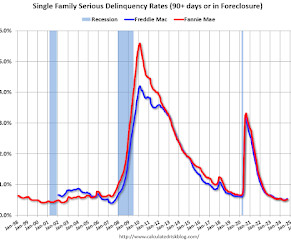

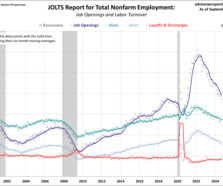

Fannie and Freddie: Single Family and Multi-Family Serious Delinquency Rates Increased in September

Calculated Risk

OCTOBER 30, 2024

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family and Multi-Family Serious Delinquency Rates Increased in September Excerpt: Single-family serious delinquencies increased slightly in September, and multi-family serious delinquencies increased. Freddie Mac reported that the Single-Family serious delinquency rate in September was 0.54%, up from 0.52% August.

Let's personalize your content