What the Fed Gets Wrong

The Big Picture

DECEMBER 16, 2022

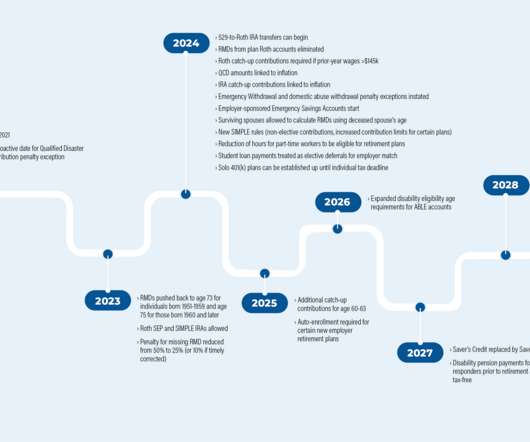

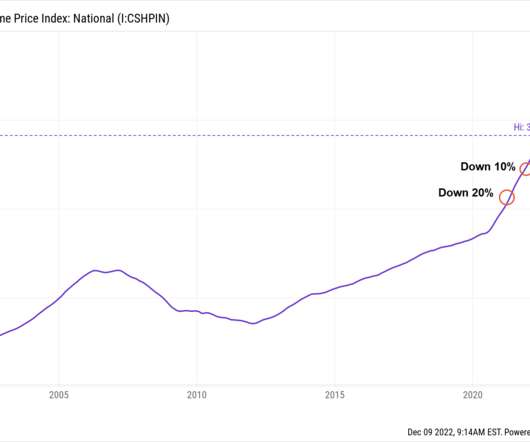

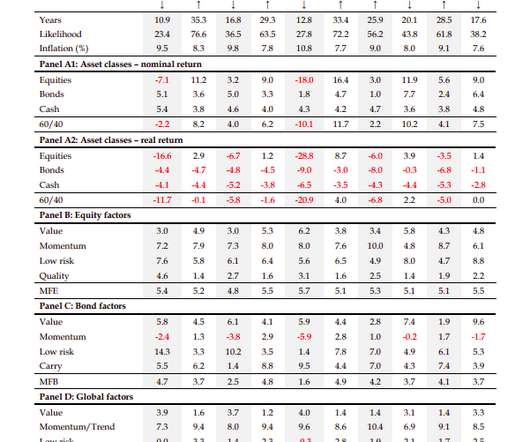

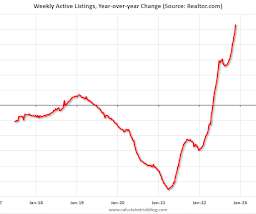

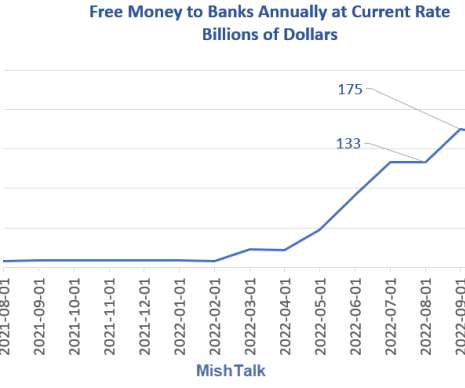

There seems to be a lot of confusion going on today with respect to inflation, interest rates, and ongoing Federal Reserve policy. A framework for exploring this has many parts: What the Fed (obviously) knows, how it express those views through police like FOMC rates, ZIRP, QE, QT, etc. There remains the question of what the Fed is actually wrong about. 1 .

Let's personalize your content