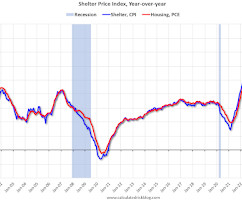

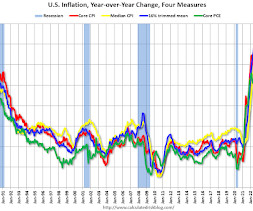

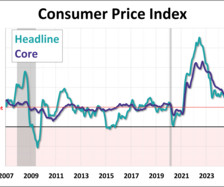

YoY Measures of Inflation: Services, Goods and Shelter

Calculated Risk

OCTOBER 10, 2024

Here are a few measures of inflation: The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up around 8% year-over-year. This declined and is now up 4.4% YoY. Click on graph for larger image. This graph shows the YoY price change for Services and Services less rent of shelter through September 2024. Services were up 4.7% YoY as of September 2024, down from 4.8% YoY in August.

Let's personalize your content