Comments on October Employment Report

Calculated Risk

NOVEMBER 3, 2023

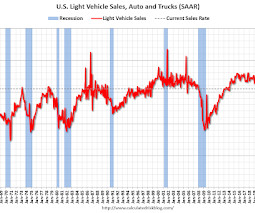

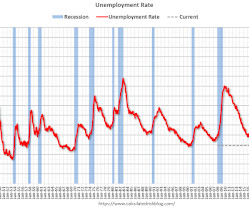

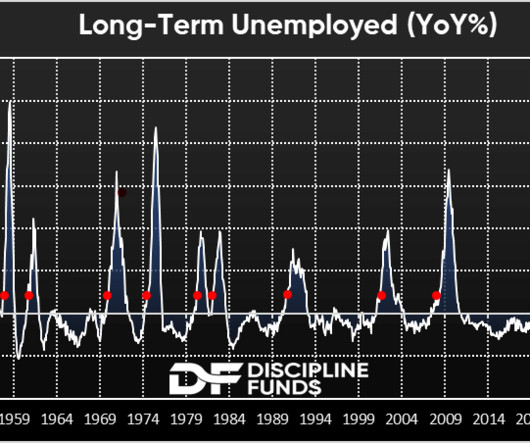

The headline jobs number in the October employment report was below expectations, and employment for the previous two months was revised down by 101,000, combined. The participation rate and the employment population ratio both decreased, and the unemployment rate increased to 3.9%. Leisure and hospitality gained 19 thousand jobs in October. At the beginning of the pandemic, in March and April of 2020, leisure and hospitality lost 8.2 million jobs, and are now down 223 thousand jobs since Februa

Let's personalize your content