The Future of Wealth Management: Transformation and Innovation

Wealth Management

JUNE 11, 2025

Brent Brodeski discusses how AI and fintech advancements are transforming wealth management, urging RIAs to adapt and seize value creation opportunities.

Wealth Management

JUNE 11, 2025

Brent Brodeski discusses how AI and fintech advancements are transforming wealth management, urging RIAs to adapt and seize value creation opportunities.

Nerd's Eye View

JUNE 13, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent survey of U.S. investors found that while 96% of respondents said they trust their (human) financial advisor, only 29% said they trust algorithms, suggesting that consumers continue to impose a "trust penalty" on algorithmically generated advice.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

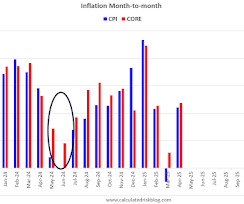

Calculated Risk

JUNE 10, 2025

The Consumer Price Index for May is scheduled to be released tomorrow. The consensus is for a 0.2% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 2.5% year-over-year (YoY), and core CPI to be up 2.9% YoY. From Goldman Sachs economists: We expect a 0.25% increase in May core CPI (vs. +0.3% consensus), corresponding to a year-over-year rate of 2.89% (vs. +2.9% consensus).

Abnormal Returns

JUNE 11, 2025

Podcasts Carl Richards talks with Oliver Burkeman dig into the emotional undercurrents of financial life. (podcasts.apple.com) Amy Arnott and Christine Benz talk with Benjamin Felix about lessons learned from the Rational Reminder podcast. (morningstar.com) Sam Dogen talks with Joe Saul-Sehy from The Stacking Benjamins podcast to talk about creating your own life curriculum.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JUNE 12, 2025

RIA and investment leaders at Wealth Management EDGE said future-ready firms will expand revenue via adjacent services and cultivate second-generation advisors through tactics including equity stakes.

Nerd's Eye View

JUNE 9, 2025

2025 has had a tumultuous start for most advisory firms, as tariffs-driven market volatility has increased client anxiety and the amount of required hand-holding, forcing advisory firms to manage their own expenses a bit more closely in the face of greater revenue uncertainty. In the meantime, the buzz around AI continues to increase as well, less now about whether the tools will replace financial advisors (they don't), and more about how advisory firms can better leverage the technology to be m

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

JUNE 9, 2025

Podcasts Jess Bost and Mark Newfield talk with Phil Pearlman about the connection between health and executive function. (podcasts.apple.com) Dan Haylett talks with Brendan Frazier about the art of spending money in retirement. (podcasts.apple.com) 14 of the best finance podcasts all investors should listen to including 'The Compound and Friends.' (forbes.com) UHNW The super-rich really are different.

Wealth Management

JUNE 12, 2025

Discover key insights on maximizing advisory firm value, avoiding common seller mistakes, and navigating M&A deals from industry expert Ted Jenkin.

Nerd's Eye View

JUNE 10, 2025

Welcome everyone! Welcome to the 441st episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Leila Shaver. Leila is the founder of My RIA Lawyer, a compliance and legal services firm based in Alpharetta, Georgia, that serves RIAs, broker-dealers, and other financial services companies. What's unique about Leila, though, is how she helps firms navigate the increasing compliance burdens that can arise as they grow in size and complexity to ensure they remain in line wit

Calculated Risk

JUNE 7, 2025

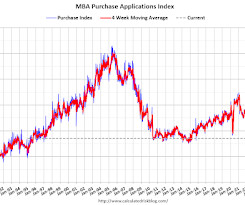

The key report this week is May CPI. -- Monday, June 9th -- No major economic releases scheduled. -- Tuesday, June 10th -- 6:00 AM ET: NFIB Small Business Optimism Index for April. -- Wednesday, June 11th -- 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. 8:30 AM: The Consumer Price Index for May from the BLS.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Abnormal Returns

JUNE 8, 2025

Top clicks this week On the importance of avoiding big investment mistakes. (behaviouralinvestment.com) Replacing Ajit Jain at Berkshire Hathaway ($BRK.A) will be no easy task. (wsj.com) How major asset classes performed in May 2025. (capitalspectator.com) An example when home bias is damaging to your portfolio. (notes.archie-hall.com) Capital flight is about more than debt and deficits.

Wealth Management

JUNE 11, 2025

CFP Board CEO Kevin Keller discusses the shift to holistic financial planning, efforts to increase diversity in the profession and AI’s impact on financial services.

Nerd's Eye View

JUNE 12, 2025

Every financial or business decision brings some amount of inherent risk. However, the consequences of those decisions – positive or negative – don't always align with the actual level of risk taken. As a result, when advisors are tasked with (re-)educating clients about the potential consequences of financial decisions, there may be a disconnect between potential risk and what a client actually experiences.

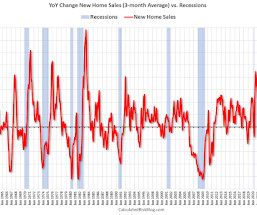

Calculated Risk

JUNE 9, 2025

Early in February , I expressed my "increasing concern" about the negative economic impact of "executive / fiscal policy errors", however, I concluded that post by noting that I was not currently on recession watch. In early April, I went on recession watch , but I'm still not yet predicting a recession for several reasons: the U.S. economy is very resilient and was on solid footing at the beginning of the year, the administration might reverse many of the tariffs (we've seen that before), and C

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

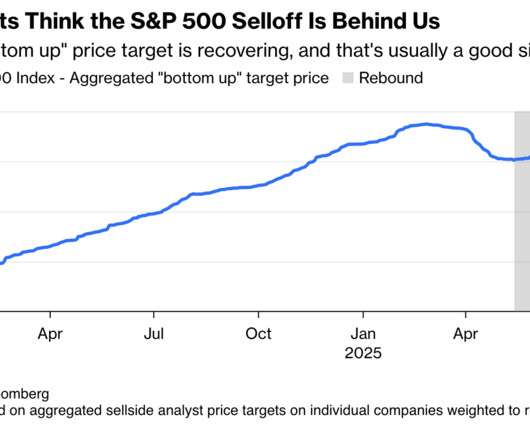

Abnormal Returns

JUNE 10, 2025

Strategy Market timing involves a prediction about market direction. (behaviouralinvestment.com) Lost decades are rarer than you think. Most people invest right through them anyway. (ofdollarsanddata.com) Crypto Another company is joining the Bitcoin Treasury game. (theblock.co) The administration and crypto industry are now in lockstep. (theatlantic.com) Finance Novo Nordisk ($NVO) has attracted an activist investor.

Wealth Management

JUNE 10, 2025

The Wealth Management EDGE conference kicked off at The Boca Raton resort with workshop panels focused on alternative investments, artificial intelligence and high net worth clients.

The Big Picture

JUNE 9, 2025

I grew up in the generation of latchkey kids: Both parents worked; you came home from school, fixed yourself a quick bite, then ran off to the playground for some stick- or b-ball. We weren’t wildly overscheduled; we didn’t have 20 hours a week of school events, after-school activities, and projects. We were (mostly) on our own. This led to a generation of parents who recognized the risks all this unsupervised play created.

Calculated Risk

JUNE 11, 2025

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 12.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 6, 2025. Last week’s results included an adjustment for the Memorial Day holiday. The Market Composite Index, a measure of mortgage loan application volume, increased 12.5 percent on a seasonally adjusted basis from one week earlier.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Abnormal Returns

JUNE 10, 2025

AI After a ramp up, AQR is increasingly embracing AI. (ft.com) How data scientists contribute to returns. (klementoninvesting.substack.com) Man Group is ordering its quants back to the office five days a week. (ft.com) Perplexity can now access EDGAR. (perplexity.ai) Research Is the institutional investment model broken? (mailchi.mp) Outperforming fixed income benchmarks isn't a walk in the park.

Wealth Management

JUNE 10, 2025

WealthManagement.com is part of the Informa Connect Division of Informa PLC INFORMA PLC | ABOUT US | INVESTOR RELATIONS | TALENT This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

NAIFA Advisor Today

JUNE 13, 2025

For many Americans, reaching Medicare eligibility marks a noticeable decrease in healthcare spending. Of course, that doesn’t mean that Medicare is free. For financial advisors helping clients prepare for retirement, understanding and planning for the costs associated with Medicare is critical. While these costs are often lower than those incurred through pre-65 health insurance, they remain significant, especially when viewed over a multi-decade retirement.

Calculated Risk

JUNE 12, 2025

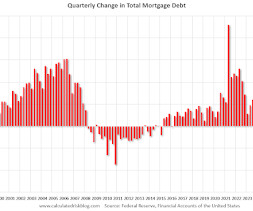

Today, in the Calculated Risk Real Estate Newsletter: The "Home ATM" Mostly Closed in Q1 A brief excerpt: During the housing bubble, many homeowners borrowed heavily against their perceived home equity - jokingly calling it the “Home ATM” - and this contributed to the subsequent housing bust, since so many homeowners had negative equity in their homes when house prices declined.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Abnormal Returns

JUNE 13, 2025

Crypto Every big company seemingly wants their own stablecoin. (wsj.com) Companies are following a Bitcoin treasury model because it works, for now. (ft.com) Another day, another Bitcoin-focused company. (theblock.co) Private equity There's really one reason why private equity managers are going down market. (riabiz.com) On the growth in search funds.

Wealth Management

JUNE 12, 2025

The asset manager, known for its low fees and prior experience with dual shares, could be a formidable competitor if the SEC approves a hybrid structure for actively managed mutual funds.

Fintoo

JUNE 11, 2025

2025 hasn’t been kind to the Indian stock market. From sudden dips to investor panic, a cocktail of global influences has turned the market into a rollercoaster. But if you’re wondering why this is happening—and more importantly, what you should do—you’re in the right place. Let’s break down the chaos and bring some clarity. Market […] The post Indian Stock Market in 2025: A Global Rollercoaster appeared first on Fintoo Blog.

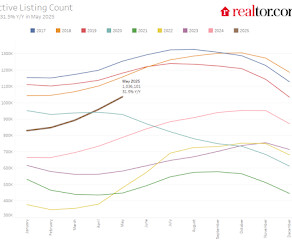

Calculated Risk

JUNE 13, 2025

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For May, Realtor.com reported inventory was up 31.5% YoY, but still down 14.4% compared to the 2017 to 2019 same month levels. Realtor.com has monthly and weekly data on the existing home market.

Speaker: Cheryl J. Muldrew-McMurtry

Remote finance teams are rewriting how the back-office runs—and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats have become more than just “growing pains”. They’re now liabilities. The challenge isn’t just team distribution, but building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Abnormal Returns

JUNE 11, 2025

Strategy Brett Steenbarger, "One of the most difficult forms of trading discipline can be the discipline to not trade." (traderfeed.blogspot.com) On the importance of avoiding stupid investing mistakes. (safalniveshak.com) Crypto On the odds of altcoin ETFs coming to market this Summer. (sherwood.news) The Bitcoin Treasury strategy is spreading. (wsj.com) Cable networks Why the Warner Bros.

Wealth Management

JUNE 12, 2025

KKR's Matthew Magill discusses how the firm partners with RIAs, offering dedicated strategies and access to private equity, infrastructure, and asset-based finance opportunities.

Fintoo

JUNE 12, 2025

Introduction: The Investment Dilemma Imagine you’ve just received a hefty bonus or sold a property, and now you’re pondering: “Should I invest this lump sum in the stock market?” The market’s volatility makes you hesitant. Enter the Systematic Transfer Plan (STP), a strategy that allows you to transfer funds from a debt to an equity […] The post Systematic Transfer Plan (STP): The Key to Growing Your Wealth Smartly appeared first on Fintoo Blog.

Calculated Risk

JUNE 9, 2025

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-June 2025 A brief excerpt: This 2-part overview for mid-June provides a snapshot of the current housing market. First, a quote from Toll Brothers CEO Douglas Yearley Jr.: “The spring selling season, which is really a winter selling season, is when most new homes are sold in this country.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Let's personalize your content