Schedule for Week of October 13, 2024

Calculated Risk

OCTOBER 12, 2024

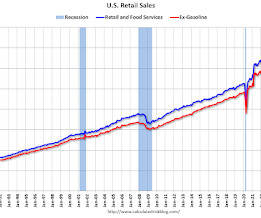

The key economic reports this week are September Retail Sales and Housing Starts. For manufacturing, September Industrial Production, and the October New York and Philly Fed surveys will be released this week. -- Monday, October 14th -- Columbus Day Holiday : Banks will be closed in observance of Columbus Day. The stock market will be open. -- Tuesday, October 15th -- 8:30 AM ET: The New York Fed Empire State manufacturing survey for October.

Let's personalize your content