UBS Is Latest Facing Cash Sweep Lawsuit

Wealth Management

AUGUST 23, 2024

According to the federal complaint calling for a class action, the firm’s policies “maximize profits for UBS while at the same time disregarding its clients’ best interests.

Wealth Management

AUGUST 23, 2024

According to the federal complaint calling for a class action, the firm’s policies “maximize profits for UBS while at the same time disregarding its clients’ best interests.

Calculated Risk

AUGUST 19, 2024

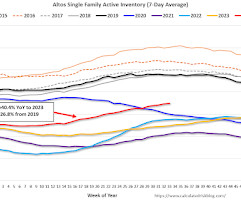

Altos reports that active single-family inventory was up 0.8% week-over-week. Inventory is now up 41.4% from the February seasonal bottom. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of August 16th, inventory was at 698 thousand (7-day average), compared to 693 thousand the prior week. This is the highest level of inventory since June 2020 ; however, inventory is still well below pre-pandemic levels.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

AUGUST 19, 2024

Markets There is big difference between politics and policies when it comes to investing. (optimisticallie.com) 20 pandemic darlings that have yet to rebound. (investmenttalk.co) Companies Couche-Tard seeks to buy US$31 billion owner of 7-Eleven stores (bnnbloomberg.ca) Why Carl Icahn and Icahn Enterprises ($IEP) just settled with the SEC. (ft.com) How the cannabis landscape is changing.

Nerd's Eye View

AUGUST 21, 2024

Irrevocable trusts lie at the heart of a variety of estate planning strategies, as gifts to irrevocable trusts can allow for the transfer of assets outside of an owner’s estate for estate tax purposes with more structure than an outright gift. The downside, however, is that irrevocable trusts are "irrevocable" and can't easily be undone; in moving assets to the trust, the original owner gives up their authority over the assets, with the trustee taking over the management and distribution o

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

AUGUST 20, 2024

The more than $50 million investment in Bleakley will help the hybrid RIA launch an equity ownership program for its advisors and enter the M&A game.

Calculated Risk

AUGUST 17, 2024

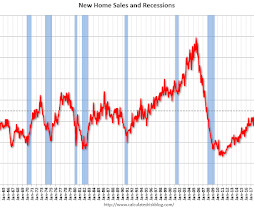

The key reports this week are July New and Existing Home sales. Fed Chair Jerome Powell will speak on the "Economic Outlook" at the Jackson Hole Symposium on Friday. The BLS will release the preliminary employment benchmark revision on Wednesday. -- Monday, August 19th -- No major economic releases scheduled. -- Tuesday, August 20th -- No major economic releases scheduled. -- Wednesday, August 21st -- 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage pu

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Big Picture

AUGUST 23, 2024

This week, we speak with Ricky Sandler , the chief investment officer and the founder of Eminence Capital. Today, Eminence is a $7B global investment management organization. Sandler came to prominence as a savvy long/short investor and Eminence continues to successfully run several different Long/Short portfolios. Prior to launching Eminence, Ricky was co-founder and co-general partner of Fusion Capital Management, LLC.

Wealth Management

AUGUST 20, 2024

Advisors Gary Perl and Katie Janda collectively manage more than $360 million in client assets and join Raymond James’ employee channel.

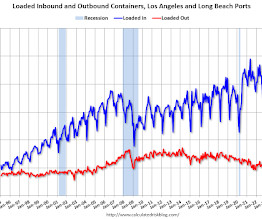

Calculated Risk

AUGUST 19, 2024

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic. The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Abnormal Returns

AUGUST 23, 2024

The biz Apple ($AAPL) is losing its dominance as a podcast player. (bloomberg.com) Apple has launched a web app for podcasts. (theverge.com) The story of how Alex Cooper of “Call Her Daddy” fame went from unemployed to a nine-figure deal with SiriusXM. (readtrung.com) How Stephen West's 'Philosophize This' podcast became a hit. (substack.com) Nate Silver Jeff Ma and Rufus Peabody talk with Nate Silver author of "On the Edge.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

The Big Picture

AUGUST 21, 2024

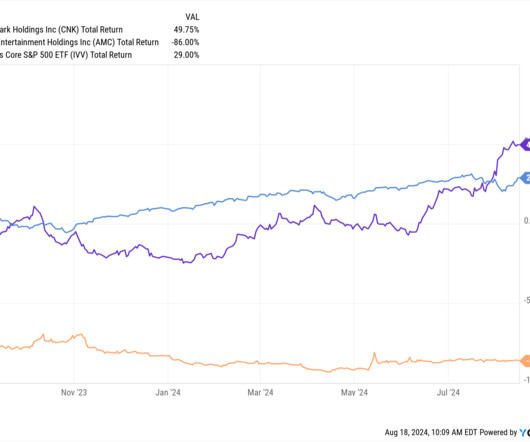

At The Money: At the Money: Learning Lifecycles of Companies. (August 21, 2024) The Magnificent Seven, the Nifty Fifty, FAANG: Each of these were popular groups of companies investors erroneously believed they could “Set & Forget,” put them away forever, and you’re set for life. But as history informs us, the list of once-great companies that dominated their eras and then declined is long.

Wealth Management

AUGUST 23, 2024

Verity Larsen, Founder and CEO of Versoft Consulting, discusses key strategies for a seamless post-deal integration strategy.

Calculated Risk

AUGUST 19, 2024

I'll be out of contact until Sept 5th. The key housing reports over the next two weeks are existing home sales on Thursday, New Home sales on Friday, and the Case-Shiller house price index next Tuesday. Best to all!

Abnormal Returns

AUGUST 19, 2024

Podcast Jim Dahle talks with Michael Kitces talk about the state of the financial planning business. (whitecoatinvestor.com) Daniel Crosby talks with Charles Eckhart, co-founder of Cathexis Group, about family wealth dynamics. (standarddeviationspod.com) Advisor tech VCs are betting big that Savvy Wealth can use AI to upend the RIA business model. (riabiz.com) Vanilla raised another round of capital.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Big Picture

AUGUST 22, 2024

My keynote at the Greater Kansas City FPA Symposium 2024 is above. They are a great group of people, and very motivated to serve their clients. The deck is an updated version of last year’s presentation to investors at the Orlando Money Show. It has evolved into a few chapters in my upcoming book (more on that to come later). The folks attending the FPA event are all CFPs and advisors, and so I tailored the presentation to ideas they can use to better serve their clients.

Wealth Management

AUGUST 22, 2024

Stick with the basics when preparing for the high exemption sunset.

Calculated Risk

AUGUST 19, 2024

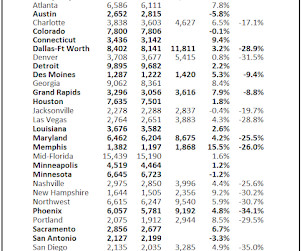

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in July and 3rd Look at Local Housing Markets A brief excerpt: From housing economist Tom Lawler: Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.96 million in July , up 1.8% from June’s preliminary pace but down 2.2% fro

Abnormal Returns

AUGUST 18, 2024

Markets It's not your imagination, market moves are getting faster. (awealthofcommonsense.com) Why bonds are now a better diversifier than they were a couple years ago. (sherwood.news) Companies What's wrong with Starbucks ($SBUX)? (wsj.com) Investors are still paying up for AI exposure. (tomtunguz.com) What do you get when you buy a share of Berkshire Hathaway ($BRK.B)?

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

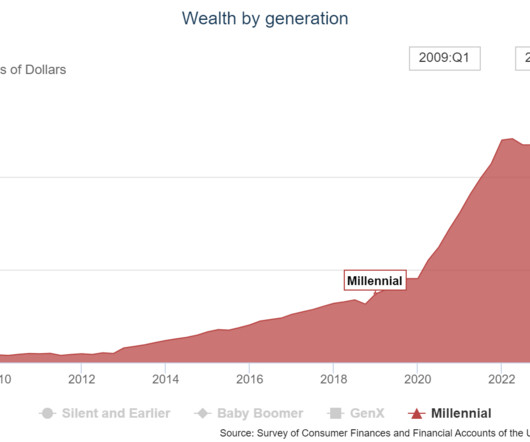

A Wealth of Common Sense

AUGUST 18, 2024

After the Great Financial Crisis, everyone was trying to figure out how it would impact the coming wave of millennials entering adulthood. Millennials were getting blamed for killing everything — napkins, diamond rings, chain restaurants, motorcycles, bar soap and more. Sure, whatever. The one that never made sense to me was all the pundits predicting millennials would never buy a home or move out of big cities.

Wealth Management

AUGUST 20, 2024

Over the last year, Swenson has been expanding Osaic’s options for advisors who want to operate without a FINRA license.

Calculated Risk

AUGUST 18, 2024

Weekend: • Schedule for Week of August 18, 2024 Monday: • No major economic releases scheduled. From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 6 and DOW futures are up 39 (fair value). Oil prices were up mostly unchanged over the last week with WTI futures at $76.65 per barrel and Brent at $79.68 per barrel. A year ago, WTI was at $81, and Brent was at $86 - so WTI oil prices are down about 5% year-over-year.

Abnormal Returns

AUGUST 20, 2024

Insiders Corporate insiders are playing games with how they are reporting their stock sales. (bloomberg.com) How corporate insiders get away with insider trading while following the rules. (papers.ssrn.com) Corporate finance How inclusion in a benchmark can affect subsequent corporate investment. (papers.ssrn.com) Nobody wants to talk about diversity on conference calls any more.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

AUGUST 20, 2024

US job growth in the year through March was likely far less robust than initially estimated, which risks fueling concerns that the Federal Reserve is falling further behind the curve to lower interest rates.

Wealth Management

AUGUST 20, 2024

A bold attempt to tackle the housing crisis and address economic disparities through a combination of housing initiatives and tax reforms

Calculated Risk

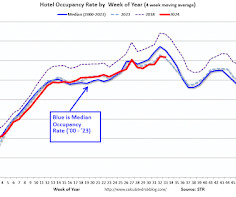

AUGUST 18, 2024

From STR: U.S. hotel results for week ending 10 August The U.S. hotel industry reported positive comparisons year over year, according to CoStar’s latest data through 10 August. 4-10 August 2024 (percentage change from comparable week in 2023): • Occupancy: 68.7% (+0.5%) • Average daily rate (ADR): US$159.49 (+1.4%) • Revenue per available room (RevPAR): US$109.51 (+1.9%) emphasis added The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Abnormal Returns

AUGUST 22, 2024

Strategy Successful investors have a long time horizon. (awealthofcommonsense.com) An example of overconfidence and leverage. (novelinvestor.com) Finance The VC boom of the early 2020s is showing up in historically bad performance. (sherwood.news) Credit card companies are adding additional perks like lounges at concert venues. (wsj.com) The popularity of sports gambling as a market failure.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

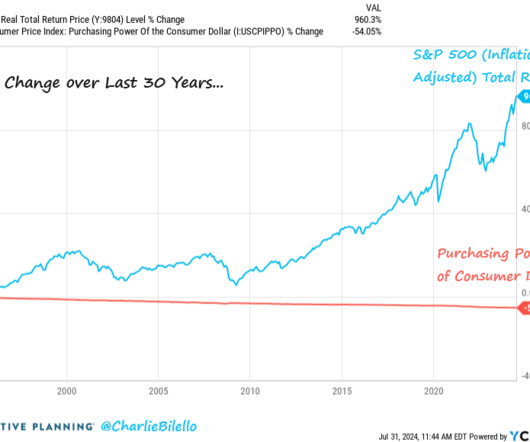

A Wealth of Common Sense

AUGUST 20, 2024

There’s plenty of investment advice out there based on what one must do to be successful. You don’t see many people who take the opposite approach and talk about what you shouldn’t do. There are many ways to succeed as an investor but only a few avenues to failure. Here are some surefire ways to make poor investment decisions: 1. Pretend you’re smarter than the market.

Wealth Management

AUGUST 20, 2024

Technology and the growth of wealth management firms.

Calculated Risk

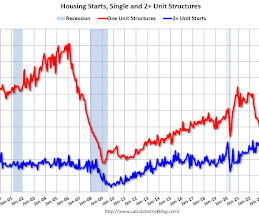

AUGUST 17, 2024

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. • Housing Starts: Single Family Down Year-15% over-year in July; Multi-Family Down 18% YoY • Part 1: Current State of the Housing Market; Overview for mid-August 2024 • Part 2: Current State of the Housing Market; Overview for mid-August 2024 • MBA: Mortgage Delinquencies Increased in Q2 2024 • 2nd Look at Local Housing Markets in July This is usually published 4 to 6 times a week and provides more in-depth

Abnormal Returns

AUGUST 23, 2024

Markets Nvidia ($NVDA) is larger than all countries, except four. (allstarcharts.com) It's now or never to lock in CD rates. (sherwood.news) Global The Tokyo Stock Exchange is not messing around. (morningstar.com) How New Zealand (successfully) manages its sovereign wealth fund. (ft.com) EVs EVs made up 8% of sales in Q2. (coxautoinc.com) Ford ($F) is backtracking on big EV SUVs and doubling down on hybrids.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content