The WealthStack Podcast: How TAMPs are Driving Tech Forward in Wealth Management

Wealth Management

OCTOBER 25, 2024

Kyle Wiggs, CEO of UX Wealth Partners, discusses the evolving role of TAMPs in wealth management.

Wealth Management

OCTOBER 25, 2024

Kyle Wiggs, CEO of UX Wealth Partners, discusses the evolving role of TAMPs in wealth management.

The Big Picture

OCTOBER 25, 2024

This week, we speak with Toto Wolff , Team Principal & CEO of the Mercedes-AMG PETRONAS F1 Team. Prior to joining Mercedes, Toto spent time in the investment world, founding his own company Marchfifteen in 1998 and Marchsixteen in 2004. In 2009 Toto combined his passion for racing and business by investing in the Williams F1 Team. He eventually came to be the team’s Executive Director, helping to lead them toward their first win at the Spanish Grand Prix in eight years.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 25, 2024

Plus, automated wash sale features have been added to intelliflo redblack.

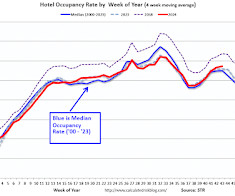

Calculated Risk

OCTOBER 25, 2024

From STR: U.S. hotel results for week ending 19 October The U.S. hotel industry reported positive year-over-year comparisons, according to CoStar’s latest data through 19 October. 13-19 October 2024 (percentage change from comparable week in 2023): • Occupancy: 70.1% (+1.6) • Average daily rate (ADR): US$169.85 (+2.5%) • Revenue per available room (RevPAR): US$119.01 (+4.2%) emphasis added The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

OCTOBER 25, 2024

The RIA acquirer sued Lars Knudsen earlier this year, alleging the advisor broke his non-compete after he was fired. He believes Hightower dismissed the charges because it expected a judge to rule in his favor.

Calculated Risk

OCTOBER 25, 2024

The BEA will release the advance estimate of Q3 GDP next week. The consensus estimate is GDP increased at a 3.0% real annual rate in Q3, the same rate as in Q2. From BofA: Our 3Q GDP tracking estimate was unchanged this week. We expect the advance 3Q GDP estimate to print at 3.0% q/q saar , unchanged from 2Q. Underlying demand in the US economy continues to impress as we expect final sales to grow by 3.2% q/q saar, up from 2.9% in 2Q.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

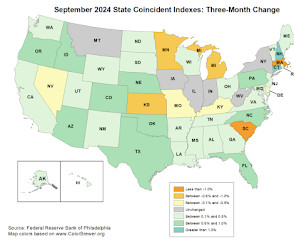

Calculated Risk

OCTOBER 25, 2024

From the Philly Fed : The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2024. Over the past three months, the indexes increased in 34 states, decreased in 10 states, and remained stable in six, for a three-month diffusion index of 48. Additionally, in the past month, the indexes increased in 36 states, decreased in seven states, and remained stable in seven, for a one-month diffusion index of 58.

Wealth Management

OCTOBER 25, 2024

The deal comes a day after the private equity firm announced a majority stake in the $8.5 billion Americana Partners, a member of the Dynasty Financial Partners network.

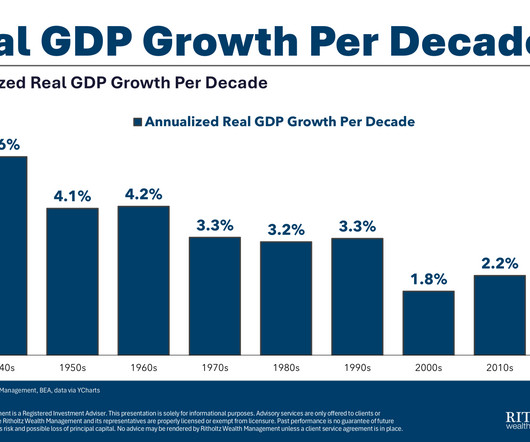

A Wealth of Common Sense

OCTOBER 25, 2024

Earlier this week I wrote about how America is the envy of the world.1 There was plenty of pushback. Many Europeans pointed out we have plenty of other problems plus a far worse safety net than they do. Fair enough. There were also a lot of comments on inequality, even though I addressed that in the piece. It is worth noting research shows 40% of the rise in income inequality has been undone since 2020.

Trade Brains

OCTOBER 25, 2024

ACC Limited stands as a prominent player in the Indian cement industry. Founded in 1936, the company has built a strong reputation for quality and innovation. With a commitment to sustainability, ACC consistently invests in eco-friendly practices. Today, ACC offers a wide range of cement products, catering to various construction needs. The company focuses on enhancing customer satisfaction through superior service and reliable delivery.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

NAIFA Advisor Today

OCTOBER 25, 2024

November is National Long-Term Care Awareness Month, an annual campaign to raise awareness about the need for long-term care (LTC) planning and the financial, emotional, and physical impacts associated with it. The campaign is aimed at educating the public about the importance of preparing for the potential need for long-term care services, which include assistance with daily activities such as bathing, dressing, and eating, often needed due to aging, chronic illness, or disability.

Trade Brains

OCTOBER 25, 2024

The share price of this Navratna Defence company was up by 6 percent from the day’s low on Friday after Reporting a net profit increase of 38 percent. Share Price Movement In Friday’s trading session, BEL’s share price was up by 6 percent from the day’s low of Rs. 257.40 touching the day’s high of Rs. 273.60. The stock was trading at Rs. 270 per share and was down around 0.63 percent from the previous close of Rs.271.40 per share.

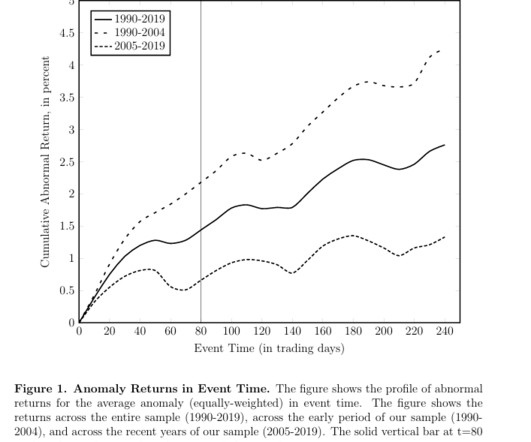

Alpha Architect

OCTOBER 25, 2024

The hurdles to adding alpha for active managers are getting higher—investment practitioners make use of it as soon as or shortly after it is available. Academic Anomalies Formed After Information Events was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Trade Brains

OCTOBER 25, 2024

One of the private bank stocks of Hinduja Group engaged in providing personal loans, vehicle financing, and credit cards. The stock has plunged by 18.76% after reporting a weak quarter of September in the financial year 2025. The company is also planning to operate an asset management company (AMC) within 6 to 9 months. Lets begin! Stock Movement After announcing its quarterly results, IndusInd Bank Limited’s share has plunged by 18.76% from the previous close of Rs 1,278.90.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Carson Wealth

OCTOBER 25, 2024

This week on Take 5 (and from the Carson headquarters!) Ryan Detrick, Chief Market Strategist at Carson Group, and Sonu Varghese, VP, Global Macro Strategist at Carson Group, discuss all things gold! Gold is at all-time highs. Is it a bad thing? Tune in and hear Sonu and Ryan’s thoughts! The post Facts Vs Feelings Take 5 – Why Gold is Shining appeared first on Carson Wealth.

Sara Grillo

OCTOBER 25, 2024

This is called crisis marketing and financial advisors may need it if they ever get into an embarrassing situation. Sound familiar? “We had a wacko employee and had to fire her for how she behaved towards our clients. This is majorly embarrassing. I’m not sure how to handle this. Do I just ignore it and hope people forget?” Okay here’s how you tackle stuff like this.

Discipline Funds

OCTOBER 25, 2024

Here are some things I think I am thinking about this weekend: 1) NVIDIA Versus the World. Jason Zweig posted this incredible figure on Twitter the other day which shows the market cap of Nvidia versus the entire market cap of different countries. Nvidia is bigger than the Canadian, UK, French, German and Italian stock markets. It’s bigger than Germany and Italy COMBINED.

Validea

OCTOBER 25, 2024

Dividend Kings represent the cream of the crop when it comes to dividend-paying stocks. These elite companies have increased their dividends for at least 50 consecutive years, demonstrating exceptional financial stability, consistent growth, and a strong commitment to shareholder returns. This remarkable achievement requires companies to maintain profitable operations through multiple economic cycles, recessions, and market downturns while continuously growing their payouts to shareholders.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

OCTOBER 25, 2024

Memory inflation of past events amplifies one's emotions and behaviors. As I will discuss, I believe that distress from recent price inflation is causing many investors to overly fear that a similar situation will reoccur.

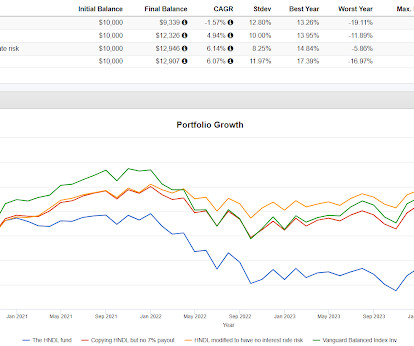

Random Roger's Retirement Planning

OCTOBER 25, 2024

Yesterday I mentioned the NASDAQ 7HANDL Index ETF (HNDL) and that I wanted to take a closer look at it in a separate post. The fund launched in early 2018, I heard about the fund from someone I knew from Claymore ETFs, a name that is long gone, and was then involved in HNDL. I was skeptical that the fund could maintain its objective of a 7% payout without eroding considerably.

Advisor Perspectives

OCTOBER 25, 2024

Advisors and their clients who seek to take advantage of the potential rewards of private equity investing should understand the performance dispersion between top- and bottom-performing managers, a factor that heightens both the risk and opportunity. Since private equity investments are designed to be long-term investments where capital can be locked up for years, getting the manager selection wrong can be a vexing obstacle to success.

Harness Wealth

OCTOBER 25, 2024

Filing taxes for the first time as a new limited liability company (LLC) owner can feel overwhelming. Between understanding your tax obligations, gathering the required documentation, and making the right deductions, the process may seem daunting. However, with the right information, filing your LLC’s small business taxes can be a manageable task.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

OCTOBER 25, 2024

The S&P 500 finished the week ending October 25 with modest losses, down 0.96% from last Friday. The index is 0.96% away from its record close last week and is now up 22.46% year-to-date.

NAIFA Advisor Today

OCTOBER 25, 2024

A change in presidential administrations often brings changes that can significantly impact tax and estate planning. As we approach the sunset or possible extension of the Tax Cuts and Jobs Act (TCJA), financial professionals must prepare for what may be a new era of tax policy. At a time when the population is aging, and interest rates remain uncertain, these potential tax changes could have far-reaching consequences for financial planning strategies.

Advisor Perspectives

OCTOBER 25, 2024

One of the only things growing faster than progress in AI applications is speculation about AI’s effect on the economy. I don’t have all the answers, not by a long shot, but I do think we should expect great unevenness in adaptation, and that itself will alter our world.

Trade Brains

OCTOBER 25, 2024

The FMCG sector is facing significant challenges, highlighted by disappointing quarterly results that have triggered a sharp decline in market indices. A slowdown in urban demand, coupled with rising input costs, has prompted analysts to reassess growth prospects, creating a complex environment for industry players. Urban Demand Slowdown Impacts FMCG Growth The FMCG sector encounters significant challenges as market leader Hindustan Unilever Limited (HUL) reports underwhelming Q2 results.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

OCTOBER 25, 2024

Economists nudged up quarterly US economic growth projections through early next year on more sanguine views of consumer demand and maintained views that limited inflation will keep the Federal Reserve on a path toward lower borrowing costs.

Trade Brains

OCTOBER 25, 2024

In the past four weeks, the Nifty index experienced a notable decline, dropping from 26,277 to 24,140. This significant fall raised concerns among investors and analysts alike. Various factors, including economic indicators and market sentiment, contributed to this downturn. As traders seek to understand market trends, they often turn to technical analysis tools.

Advisor Perspectives

OCTOBER 25, 2024

When Warren Buffett calls a book on investing “by far the best book about investing ever written,” it is common sense to concede the point.

Truemind Capital

OCTOBER 25, 2024

This is probably one of the best podcasts out there on personal finance & investment topics. This beautifully explains why debt/loans can cause a lethal blow to your finances. A lot of wealth & lives have been destroyed because overconfidence led people to take on more loans than they should have. As loans increase, you narrow the range of outcomes you can endure in life.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content