Journey Strategic Wealth Recruits 3 Teams, $210M in Assets

Wealth Management

OCTOBER 11, 2022

The new teams come from Private Advisor Group, Raymond James and New York Life subsidiary Eagle Strategies.

Wealth Management

OCTOBER 11, 2022

The new teams come from Private Advisor Group, Raymond James and New York Life subsidiary Eagle Strategies.

Calculated Risk

OCTOBER 11, 2022

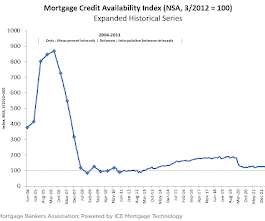

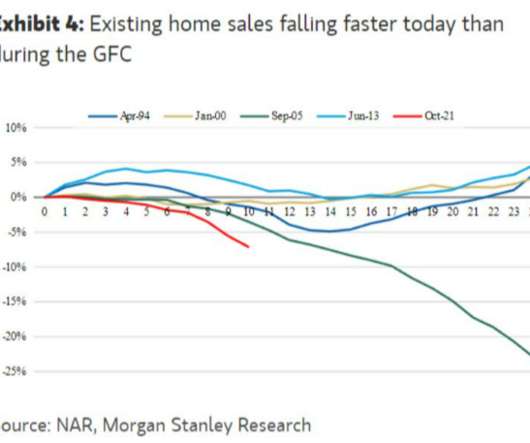

Today, in the Calculated Risk Real Estate Newsletter: MBA: Mortgage Credit Availability was Never Excessive During the Recent Housing Boom A brief excerpt: Although mortgage credit availability decreased in September (the MBA headline below), the most important point is mortgage credit availability was never excessive during the boom. Here is the expanded series from the MBA of mortgage credit availability that includes the bubble years (2004 - 2006).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 11, 2022

Simon will acquire the stake from Jamestown founding partners Christoph and Ute Kahl. The Kahls will continue to be shareholders of the Atlanta-based firm, which had more than $13 billion in assets under management as of June 30.

Calculated Risk

OCTOBER 11, 2022

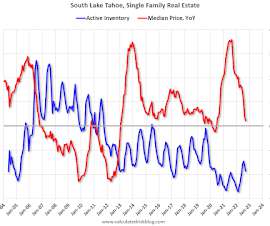

With the pandemic, there was a surge in 2nd home buying. I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic. This graph is for South Lake Tahoe since 2004 through September 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

OCTOBER 11, 2022

The new platform bundles content generation and analytics, social media management and compliance features, among others.

Abnormal Returns

OCTOBER 11, 2022

Strategy Mark Rzepczynski, "Every good trader thinks about opportunity cost and exit strategies. In fact, quitting is the core skill for protecting principal." (mrzepczynski.blogspot.com) Jason Zweig, "Try to watch a tree growing, and you see nothing; yet it is growing all the same. It can send out new branches and green foliage for several human lifetimes.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

OCTOBER 11, 2022

Welcome back to the 302nd episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Libby Greiwe. Libby is the owner of The Efficient Advisor, a financial advisor coaching and consulting business based out of Loveland, Ohio, that’s focused on helping advisors create systems and processes for themselves so that they can run their businesses in less time and with less stress.

Wealth Management

OCTOBER 11, 2022

Once again, the DOL could put the employment status of independent broker/dealers in jeopardy. FSI president Dale Brown questioned whether the department gave enough attention to feedback from the industry when formulating the proposal.

Pragmatic Capitalism

OCTOBER 11, 2022

When you pivot in basketball you have full control of the ball and the future outcomes.

Wealth Management

OCTOBER 11, 2022

Individuals ages 21 to 42 with at least $3 million in assets have only a quarter of their portfolio in equities, compared with more than half for those who are older.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

A Wealth of Common Sense

OCTOBER 11, 2022

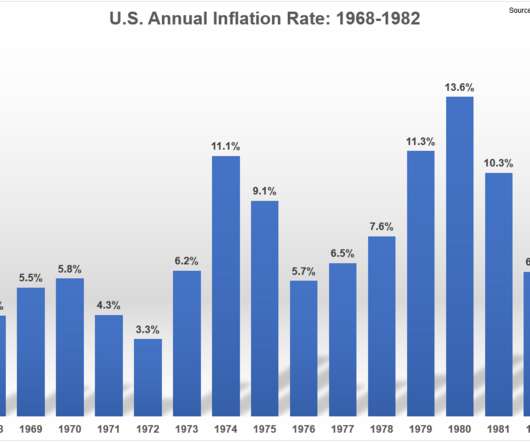

The long-term average inflation rate in the United States going back 100+ years is right around 3% per year. Obviously, there is a range around that long-term average. For instance, in the 38 years from 1983-2020, inflation finished the year below 3% more than 60% of the time. Inflation was running at more than 4% in just 5 years and finished above 5% just once (in 1990 when it was 5.4%).

Wealth Management

OCTOBER 11, 2022

Even though Mexico’s manufacturing costs are as much as 30 percent higher than China’s for Returnity, the absence of tariffs and the speed of trucks give its customers a rarity in today’s disorderly arena of global commerce: more certainty about when their delivery will arrive.

Calculated Risk

OCTOBER 11, 2022

From Matthew Graham at Mortgage News Daily: Mortgage Rates Escape Harsher Fate as Bonds Fight to Hold Ground Treasury futures took a beating on Monday as the UK bond market once again traded in panic mode. The high rate implications were still in place as of Tuesday's overnight trading. 10yr Treasury yields broke above 4.0% yet again and continued struggling to move much lower until later in the trading day.

Wealth Management

OCTOBER 11, 2022

The conversation shouldn’t be about “How are we going to get more?” it needs to be, “What do we want more of?

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Abnormal Returns

OCTOBER 11, 2022

Retail Kris Abdelmessih, "Options trading is high margin for the brokerage. A mirror of what it looks like for the client." (moontowermeta.com) Are retail investors to blame for stock market seasonality? (papers.ssrn.com) Behavior More information makes us overconfident. (klementoninvesting.substack.com) Just because you can Google something doesn't mean you understand it.

Wealth Management

OCTOBER 11, 2022

Model portfolios are an increasingly popular way for advisors to reduce the time needed to manage individual client portfolios. This way, advisors can spend more time growing their overall practice while providing existing clients with the benefits of a professionally-managed portfolio.

The Irrelevant Investor

OCTOBER 11, 2022

Today’s Animal Spirits is brought to you by YCharts: See here for YCharts September Fund Flow Report On today’s show we discuss: Good news is bad news 8 ways to invest with a strong dollar The awful economy Paul Volcker inherited in 1979 (AWOCS) Cathie Woods open letter to the Fed Things are getting weird in the housing market Calculated Risk on housing prices Luxury home market is the first to go Homebuil.

Wealth Management

OCTOBER 11, 2022

The Wall Street Journal looks at the struggles of regional mall owners. The Dodge Momentum Index for commercial construction spending rose in September. These are among today’s must reads from around the commercial real estate industry.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Mullooly Asset Management

OCTOBER 11, 2022

Almost everyone knows they’ll receive social security in retirement. But many people don’t realize that their spouse may qualify for spousal social security benefits as well! Social security is a big piece of the retirement puzzle. When should you claim? How do you claim? How will my benefits affect the overall outcome of my retirement? […].

Wealth Management

OCTOBER 11, 2022

The St. Louis-based firm launches its fourth location in four years.

Brown Advisory

OCTOBER 11, 2022

CIO Perspectives Podcast: Private markets, slowing global growth and are bonds back? mhannan. Tue, 10/11/2022 - 13:22. Investors have plenty of challenges to focus on as a volatile year enters its final months. The global growth picture seems to be slowing, corporate earnings may face headwinds and geopolitical tensions seem to be rising. And while we believe private markets continue to be hotbeds of innovation and long-term outperformance, they too face some challenges.

Wealth Management

OCTOBER 11, 2022

Seventeen-member team departs Robert W. Baird & Co. to take advantage Raymond James' employee advisor platform.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Million Dollar Round Table (MDRT)

OCTOBER 11, 2022

By Renee Hanson, CFP, CDFA We talk a lot about the value we provide to centers of influence (COIs). If it’s a reciprocal relationship, they have to provide value to us as well. So, are they providing value by being able to answer our questions? Are they helping us build our business? Are they helping introduce us to other people? There was one attorney — she wasn’t fresh out of law school, but she was newer.

Wealth Management

OCTOBER 11, 2022

Financial planning often involves managing multiple accounts. These accounts have specific risk profiles, but individually, they do not represent a client’s full risk picture or even total wealth. In fact, when accounts are viewed together, the aggregate risk may look very different. How can you gain more visibility?

WiserAdvisor

OCTOBER 11, 2022

Most people start financial planning with the goal of growing their finances through savings and investments. But financial planning is not limited to increasing your wealth alone. It is also about reducing your cash output. Essential expenses, impulse purchases, interest rate payments, etc., can increase your cash outflow and reduce your savings. While these can be avoided, there is another cash outflow that can considerably lower your savings and returns and is also hard to avoid – tax.

Wealth Management

OCTOBER 11, 2022

A strong technology partner has a symbiotic relationship with wealth managers and shared goals for progressing their businesses. There should also be an understanding of the specific needs of those businesses, such as knowledge of local regulations or the nature of advisor/end-client relationships in wealth management.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Brown Advisory

OCTOBER 11, 2022

CIO Perspectives Podcast: Private markets, slowing global growth and are bonds back? mhannan Tue, 10/11/2022 - 13:22 Investors have plenty of challenges to focus on as a volatile year enters its final months. The global growth picture seems to be slowing, corporate earnings may face headwinds and geopolitical tensions seem to be rising. And while we believe private markets continue to be hotbeds of innovation and long-term outperformance, they too face some challenges.

Wealth Management

OCTOBER 11, 2022

The Unlimited HFND Multi-Strategy Return Tracker ETF (HFND) joins a pool of hedge-fund replica ETFs.

Brown Advisory

OCTOBER 11, 2022

2021 Impact Report: Sustainable Small-Cap Core Strategy mhannan Tue, 10/11/2022 - 17:44 Download the Report A Letter of Introduction From The Portfolio Managers Brown Advisory has made a deep commitment to sustainable investing, across a wide range of its equity and fixed income strategies. We firmly believe that there does not have to be a trade-off between strong performance and smart investments that help address society’s trickiest sustainability challenges.

Wealth Management

OCTOBER 11, 2022

The Advisors’ Inner Circle is planning to launch the PMV Adaptive Risk Parity ETF under the ticker ARP.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content