How I Found Success Breaking Through to the Next Generation

Wealth Management

NOVEMBER 21, 2023

Gen X, millennials and Gen Z each require a tailored approach based on their values and beliefs.

Wealth Management

NOVEMBER 21, 2023

Gen X, millennials and Gen Z each require a tailored approach based on their values and beliefs.

Abnormal Returns

NOVEMBER 21, 2023

Quant stuff Good luck trying to explain ML models. (mrzepczynski.blogspot.com) A round-up of recent research on return expectations including 'Inflation Expectations and Stock Returns.' (capitalspectator.com) Earnings Using AI to suss out future earnings surprises. (klementoninvesting.substack.com) People like working for companies that beat Wall Street earnings expectations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

NOVEMBER 21, 2023

The national healthcare advisory firm will merge its wealth management business, Curi Capital, with RMB.

Abnormal Returns

NOVEMBER 21, 2023

Strategy Hedge funds are piling into the Big Seven stocks. (ft.com) Diversification always means having something underperform. (ofdollarsanddata.com) Why moats matter. (investmenttalk.co) Crypto Another domino falls in the crypto space as Binance CEO CZ plans to plead guilty to money laundering charges. (wsj.com) Meanwhile there are plenty of other goings-on in the exchange space.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

NOVEMBER 21, 2023

Japan’s government pension fund is investing $1 billion in funds managed by Brookfield and Blackstone, reported Bisnow. Private investors have been increasingly focusing on retail real estate in recent months, according to JLL. These are among today’s must reads from around the commercial real estate industry.

The Big Picture

NOVEMBER 21, 2023

The transcript from this week’s, MiB: Brad Gerstner, Altimeter Capital & Invest America , is below. You can stream and download our full conversation, including any podcast extras, on Apple Podcasts , Spotify , YouTube , and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here. ~~~ This is Masters in business with Barry Ritholtz on Bloomberg Radio 00:00:07 [BARRY RITHOLTZ] This week on the podcast.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

NOVEMBER 21, 2023

Welcome back to the 360th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Suzanne Powell. Suzanne is a Senior Financial Advisor at Meridian Wealth Management, an RIA based in Lexington, Kentucky, where she oversees approximately $110 million in assets under management for nearly 150 client households. What's unique about Suzanne, though, is how she grew to more than $100M of AUM by intentionally organizing her schedule from month to month throughout the year, cl

Wealth Management

NOVEMBER 21, 2023

There are already ETFs in the market that invest in mortgage-backed securities. But the MTBA ETF focuses on recently issued ones.

The Big Picture

NOVEMBER 21, 2023

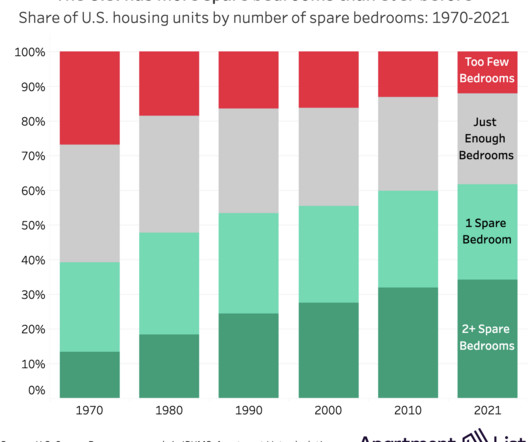

My Two-for-Tuesday morning train WFH reads: • The Share of Americans Who Are Mortgage-Free Is at an All-Time High : Almost 40% of US homeowners own their homes outright as of 2022—many of them baby boomers who refinanced when rates were low. ( Businessweek ) see also Why Your Office Space Continues to Shrink : Despite more than a billion square feet of empty office space in the US, a return to roomier layouts and private offices does not seem to be in the cards. ( Bloomberg ) • Satoshi Is Black

Wealth Management

NOVEMBER 21, 2023

The SEC settled charges with Laidlaw & Co. and two of its registered reps with violating Reg BI's care obligations with instances of "in-and-out" trading.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

NOVEMBER 21, 2023

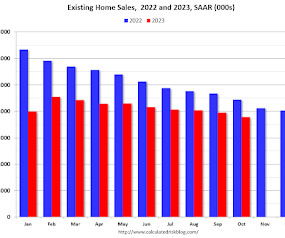

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.79 million SAAR in October; New Cycle Low Excerpt: Sales Year-over-Year and Not Seasonally Adjusted (NSA) The fourth graph shows existing home sales by month for 2022 and 2023. Sales declined 14.6% year-over-year compared to October 2022. This was the twenty-sixth consecutive month with sales down year-over-year.

Wealth Management

NOVEMBER 21, 2023

You set yourself apart when you recognize your clients’ losses and support them in ways that most others do not.

The Reformed Broker

NOVEMBER 21, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Sam Altman – OpenAI turmoil. ►Buyback SURGE – “$QQQ largest weekly inflows on record this past week.” ►NVDA Earnings – “The chip maker’s earnings beat Wall Street expectations in.

Wealth Management

NOVEMBER 21, 2023

On the heels of its move to NYC, RCG has received awards for ‘deal of the year’ and ‘firm of the year’ from The M&A Advisor.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

NOVEMBER 21, 2023

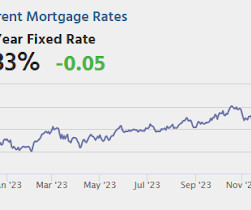

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 229 thousand initial claims, down from 231 thousand last week. • Also at 8:30 AM, Durable Goods Orders for October from the Census Bureau.

Wealth Management

NOVEMBER 21, 2023

Michael Hunstad, Ph.D., Deputy CIO & CIO of Global Equities at Northern Trust Asset Management, discusses credit markets and market risks.

Calculated Risk

NOVEMBER 21, 2023

From the NAR: Existing-Home Sales Receded 4.1% in October Existing-home sales dropped in October, according to the National Association of REALTORS®. Among the four major U.S. regions, sales slid in the Northeast, South and West but were unchanged in the Midwest. All four regions experienced year-over-year sales declines. Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – fell 4.1% from September to a seasonally adjusted annu

Wealth Management

NOVEMBER 21, 2023

The Tema Cardiovascular and Metabolic ETF (HRTS) tracks companies involved in the treatment of cardio-metabolic diseases — a term that links cardiovascular diseases, obesity and diabetes.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

A Wealth of Common Sense

NOVEMBER 21, 2023

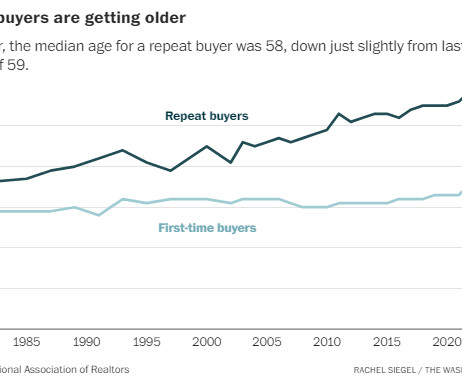

I’ve been writing about how demographics are destiny in the housing market for nearly a decade (see here, here and here). This has mainly been from the perspective of millennials because that’s my demographic. Following the Great Financial Crisis, many pundits assumed millennials would never settle down, own a home or buy a car. They would simply live in a big city and eschew the typical path to the suburbs.

Wealth Management

NOVEMBER 21, 2023

The move comes as former Merrill Wealth Management President Andy Sieg takes over as weatlh chief at Citigroup.

Discipline Funds

NOVEMBER 21, 2023

One of the big stories of the year has been the lack of breadth in the performance of the US stock market. The so-called “magnificent 7” of Microsoft, Amazon, Apple, Google, Meta, Tesla and Nvidia have generated 71% returns. The S&P 500 is up 20%. And the remaining 493 companies are up 5%. The equal weight S&P 500 (which weights every company evenly instead of letting the market caps skew) is up 5% year to date.

Wealth Management

NOVEMBER 21, 2023

Replacing a 700-year-old system of recording asset ownership with digital chips comes with its own set of risks.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

NOVEMBER 21, 2023

From the Fed: Minutes of the Federal Open Market Committee, October 31–November 1, 2023. Excerpt: Participants noted that real GDP had expanded at an unexpectedly strong pace in the third quarter, boosted by a surge in consumer spending. Nevertheless, participants judged that aggregate demand and aggregate supply continued to come into better balance, as a result of the current restrictive stance of monetary policy and the continued normalization of aggregate supply conditions.

Wealth Management

NOVEMBER 21, 2023

While his travel may be limited, Morgan Stanley Co-President Andy Saperstein says he plans to keep working during cancer treatment.

Million Dollar Round Table (MDRT)

NOVEMBER 21, 2023

By Bryce Sanders Consider two statements: The wealthy like their privacy. Once people reach a certain level of wealth and success, they tend to give back to the community. The first statement makes the high-net-worth difficult to prospect. The second provides a way to approach them. Meeting wealthy people socially is not a shortcut to asking for business.

Wealth Management

NOVEMBER 21, 2023

Bond managers from Capital Group, DoubleLine Capital, Pimco and TCW Group say it's time to put money to work.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Trade Brains

NOVEMBER 21, 2023

7 Best Technical Analysis Courses : Unlocking secrets of trading in the stock market begins with mastering technical analysis. In this article, we explore some of the best technical analysis courses available that are specifically designed for beginners. By enrolling in one of these courses, you can enhance your skills, make informed decisions, and navigate with confidence.

Wealth Management

NOVEMBER 21, 2023

A broker-dealer/RIA transition is a time when you must rely on others to get to the finish line. What do you need to know to create a winning team and seamless client transition experience? Learn what every advisor needs to understand in this tell-all from an industry executive who’s seen her fair share of transitions.

Clever Girl Finance

NOVEMBER 21, 2023

Whether you’ve recently gotten lucky or scrimped and saved for a few years, knowing what to do with 50k is essential. Having money in the bank is a unique opportunity. It means you can grow it and have an even larger safety net. Table of contents How much is $50k and how can you get it? What to do with $50k before you invest it! 18 Smart ways to grow $50k in cash Expert tip: Diversify your $50k to avoid volatility 3 Mistakes to avoid with 50k in cash How much interest will $50,000 earn in a year

Advisor Perspectives

NOVEMBER 21, 2023

What are some of the more unique gifts or events advisors are doing for clients?

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content