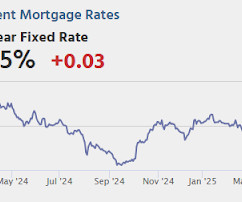

Lawler: Some Observations on the Federal Reserve’s Balance Sheet Wind-Down and Reinvestment “Strategy” (Still in Quantitative Easing Mode, Just Less So)

Calculated Risk

MARCH 11, 2025

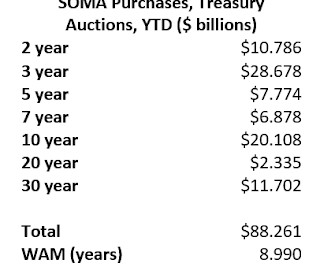

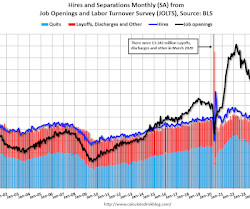

From housing economist Tom Lawler: From the beginning of 2020 to early June of 2022 the Federal Reserves balance sheet more than doubled to an almost inconceivable $8.9 trillion, with almost all of the gain reflecting increases in the Federal Reserves holdings of Treasuries and Agency MBS. Most of these gains in Treasury and Agency MBS assets were funded with increases in very short duration interest-bearing Federal Reserve liabilities, mainly deposits of depository institutions (reserves) and R

Let's personalize your content