Which State Has the Wealthiest 1%?

Wealth Management

JULY 24, 2023

What does it take to be considered part of the 1%? Nationally, households must make $652,657 to make the cut. These states require more.

Wealth Management

JULY 24, 2023

What does it take to be considered part of the 1%? Nationally, households must make $652,657 to make the cut. These states require more.

Nerd's Eye View

JULY 24, 2023

As a financial advisor, there are many potential sources of advice on running a practice and serving clients, from fellow advisors to coaches to academic researchers and others. Sometimes, it can be tempting to rely solely on the advice of those with an ‘in-the-trenches’ perspective, as these individuals have actually lived out a similar experience and can appreciate some of the nuanced challenges that an industry outsider might not.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 24, 2023

The fund, sponsored by MLG Capital, enables owners to contribute commercial real estate they directly own in exchange for ownership units.

The Reformed Broker

JULY 24, 2023

The downloads for this episode as an audio podcast are among the fastest we’ve ever seen, with over 30,000 listens in the first couple of days and counting. This will go over 45,000 by week’s end. The YouTube video is on pace to do a similar number. Combine the two and you’re talking about one of the biggest audiences in finance for a podcast episode.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JULY 24, 2023

Judi Galst of Henly & Partners talks about the increasing demand from Americans to invest in foreign passports to help diversify their mobility options.

Abnormal Returns

JULY 24, 2023

Podcasts Stephen Clapham talks with Beth Lilly about value investing and managing a family office. (behindthebalancesheet.com) Brendan Frazier talks with Michael Thomas about the power of data visualization to affect client behavior. (wiredplanning.com) Jonathan Hollow talks with Brian Portnoy about pursuing a meaningful life. (podcasts.apple.com) Q&As A Q&A with Larry Swedroe about valuations and private credit.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 24, 2023

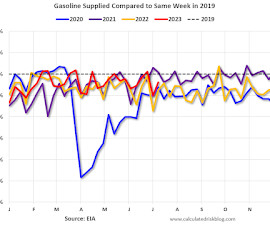

I stopped the weekly updates of high frequency indicators at the end of 2022. Here is a late July look at four indicators: -- Airlines: Transportation Security Administration -- The TSA is providing daily travel numbers. This data is as of July 23rd. Click on graph for larger image. This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue), 2022 (Orange) and 2023 (Red).

Wealth Management

JULY 24, 2023

The mega-RIA will move "multiple-billions" of dollars to GSAS over the next few years, the firm says, as it opens more advanced investment strategies to HNW clients.

Calculated Risk

JULY 24, 2023

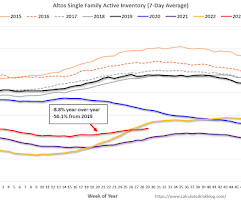

Altos reports that active single-family inventory was up 1.9% week-over-week. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of July 21st, inventory was at 479 thousand (7-day average), compared to 470 thousand the prior week. Year-to-date, inventory is down 2.4%. And inventory is up 18.2% from the seasonal bottom 14 weeks ago.

Wealth Management

JULY 24, 2023

The most valuable gatherings focus on the future, which is what the Wealth@Work conference is all about.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

JULY 24, 2023

From Matthew Graham at Mortgage News Daily: Mortgage Rates Unchanged to Slightly Higher It was a fairly uneventful day for mortgage rates for the average lender--at least until the very end of the business day. Mortgage lenders prefer to set rates once a day, in the morning. Because rates are ultimately determined by bond prices, if bonds move enough during the day, lenders can "reprice" to follow the market.

Wealth Management

JULY 24, 2023

Private equity company Lightyear, which has taken stakes in such firms as Allworth Financial and Advisor Group, has tapped Naratil to support growth and investments in the wealth management space.

The Big Picture

JULY 24, 2023

My back-to-work morning train WFH reads: • The Problem with Valuation. I have an issue with valuation models in general. Because basically all the valuation metrics tell the same story—U.S. stocks are overvalued, therefore, we should expect a major crash as these metrics return to their long-term historical averages. Whether you use Hussman’s measure, the Buffett indicator, or Shiller’s CAPE (cyclically-adjusted price-to-earnings) ratio, the logic is always the same.

Wealth Management

JULY 24, 2023

Lumping student loans into a single obligation can ease the sting of repayments, but there are pitfalls

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

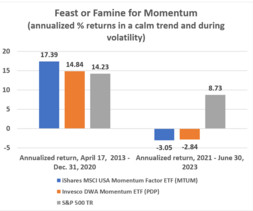

Advisor Perspectives

JULY 24, 2023

As the recent regime changes between value and growth illustrate, momentum is unlikely to be successful in the long term.

Wealth Management

JULY 24, 2023

September 12, 2023 at 2:00 PM ET | September 13, 2023 at 11:00 AM ET | September 13, 2023 at 2:00 PM ET

A Wealth of Common Sense

JULY 24, 2023

On today’s show, we are joined by Matt Middleton, CEO and Co-Founder of Advisor Circle to discuss all things Future Proof 2023! Future Proof Information: Register here Speakers Agenda Accommodations On today’s show, we discuss: How Advisor Circle was started The conference experience during Covid What makes Future Proof special Differences between 2022 and 2023 What an advisor gets out of goin.

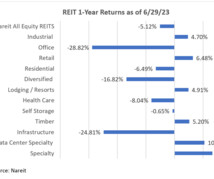

Wealth Management

JULY 24, 2023

Public Storage has agreed to buy Simple Self Storage from Blackstone REIT for $2.2 billion. Nareit looked at the 28 largest actively managed real estate mutual funds and assessed their property sector allocations. These are among the must reads from around the real estate investment world to kick off the new week.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Carson Wealth

JULY 24, 2023

“However beautiful the strategy, you should occasionally look at the results.” — Winston Churchill How about that? As soon as we released our Mid-Year Outlook predicting the bull market to broaden out, we find the Dow Jones Industrial Index up nine days in a row. The Dow is currently on a 10-day winning streak, which is good news for markets.

Wealth Management

JULY 24, 2023

DeVoe & Company’s quarterly RIA Deal Book reported 57 total deals in the second quarter of 2023, a 15% drop from the same period in 2022. This year could be the first down year for M&A activity in nearly a decade.

XY Planning Network

JULY 24, 2023

When I was a kid, I had a friend named John. John and I were as close as could be—and what unified our friendship was the love of strategy-based video games. We played them all—particularly the 90’s fad at the time, Pokemon. The only problem our friendship endured was that when we faced off in those games, he beat me EVERY. SINGLE. TIME. It wasn’t enough that I couldn’t win—I didn’t know how he did it.

Wealth Management

JULY 24, 2023

But please don’t hide dinosaur fossils away in your home. They belong in museums where everyone can enjoy them.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

JULY 24, 2023

As we enter the hurricane season, there are signs of three financial calamities merging to form the perfect storm. The nexus is in commercial real estate, but it extends to banking and the broader economy.

Wealth Management

JULY 24, 2023

UBS agreed to pay $268.5 million for “unsafe and unsound counterparty credit-risk management practices” at Credit Suisse, which UBS acquired in June.

Clever Girl Finance

JULY 24, 2023

Did you know you can only contribute a certain amount to a 401k per year? The biggest benefit of maxing out your 401k is the chance to save more money for retirement. If you are already making some contributions, you might start to wonder: should I max out my 401k? Well, keep reading. Table of contents Should I max out my 401k? 4 Reasons you should Expert tip Questions to help you determine if you should max out your 401k What to do before maxing out your 401k What is the downside of maxing out

Financial Symmetry

JULY 24, 2023

The behavioral and emotional side of financial planning takes precedence when planning for our future. I see this play out frequently in the form of anchoring to a perceived value we’ve grown accustomed to, based on prior experience. This “value”; … Continued The post Anchoring to an Arbitrary Dollar Amount, Ep #195 appeared first on Financial Symmetry, Inc.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

JULY 24, 2023

I sense a growing middle-of-the-road regulatory consensus on cryptocurrencies. It splits the difference between “crypto is a Ponzi scheme to defraud investors and enable criminals,” on the one hand, and “crypto solves ancient financial problems and will usher in an era of prosperity and freedom,” on the other.

Integrity Financial Planning

JULY 24, 2023

Inflation has been a hot-button issue in finance and politics lately. You may have noticed changes in inflation yourself if you went to buy something and it was much more expensive than you expected. Eggs are a great example of this. [1] In 2022 the price of eggs went up by 59.9% due to an outbreak of avian influenza. Another factor was the pandemic, which caused disruptions to supply chains across the globe, causing inflation and increasing prices. [2] A few other reasons include shortages in l

Advisor Perspectives

JULY 24, 2023

Investors willing and able to accept the illiquidity risk of CLOs should consider them as alternatives with attractive risk/reward characteristics.

Alpha Architect

JULY 24, 2023

The results of this research extend the literature in a number of areas including: the analyst forecast literature; the literature on behavioral accounting and finance with respect to corporate decision-making all in the context of gender; and the dominant role of the CEO on information transparency. Female execs bring more accuracy to analysts’ earnings forecasts was originally published at Alpha Architect.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content