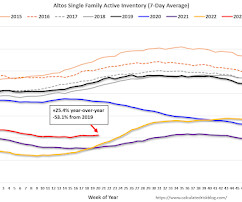

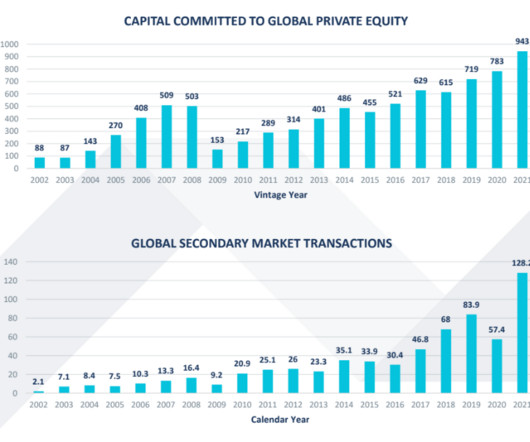

Housing May 22nd Weekly Update: Inventory Increased 0.9% Week-over-week

Calculated Risk

MAY 22, 2023

Altos reports that active single-family inventory was up 0.9% week-over-week. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of May 19th, inventory was at 424 thousand (7-day average), compared to 420 thousand the prior week. Year-to-date, inventory is down 13.6%. And inventory is up 4.6% from the seasonal bottom five weeks ago.

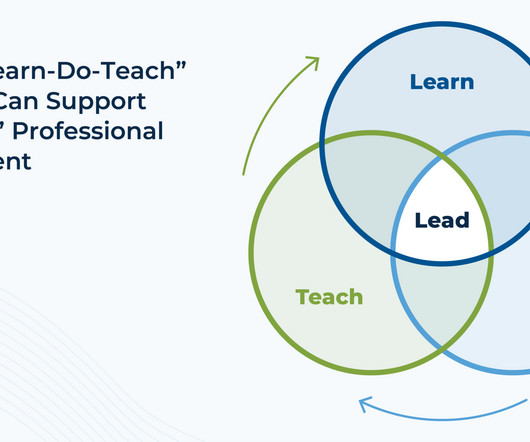

Let's personalize your content