401(k) Industry Sends Urgent Call to Wealth Advisors

Wealth Management

NOVEMBER 13, 2023

Convergence and the growth of new plans are beyond what RPAs can handle.

Wealth Management

NOVEMBER 13, 2023

Convergence and the growth of new plans are beyond what RPAs can handle.

Abnormal Returns

NOVEMBER 13, 2023

Crypto The crypto industry is at a crossroads, post-FTX. (on.ft.com) Michael Batnick and Ben Carlson talk with Chris Kuiper, Director of Research at Fidelity Digital Assets. (theirrelevantinvestor.com) Startups The startup scene is living in two different worlds: AI and everything else. (theinformation.com) What rate of return do successful VCs need to get from their investments?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

NOVEMBER 13, 2023

Van Leeuwen & Company's Jeff Mattonelli discusses ways to connect with the generation that relies on non-traditional sources to get their investment ideas and data.

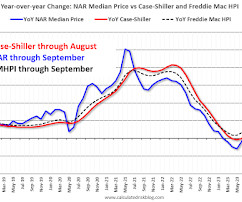

Calculated Risk

NOVEMBER 13, 2023

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-November A brief excerpt: Last week, in Part 1: Current State of the Housing Market; Overview for mid-November I reviewed home inventory and sales. Most measures of house prices have shown an increase in prices over the last several months, and a key question I discussed in July is Will house prices decline further later this year?

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

NOVEMBER 13, 2023

Band-aid solutions will no longer work to bring family offices into a more digital world.

Abnormal Returns

NOVEMBER 13, 2023

Podcasts Jack Forehand and Justin Carbonneau talks with Doug and Heather Boneparth about having better money conversations. (youtube.com) Justin L. Mack talks with Jennifer and Lisa Dazols, founders of Modern Family Finance, about working with LGBTQ+ clients. (financial-planning.com) Smoke Show The pilot episode of 'The Smoke Show' is this week focusing on fintech founders and their startups.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

NOVEMBER 13, 2023

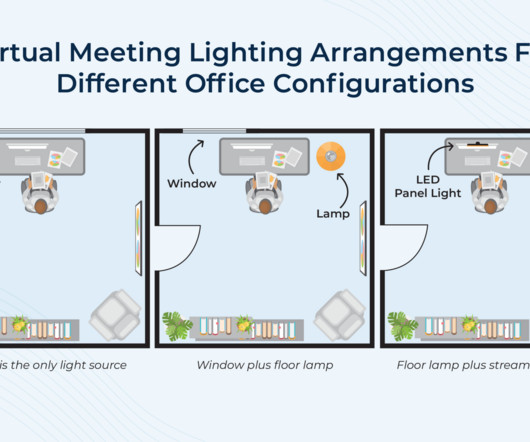

Traditionally, financial planning meetings have been held face-to-face in an advisor's office, and over the years, a body of research has emerged showing that how the advisor's office is laid out can have a significant impact on how clients perceive the advisor, their mood during the meeting, and even their resulting financial planning decisions. However, over the last decade (and particularly since the beginning of the COVID-19 pandemic), many advisors have increasingly been holding virtual cli

Wealth Management

NOVEMBER 13, 2023

The IRS isn’t playing around; neither should your clients. Look to legal and ethical ways to reduce tax burdens.

Calculated Risk

NOVEMBER 13, 2023

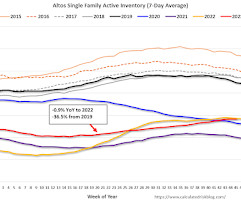

Altos reports that active single-family inventory was up slightly week-over-week. This is the latest in the year that inventory was still increasing in this series! Inventory will start decreasing seasonally soon (for Thanksgiving and Christmas). Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of November 10th, inventory was at 567 thousand (7-day average), compared to 567 thousand the prior week.

Wealth Management

NOVEMBER 13, 2023

Bluerock is among a group of alternative asset managers creating offerings meant to increase access to other asset types and investment structures.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

NOVEMBER 13, 2023

First, shutdowns are expensive, and many government employees continue to work (like the military), but don't get paid. In addition to the closings of National Parks, and many services, we will all be flying mostly blind without reports on employment, inflation, housing starts and more. However, there will be some private data to fill the gap. The employment data for November has already been gathered since the BLS reference week was November 5th through 11th this year (one of the exceptions for

Wealth Management

NOVEMBER 13, 2023

CBRE President and CEO Robert Sulentic said office real estate values could fall another 10% before reaching their nadir. The Wall Street Journal looked at the rise in distress among mezzanine loans. These are among the must reads from the real estate investment world to kick off the new week.

Calculated Risk

NOVEMBER 13, 2023

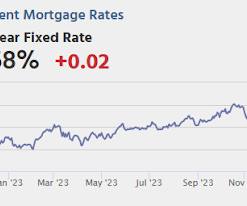

From Matthew Graham at Mortgage News Daily: Mortgage Rates Start Higher But Recover Ahead of Key Inflation Report Mortgage rates began the day at the highest levels in nearly 2 weeks. The underlying bond market had been losing ground steadily since last Thursday and there was some follow-through to that negative momentum early today. Weaker bonds = higher rates, all other things being equal.

Wealth Management

NOVEMBER 13, 2023

The news comes as Avantax faces three lawsuits and "multiple" demand letters from stockholders asking the company for additional financial disclosures.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Big Picture

NOVEMBER 13, 2023

As promised, the full video of the Navigating Financial Disasters presentation from last month. In it, I tell the story of the Belfers, a successful American family of immigrants, and some of the woes that befell them. (Don’t worry, they are fine). You can find the full slide deck here. The post Navigating Financial Disasters (video) appeared first on The Big Picture.

Wealth Management

NOVEMBER 13, 2023

Wealth Management Invest will cover how advisors are creating personalized portfolios at scale.

The Big Picture

NOVEMBER 13, 2023

My back-to-work morning train WFH reads: • Whatever happened to NFTs? When Homer Simpson comes up with a get-rich-quick scheme it usually ends badly. In the latest episode of The Simpsons the hapless dad turns his son Bart, and then himself, into NFTs to make millions. It all goes wrong when Homer finds out from a floating pizza cat that “the NFT craze is over” The episode has been widely applauded by NFT fans and sceptics alike for successfully poking fun at a side of the crypto wor

Wealth Management

NOVEMBER 13, 2023

The 7th breakaway advisor to join Snowden Lane this year, William “Trey” Jones III managed $230 million as a VP at Merrill Lynch.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

NOVEMBER 13, 2023

Research on tax-efficient retirement distribution strategies aims to sequence withdrawals from taxable, tax-deferred, and tax-exempt accounts to maximize after-tax spending. That can be either in terms of meeting an after-tax spending goal for as long as possible or preserving the most after-tax legacy after meeting spending needs over a specified timeframe.

Wealth Management

NOVEMBER 13, 2023

Franklin Tsung, CEO at Future Advice, discusses the future for RIAs seeking to compete with both "platform" RIAs and traditional wirehouse advisors.

XY Planning Network

NOVEMBER 13, 2023

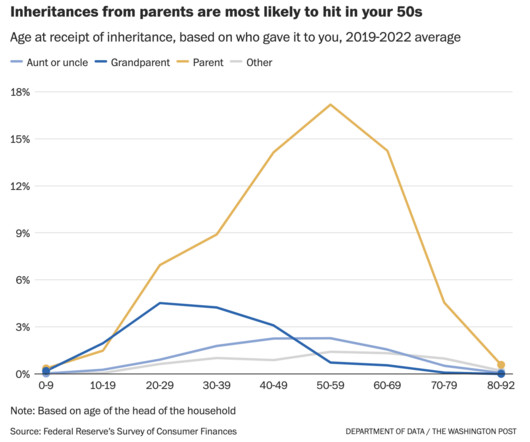

Move over, Millennials; there’s a new class in town. Generation Z (Gen Z) is the latest age group phasing into the workforce. Those who work in financial planning know: it’s never too early to start. Every generation is shaped by the actions of their predecessors and the distinctive events and trends they collectively experience as they join the ranks of adulthood.

Wealth Management

NOVEMBER 13, 2023

David Grau Jr., MBA at Succession Resource Group, discusses Advisor Succession.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

NOVEMBER 13, 2023

Here are tips for handling prospect objections and how every advisor can improve client meetings.

Wealth Management

NOVEMBER 13, 2023

Morningstar says retired workers can now safely withdraw 4% a year, up slightly from a 2022 analysis.

Alpha Architect

NOVEMBER 13, 2023

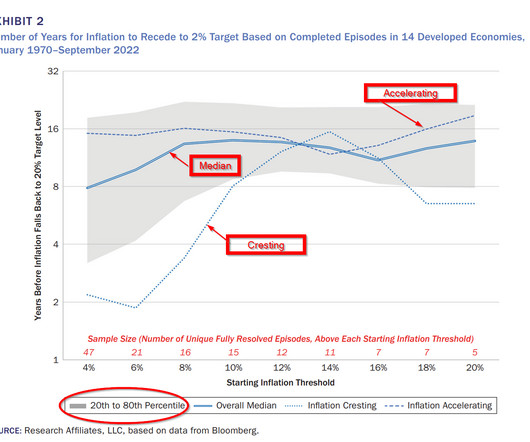

If inflation surges, how long on average, will it take to subside to a reasonable target rate of 2%? Is Inflation Ever Going to Go Down? was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

NOVEMBER 13, 2023

Bloomberg’s holding data for the ETF currently shows a short position of 5,280 contracts of the Nasdaq 100 14,600 calls expiring Nov. 17, and no futures contracts.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Cornerstone Financial Advisory

NOVEMBER 13, 2023

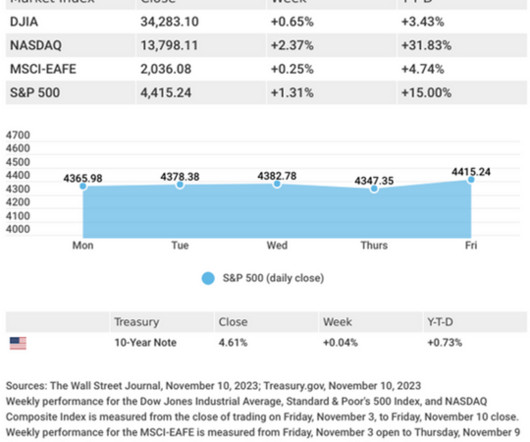

Weekly Market Insights: Stocks Rally Friday; Powell Cautious On Progress Presented by Cornerstone Financial Advisory, LLC A powerful Friday rally left stocks higher last week, extending the market’s early November gains. The Dow Jones Industrial Average rose 0.65%, while the Standard & Poor’s 500 advanced 1.31%. The Nasdaq Composite index jumped 2.37% higher for the week.

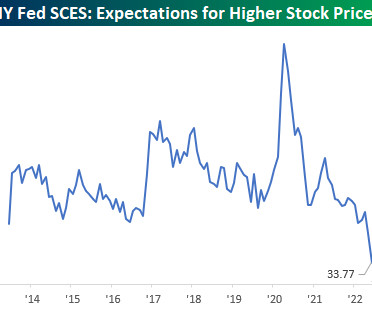

A Wealth of Common Sense

NOVEMBER 13, 2023

Today’s Talk Your Book is presented by Fidelity Digital Assets: On today’s show, we are joined by Chris Kuiper, Director of Research at Fidelity Digital Assets to give us an update on digital assets in 2023. On today’s show, we discuss: Fundamental reasons for Bitcoin’s positive performance in 2023 Q3 2023 Fidelity Digital Assets Signals Report Bitcoin first revisited Illiquid Bitcoin supply.

Carson Wealth

NOVEMBER 13, 2023

After the best week of the year for stocks two weeks ago, it was nice to see some follow-through last week. We think the stage is set for a strong end-of-year rally and the late-October lows won’t be violated. November and December are historically two of the strongest months. And even more encouragingly, when stocks are positive heading into November, markets tend to chase year-to-date strength as investment managers add equities before the year’s close.

Advisor Perspectives

NOVEMBER 13, 2023

Private equity (PE) has become a staple of institutional portfolios, but its performance has often been disappointing. New research shows that the levels of specialization and portfolio diversification should be important considerations when selecting a manager to implement a PE strategy.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content