AssetBook Launches Valian Communications App

Wealth Management

SEPTEMBER 22, 2022

Valian complements the firm's established Pulse portfolio management and reporting platform.

Wealth Management

SEPTEMBER 22, 2022

Valian complements the firm's established Pulse portfolio management and reporting platform.

The Big Picture

SEPTEMBER 22, 2022

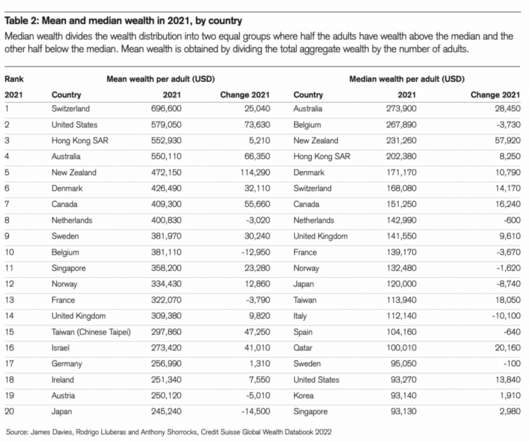

Every year, Credit Suisse puts out an in-depth look at wealth around the world (I often pull a chart or two for the reads). The data always has some interesting findings about how the very wealthy are investing, consuming, and otherwise spending their time and money. I don’t always reference it, but intriguing and anomalous findings are always worth sharing.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 22, 2022

His planning serves as a reminder for advisors to understand our clients’ goals and develop tools to achieve them.

Calculated Risk

SEPTEMBER 22, 2022

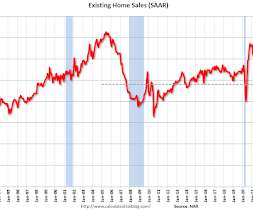

From the NAR: Existing-Home Sales Slipped 0.4% in August Existing-home sales experienced a slight dip in August, marking the seventh consecutive month of declines, according to the National Association of REALTORS®. Month-over-month sales varied across the four major U.S. regions as two regions recorded increases, one was unchanged and the other posted a drop.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

SEPTEMBER 22, 2022

Some tips to help advisors stay compliant and avoid big fines.

Calculated Risk

SEPTEMBER 22, 2022

Statement here. Fed Chair Powell press conference video here or on YouTube here , starting at 2:30 PM ET. Here are the projections. In June, most participants expected thirteen 25bp rate hikes in 2022. The FOMC raised rates 25 bp in March, 50 bp in May, 75 bp in June, 75 bp in July and 75 bp in September. That is twelve 25 bp increases so far, and the Fed expects rates to rise another 150 bp.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

SEPTEMBER 22, 2022

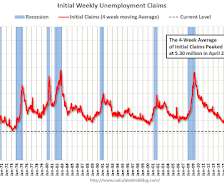

The DOL reported : In the week ending September 17, the advance figure for s easonally adjusted initial claims was 213,000 , an increase of 5,000 from the previous week's revised level. The previous week's level was revised down by 5,000 from 213,000 to 208,000. The 4-week moving average was 216,750, a decrease of 6,000 from the previous week's revised average.

Wealth Management

SEPTEMBER 22, 2022

High natural gas prices are leading European-based manufacturers to shift operations to the U.S., reports The Wall Street Journal. The AIA’s latest billing index shows demand for design services accelerated in August. These are among today’s must reads from around the commercial real estate industry.

Calculated Risk

SEPTEMBER 22, 2022

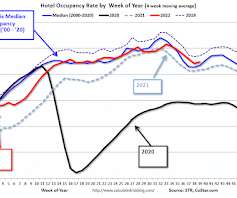

From CoStar: STR: US Hotel Performance Improves; Occupancy Nears 70% Nationwide U.S. hotel performance increased from the previous week and showed improved comparisons with 2019, according to STR‘s latest data through Sept. 17. Sept. 11-17, 2022 (percentage change from comparable week in 2019*): • Occupancy: 69.6% (-2.4%) • Average daily rate (ADR): $155.58 (+15.6%) • Revenue per available room (RevPAR): $108.25 (+12.9%) *Due to the pandemic impact, STR is measuring recovery against comparable t

Wealth Management

SEPTEMBER 22, 2022

James Arthur McDonald, Jr. appears to be on the lam as he faces as much as 20 years in prison for allegedly defrauding investors, according to the Justice Department. The SEC also filed a complaint against the Calif.-based advisor and frequent CNBC commentator.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Nerd's Eye View

SEPTEMBER 22, 2022

As the world becomes increasingly digital, the barrier to get one’s ideas out and in front of others becomes lower and lower. In the financial sector, in particular, this has led to an open floodgate of financial tips and advice. Many financial advisors have found that sharing their own expertise and marketing their intellectual property are great ways to establish themselves as dependable, trustworthy sources.

Wealth Management

SEPTEMBER 22, 2022

J.P. Morgan Asset Management's Jed Laskowitz details how ETFs can help advisors develop long-term portfolio strategies, regardless of market conditions.

Abnormal Returns

SEPTEMBER 22, 2022

Books Insights from "Two and Twenty: How the Masters of Private Equity Always Win" by Sachin Khajuria (newrepublic.com) A Q&A with Lina Flanagan author of "Take Back the Game: How Money and Mania Are Ruining Kids’ Sports, and Why It Matters." (annehelen.substack.com) An excerpt from "The Year Of The Puppy - How Dogs Become Themselves" by Alexandra Horowitz.

Wealth Management

SEPTEMBER 22, 2022

The advantages, and potential drawbacks, of The Community Property Trust Act.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

SEPTEMBER 22, 2022

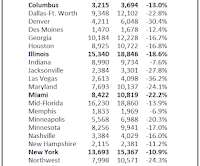

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in August A brief excerpt: The big story for August existing home sales was the sharp year-over-year (YoY) decline in sales. Another key story was that new listings were down YoY in August as the sellers’ strike continued. And active listings were up. Also, median prices are falling nationally (more than normal seasonally).

Wealth Management

SEPTEMBER 22, 2022

The Citadel founder worth $29.6 billion has ditched Chicago for Wall Street South. Not everyone in Miami is so welcoming.

The Reformed Broker

SEPTEMBER 22, 2022

We are getting into a situation where this is a really good investing environment, says Ritholtz’s Josh Brown from CNBC. The post Clips From Today’s Closing Bell appeared first on The Reformed Broker.

Wealth Management

SEPTEMBER 22, 2022

NASAA's annual enforcement report charted the continued problem of promissory note fraud, and the rise of interest in the metaverse in the securities markets.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Abnormal Returns

SEPTEMBER 22, 2022

Markets Market valuations are a lot more attractive than they were a year ago. (blog.validea.com) Visualizing U.S. interest rates since 2020. (visualcapitalist.com) Strategy The hardest part of investing is holding through tough times. (evidenceinvestor.com) A lot of investor problems are self-inflicted. (mantaro.money) Media Jeff Jarvis, "If network prime time has lost its value, so have networks, so has television, so has broadcast.

Wealth Management

SEPTEMBER 22, 2022

In the summer 2021, advisor Jonathan DeYoe tragically lost his only brother. Since then, he has been on a journey to rebuild healthy habits after experiencing this huge loss.

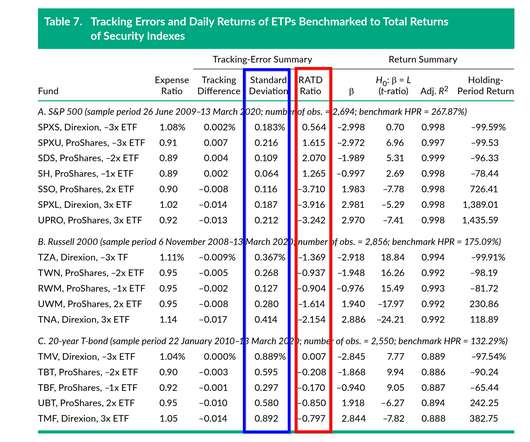

Alpha Architect

SEPTEMBER 22, 2022

In this article, we explore Levered and Inverse ETPs (exchange-traded products); their purpose, the circumstances in which they tend to succeed and fail, and the research questions associated with them. Should Levered and Inverse ETFs Even Exist? was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

SEPTEMBER 22, 2022

The seven advisors collectively had about $1.2 billion in managed assets, according to the Wells Fargo Advisors' suit against former in-house counsel Steven Satter, who joined his colleagues at the independent firm.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

FMG

SEPTEMBER 22, 2022

Clients are the lifeblood of every business regardless of industry. Financial advisors especially should make sure customers feel appreciated. To distinguish themselves from others in the industry and make clients feel special. For this exact reason, going the way of surprising and delighting is an excellent tactic in providing exceptional service. When a financial advisor is able to surprise or delight their client, they’re showing through action why that customer made the right choice in

Wealth Management

SEPTEMBER 22, 2022

Breaking up is hard to do.

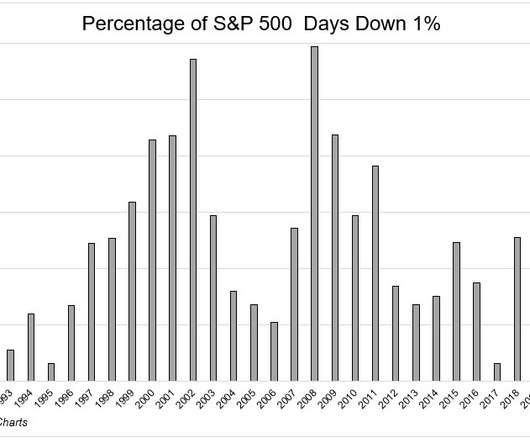

The Irrelevant Investor

SEPTEMBER 22, 2022

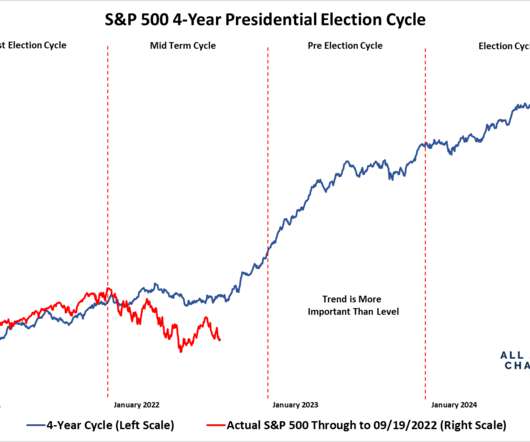

The market didn’t like what it heard yesterday. It hasn’t liked much of anything this year. The S&P 500 has declined more than 1% in one out of four days so far in 2022. The only other years with a higher reading since 1990 were 2008 when the S&P fell 38%, and 2002, when it fell 23%. Mega cap tech stocks have been the best performing stocks for the last decade.

Wealth Management

SEPTEMBER 22, 2022

Funds focused on clean energy and semiconductors were among the best-performing over the last five years.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

David Nelson

SEPTEMBER 22, 2022

Yesterday Nancy and I. Yesterday with Fox Business anchor Charles Payne and Nancy Tengler CIO Laffer Tengler Investments. We covered a lot of ground all leading up to today’s FOMC decision.

Wealth Management

SEPTEMBER 22, 2022

As your clients face life events, it provides advisors an opportunity to show empathy and compassion.

Alpha Architect

SEPTEMBER 22, 2022

Consumer demand drives the cash flows of consumer-oriented companies. Thus, they should serve as a reliable source of information to predict future fundamentals above and beyond the information contained in financial statements and readily available market data. High-Frequency Consumer Spending Data and the Cross-Section of Stock Returns was originally published at Alpha Architect.

Wealth Management

SEPTEMBER 22, 2022

In October, the first cohort of 49 advisors will graduate from the new program, part of the firm's strategic emphasis on expanding resources for advisors to clients with more than $5 million in assets,

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content