Bear in mind

The Reformed Broker

SEPTEMBER 25, 2022

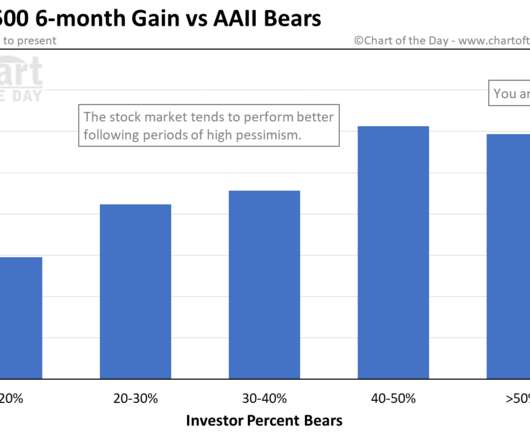

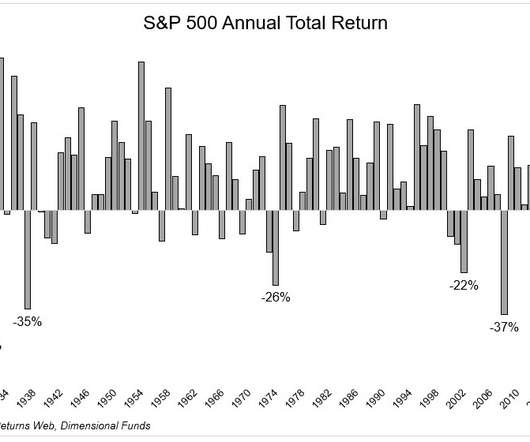

Okay don’t press the <Buy> because of this but maybe reconsider pressing the <Sell> button if you haven’t already… The AAII sentiment poll hit 60% Bears this week. History says the more pessimistic the investor class becomes, the better the prospective returns look six months out. The way I think about this is that the only thing that could make investors really bearish is a big sell-off in t.

Let's personalize your content