What Is a FinCEN Identifier?

Wealth Management

NOVEMBER 17, 2023

Understand this important aspect of the Corporate Transparency Act, as well as its limitations.

Wealth Management

NOVEMBER 17, 2023

Understand this important aspect of the Corporate Transparency Act, as well as its limitations.

Calculated Risk

NOVEMBER 17, 2023

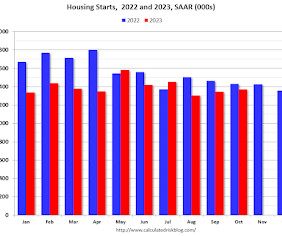

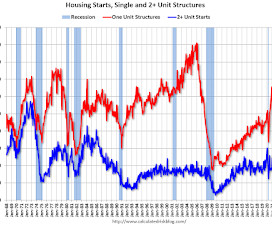

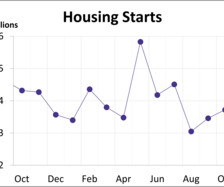

Today, in the CalculatedRisk Real Estate Newsletter: October Housing Starts: Near Record Number of Multi-Family Housing Units Under Construction Excerpt: The third graph shows the month-to-month comparison for total starts between 2022 (blue) and 2023 (red). Total starts were down 4.2% in October compared to October 2022. And starts year-to-date are down 11.3% compared to last year.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

NOVEMBER 17, 2023

visiWealth founder Dr. Ross Riskin discusses the how engaging visuals takes the complexity out of financial planning.

Calculated Risk

NOVEMBER 17, 2023

From the Census Bureau: Permits, Starts and Completions Housing Starts: Privately‐owned housing starts in October were at a seasonally adjusted annual rate of 1,372,000. This is 1.9 percent above the revised September estimate of 1,346,000, but is 4.2 percent below the October 2022 rate of 1,432,000. Single‐family housing starts in October were at a rate of 970,000; this is 0.2 percent above the revised September figure of 968,000.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

NOVEMBER 17, 2023

Executives say Osaic's new name and consolidation drove a 240% increase in its recruited assets in the third quarter over a year ago.

Calculated Risk

NOVEMBER 17, 2023

From Goldman: We boosted our Q4 GDP tracking estimate by 0.1pp to +1.9% (qoq ar) and our domestic final sales estimate by 0.1pp to 2.0%. [Nov 17th estimate] emphasis added And from the Altanta Fed: GDPNow The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 2.0 percent on November 17, down from 2.2 percent on November 15.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

NOVEMBER 17, 2023

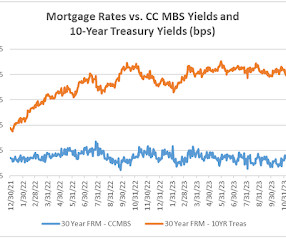

Today, in the CalculatedRisk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in October Excerpt: Chart of the Week: Mortgage Rates Follow MBS Yields, Not 10-Year Treasury Yields For an explanation of “why”, see Lawler: Update on Mortgage/Treasury Spreads From Tom Lawler: 30 Year FRM: Optimal Blue Conventional Conforming 30-year Fixed-Rate Mortgage where LTV 740.

Wealth Management

NOVEMBER 17, 2023

Also, Wealthfront grew client assets, Income Lab selects BridgeFT, Summit adds LifeYield, and AdvicePay surpasses a million transactions.

The Reformed Broker

NOVEMBER 17, 2023

On episode 118 of The Compound and Friends, Michael Batnick and Downtown Josh Brown are joined by Kevin Simpson to discuss: covered call strategies, the Fed, Warren Buffett’s latest moves, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods! Listen here: Apple podcasts Spotify podcasts Google podcasts Everywhere else!

Wealth Management

NOVEMBER 17, 2023

Telemus adds Chicago-based Ketoret Capital, which focuses on serving widows, divorcees and members of the Jewish diaspora.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

A Wealth of Common Sense

NOVEMBER 17, 2023

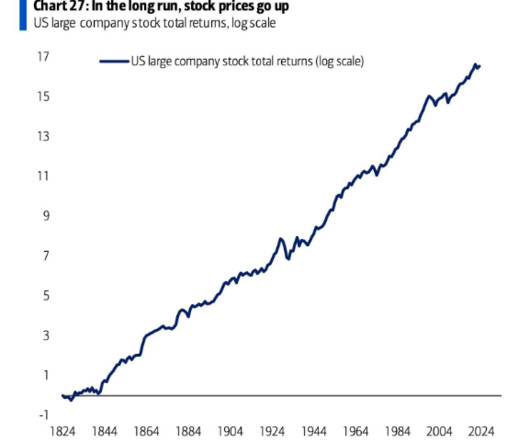

I saw a chart this week from Bank of America that more or less sums up my entire investment philosophy: In the long run, stock prices go up. I view the stock market as a way to invest in innovation, profits, progress and people waking up in the morning looking to better their current situation. While I love the fact that this chart illustrates my long-term philosophy it’s a bit misleading.

Wealth Management

NOVEMBER 17, 2023

Ron Chandler, president of Summit Investment Management, provides an honest assessment of the technology tools used by the $75-million-AUM firm to work with clients and drive business.

Alpha Architect

NOVEMBER 17, 2023

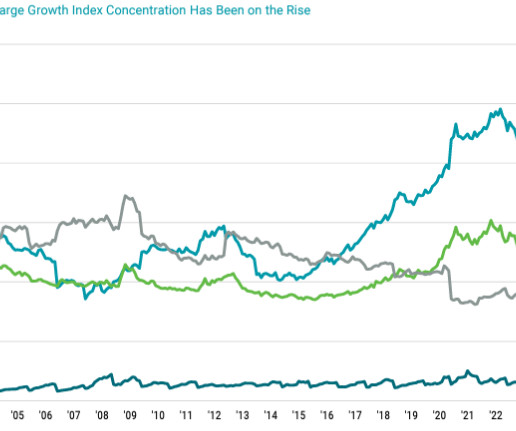

When a small subset of companies makes up a large portion of a portfolio, for better or worse their returns will have a greater impact on overall portfolio results. The Magnificent Seven was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

NOVEMBER 17, 2023

The tax code may be complicated, but it's got nothing on TikTok slang.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Big Picture

NOVEMBER 17, 2023

I had fun chatting with David L. Bahnsen of The Bahnsen Group. David hosts a podcast on National Review with the delightfully punny title, Capital Record. David is a card-carrying conservative; we are on the opposite sides of many issues, but we always manage to enjoy a respectful debate about broad issues and theory. I think you will enjoy our conversation… Source : Episode 145: Politics and Your Portfolio DAVID L.

Wealth Management

NOVEMBER 17, 2023

Joining as a founding managing partner and global investment strategist, Joelson brings an impressive resume to the nascent, tech-centric advisory platform.

Advisor Perspectives

NOVEMBER 17, 2023

I've updated this series to include the October release of the consumer price index as the deflator and the monthly employment update. The latest hypothetical real (inflation-adjusted) annual earnings are at $49,185, down 8.1% from over 50 years ago. After adjusting for inflation, hourly earnings are below their all-time high from April 2020.

Wealth Management

NOVEMBER 17, 2023

Mariner's "ongoing" campaign to lure Edelman Financial Engines advisors incentivizes them to break employment agreements and a "sinking ship"

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Trade Brains

NOVEMBER 17, 2023

Fundamental Analysis Of Waaree Renewable Technologies : Electricity is a necessity and there would be no commercial activity in the economy without energy. Industries and Households require electricity in day-to-day activities and operations. In this article, we are going to fundamentally discuss a company that is into Solar Power Supplier as well as undertake projects on Installation.

Wealth Management

NOVEMBER 17, 2023

It was another busy week for M&A in the RIA space, with no less than 10 firms announcing deals, representing close to $8 billion in transacted assets.

Integrity Financial Planning

NOVEMBER 17, 2023

In a time when computers and online platforms dominate our leisure time, revisiting classic board games like Scrabble, Rummikub, and Clue can offer a refreshing change of pace and a great way to unplug for the night. These games, timeless in their appeal, provide not just entertainment but also a way to stimulate the mind and foster social connections.

Wealth Management

NOVEMBER 17, 2023

Wednesday, December 13, 2023 | 2:00 PM ET

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

NOVEMBER 17, 2023

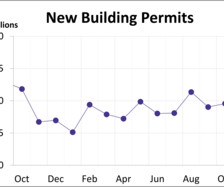

In October, building permits reached a seasonally adjusted annual rate of 1.487 million, surpassing the forecasted 1.450 million. This marks a 1.1% increase from September and a 4.4% decline compared to one year ago.

Wealth Management

NOVEMBER 17, 2023

Pass the torch with confidence.

Advisor Perspectives

NOVEMBER 17, 2023

In October, housing starts rose to a seasonally adjusted annual rate of 1.372 million, surpassing the forecasted 1.345 million. This marks a 1.9% increase from September and a 4.2% decline compared to one year ago.

Wealth Management

NOVEMBER 17, 2023

Kingswood now has until Feb. 24 of next year to complete its merger with broker/dealer aggregator Wentworth.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

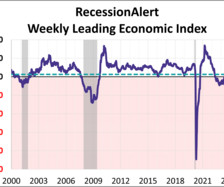

Advisor Perspectives

NOVEMBER 17, 2023

The weekly leading economic index (WLEI) is a composite for the U.S economy that draws from over 20 time-series and groups them into the following six broad categories which are then used to construct an equally weighted average. As of November 3rd, the index was at 7.535, up 0.337 from the previous week, with 4 of the 6 components in expansion territory.

Wealth Management

NOVEMBER 17, 2023

Wednesday, December 13, 2023 | 2:00 PM ET

Dear Mr. Market

NOVEMBER 17, 2023

Dear Mr. Market: The stock market is made up of thousands of choices and one easy way to gain exposure to it is via mutual funds. While we don’t want to broad brush the topic, we’re going to get right into it and explain 100 reasons why you or your financial advisor should not be using mutual funds versus ETFs (Exchange Traded Funds). Costs/Expenses : ETFs typically have lower expense ratios compared to mutual funds.

Advisor Perspectives

NOVEMBER 17, 2023

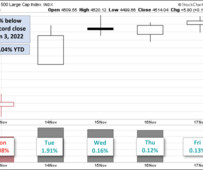

The S&P 500 rose for a third straight week, finishing Friday up 2.2% from the previous week. The index has now posted gains for 11 of the 13 trading days in November thus far. The index is currently up 18.04% year to date and is 5.89% below its record close from January 3, 2022.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content