June Employment Report: 206 thousand Jobs, 4.1% Unemployment Rate

Calculated Risk

JULY 5, 2024

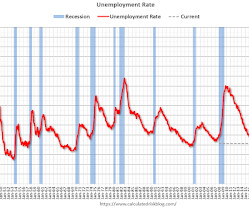

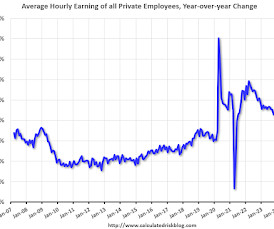

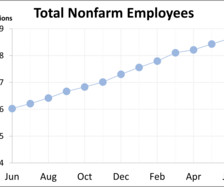

From the BLS: Employment Situation Total nonfarm payroll employment increased by 206,000 in June , and the unemployment rate changed little at 4.1 percent , the U.S. Bureau of Labor Statistics reported today. Job gains occurred in government, health care, social assistance, and construction. The change in total nonfarm payroll employment for April was revised down by 57,000, from +165,000 to +108,000, and the change for May was revised down by 54,000, from +272,000 to +218,000.

Let's personalize your content