17, 2022

It’s no secret that the financial landscape is changing rapidly. To stay ahead of the curve, financial advisors must identify and align themselves with the top influencers in the field. Here are 36 financial advisor influencers who will likely have a big impact on the industry in 2022.

Yardley Wealth Management

OCTOBER 1, 2024

Bitcoin’s Vulnerability to Technological Disruption As Mike Garry, host and financial advisor, points out, the value of Bitcoin largely hinges on its scarcity. Diversification and Risk Management The key takeaway from the discussion is the importance of diversification. Could Bitcoin experience a similar downfall?

Sara Grillo

DECEMBER 12, 2022

Watch as all h&#@ breaks loose discussing the question of broker vs. financial advisor, commissions, fees, value, and more! I am a CFA® charterholder and financial advisor marketing consultant. I am an irreverent and fun marketing consultant for financial advisors. This debate went psycho at times.

Midstream Marketing

SEPTEMBER 15, 2019

We’ve recently compiled a handy list of all the top financial advisor and wealth management blogs out there, as per traffic estimates from SEMRUSH. If you make it a priority to follow just one financial advisor or wealth management blog, do yourself a favor and make sure it’s this one.

Sara Grillo

AUGUST 14, 2023

So we’ve got a lively crew here today to debate, does it really matter if someone is a fiduciary financial advisor, or not? I am a CFA® charterholder and financial advisor marketing consultant. I am an irreverent and fun marketing consultant for financial advisors. Let’s debate it! Let’s talk about it.

WiserAdvisor

FEBRUARY 29, 2024

Working with a financial advisor can significantly enhance your chances of retiring with more wealth. According to the National Study of Millionaires, nearly 7 out of 10 millionaires attribute their success, in part, to partnering with an investment professional or financial advisor. However, there is good news.

WiserAdvisor

JANUARY 23, 2024

The decision to hire a financial advisor is a prudent move. Seeking professional advice can provide valuable insights and a roadmap to achieve your financial goals with strategic planning. But the world of financial advice is crowded. Moreover, your financial advisor’s way of working might not match your style.

Yardley Wealth Management

FEBRUARY 18, 2025

Key Considerations When adopting a waterfall wealth strategy, consider the following: Define financial goals and categorize them into tiers. Regularly review and adjust priorities as financial situations evolve. Work with a financial advisor to tailor the strategy to your unique needs.

Integrity Financial Planning

OCTOBER 9, 2022

This creates a unique risk and can potentially be mitigated by talking to a financial advisor to figure out how best to diversify your equity in a tax-efficient way. Some senior-level employees and executives of companies accumulate large stock positions in the company that employs them over the years they work there.

Zoe Financial

FEBRUARY 21, 2023

Depending on your situation, you may need the help of a financial advisor or an accountant. Dear Zoe Experts, I’ve been looking for tax planning guidance and am deciding whether to hire a financial advisor or an accountant. Depending on your situation, you may need the help of a financial advisor or an accountant.

BlueMind

NOVEMBER 24, 2022

However, acquiring and retaining an HNW client is every financial advisor’s dream. An advisor can certainly not consider their approach homogenous to their other clientele for dealing with the elite, which requires a certain kind of finesse. Even protecting such large amounts of wealth comes with a high cost.

WiserAdvisor

JUNE 22, 2023

Hiring a financial advisor can be an excellent step towards building your financial future. They can help guide you in managing your finances and in avoiding costly financial mistakes in the long run. financial advisor can help you understand how to start a financial portfolio.

Integrity Financial Planning

JULY 3, 2023

One way to prepare for a possible economic downturn is to talk to a financial advisor. They can help you organize your finances in a way that can help you make informed decisions about risk management and current economic conditions. 5] How Can You Prepare for Such an Occurrence?

Million Dollar Round Table (MDRT)

APRIL 4, 2023

If I’m going to do a global risk management project for your finance s , you ’ve got to tell me everything.” And it’s a bit rude, even for a financial advisor, to sit down with a prospective client and ask, “How much do you earn?” ” We show them the formula on screen. .”

Yardley Wealth Management

NOVEMBER 19, 2024

Mike Garry, a financial advisor, CFP practitioner, and estate planning lawyer, notes, “How we treat pets in America has changed drastically in a generation or two. With over 30 years of experience, Michael specializes in personalized insurance portfolios and risk management strategies.

James Hendries

JULY 13, 2022

When times are turbulent, the surest path toward progress remains sound financial advice from dedicated professionals who have logged many hours in similar conditions. Please reach out to your trusted financial advisor with any questions. GENERAL RISK DISCLOSURES. Click here to view the digital version.

Yardley Wealth Management

AUGUST 20, 2024

If you’re feeling overwhelmed or uncertain about how to proceed, consider seeking professional advice from a financial advisor. A qualified advisor can provide personalized guidance and help you develop a disciplined investment strategy that aligns with your goals, risk tolerance, and time horizon.

NAIFA Advisor Today

OCTOBER 10, 2022

There is a tremendous lack of diversity in financial services and the average age of financial advisors is 57. Part of NAIFA's mission is to help more people become aware of careers in financial services and to create a healthy, diverse workforce.

International College of Financial Planning

NOVEMBER 10, 2021

MBA (Finance) – This is the minimum qualification that you’d need to work as an investment or financial advisor in India. Financial Risk Manager (FRM) – If you love solving problems and wish to help your clients mitigate risks you can turn your attention to a career as a Financial Risk Manager.

International College of Financial Planning

MARCH 12, 2025

Many influencers dont have professional financial expertise; theyre just good at marketing. What to Do Instead: Stick to fundamentals: Learn about asset allocation, risk management, and diversification before investing. Think long-term: The goal isnt to get rich overnightits to build wealth sustainably.

Harness Wealth

APRIL 16, 2025

The elimination of this risk management tool forced a paradigm shift in conversion planning. Therefore, taxpayers should evaluate these potential impacts as part of their overall financial planning strategy when considering a Roth conversion. Some investors even convert stable-value assets first to minimize market risk.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content