Educating Investors on the Economics of Dividends

Wealth Management

JUNE 11, 2024

Explaining the fallacy of a free dividend can overcome both investor ignorance and their biases.

Wealth Management

JUNE 11, 2024

Explaining the fallacy of a free dividend can overcome both investor ignorance and their biases.

Calculated Risk

JUNE 11, 2024

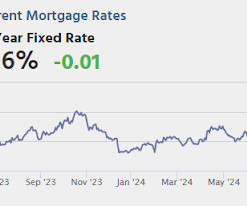

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:30 AM, The Consumer Price Index for May from the BLS. The consensus is for 0.2% increase in CPI (up 3.4% YoY), and a 0.3% increase in core CPI (up 3.5% YoY). • At 2:00 PM, FOMC Statement.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 11, 2024

An RIA’s level of satisfaction with a custodian is directly correlated with the proportion of assets held with them.

Abnormal Returns

JUNE 11, 2024

Diversification We are in a 'bear market for diversification.' (thinkadvisor.com) What really is the goal of portfolio diversification? (rogersplanning.blogspot.com) Books Insights from "The Price of Time: The Real Story of Interest" by Edward Chancellor. (blas.com) A review of Nathaniel Popper's "The Trolls of Wall Street: How the Outcasts and Insurgents are Hacking the Markets.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JUNE 11, 2024

Instead of simply a question-and-answer format, Brightwave reports are “living documents” that can be expanded and manipulated based on an advisor’s interests.

Abnormal Returns

JUNE 11, 2024

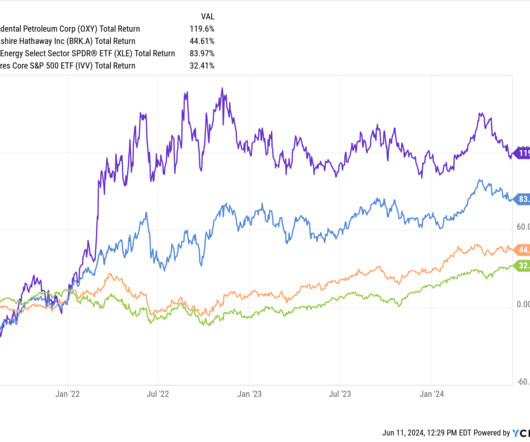

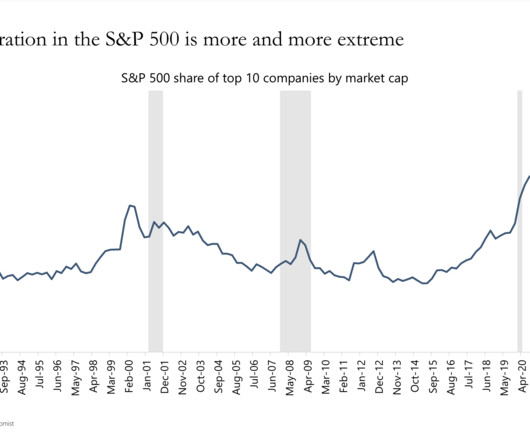

Concentration A look at 200 years of stock market concentration in the U.S. (globalfinancialdata.com) "Stock Market Concentration: How Much is Too Much?" by Mauboussin and Callahan. (morganstanley.com) Trend What happens when you stack managed futures trend on top of equities? (caia.org) Comparing the diversification benefits of bonds vs. trend following.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

JUNE 11, 2024

Welcome everyone! Welcome to the 389th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Mark Berg. Mark is the Founder of Timothy Financial Counsel, an RIA based in Wheaton, Illinois, that is on track to generate approximately $5 million in annual revenue this year serving 800 client households. What's unique about Mark, though, is how his firm has scaled from $1.8 million of revenue to $5 million, in only 6 years, and has maintained a 25% profit margin… al

Wealth Management

JUNE 11, 2024

How AI revolutionizes wealth management with personalized, efficient solutions.

Calculated Risk

JUNE 11, 2024

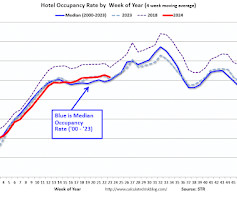

From STR: U.S. hotel results for week ending 1 June Due to Memorial Day, the U.S. hotel industry reported lower performance results from the previous week but slightly positive comparisons year over year, according to CoStar’s latest data through 1 June. 26 May through 1 June 2024 (percentage change from comparable week in 2023): • Occupancy: 62.0% (+0.9%) • Average daily rate (ADR): US$150.87 (+0.1%) • Revenue per available room (RevPAR): US$93.50 (+1.0%) emphasis added The following graph show

Wealth Management

JUNE 11, 2024

SRM Private Wealth represents the 11th team to join Summit this year. It will use Goldman Sachs for custody.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

JUNE 11, 2024

The key economic report this week is May CPI to be released tomorrow. The consensus is for 0.2% increase in CPI (up 3.4% YoY unchanged from April), and a 0.3% increase in core CPI (up 3.5% YoY, down from 3.6% YoY in April). From BofA: After averaging 0.4% m/m in January through March, inflation took a small step in the right direction in April with core Consumer Price Inflation (CPI) and Personal Consumption Expenditure Inflation (PCE) both decelerating to 0.3% m/m (core PCE inflation was 0.26%

Wealth Management

JUNE 11, 2024

The online presence and listings manager could pay up to $220 million for the client engagement and compliance platform.

Calculated Risk

JUNE 11, 2024

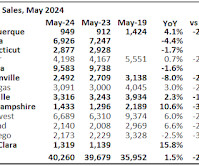

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in May A brief excerpt: NOTE: The tables for active listings, new listings and closed sales all include a comparison to May 2019 for each local market (some 2019 data is not available). This is the second look at several early reporting local markets in May. I’m tracking over 40 local housing markets in the US.

Wealth Management

JUNE 11, 2024

In a challenging labor market, attracting and retaining talent remains a top priority for firms.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

A Wealth of Common Sense

JUNE 11, 2024

The plural of anecdote is not data. You can’t extrapolate your individual experience or the experiences of your family, friends and peers to the broader economy, markets, political climate, etc. Just because the dumbest person you know is going all-in on Nvidia does not mean the stock market is going to collapse tomorrow. That’s not how any of this works.

Wealth Management

JUNE 11, 2024

The acquisition of Shore Morgan Young, an RIA with over $615 million in client assets, gives Lido a foothold in the Silicon Heartland.

Alpha Architect

JUNE 11, 2024

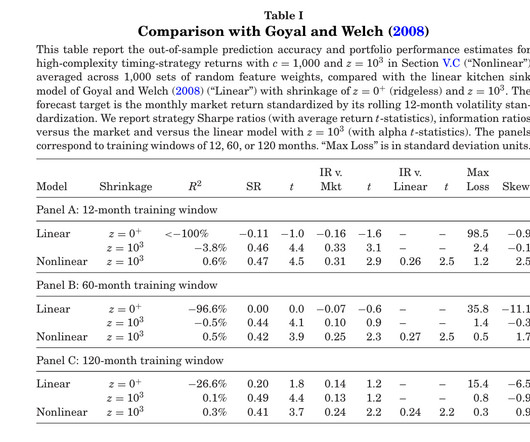

Simple models severely understate return predictability compared to “complex” models in which the number of parameters exceeds the number of observations. Complexity is a virtue in return prediction was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

JUNE 11, 2024

California-based duo Tim Woodall and Dustin Raring are the latest team from the collapsed bank to leave its acquirer. They are joining LPL through its affiliation model for employee advisors.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

JUNE 11, 2024

By championing innovation, fostering cross-functional collaboration, and driving a holistic growth strategy, a CGO can propel your firm towards achieving its growth targets and securing its competitive edge.

Wealth Management

JUNE 11, 2024

Denver-based SRS Capital Advisors is the latest RIA to join under Arax’s multi-boutique strategy.

Million Dollar Round Table (MDRT)

JUNE 11, 2024

By Yohei Tomita In my fifth year in this profession, I was lost and worried. I was working like a horse day and night and made it to the top 20% of my primary company’s production ranking. However, high-performing colleagues were producing the same in half the time. I thought, I must be doing something wrong. One day, I visited a Zen temple with an old friend to practice zazen, which is seated meditation.

Wealth Management

JUNE 11, 2024

Independence affords advisors the flexibility to break out on their own and still work with a broker/dealer on commissionable business.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

JUNE 11, 2024

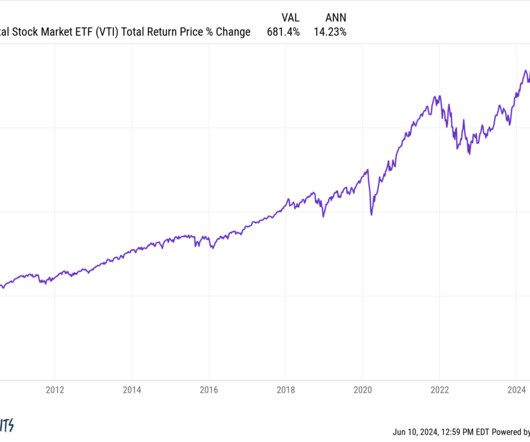

While early earnings guidance for Q2 is more a mixed bag, and not all months will look like this, May was a great month for equity investors. The adage, “Sell in May and go away” hasn’t seemed to work out so well over the last few decades.

Wealth Management

JUNE 11, 2024

Almost 50% of pension funds, insurers or other investors already have money in funds that have little hope of liquidating their assets or raising a successor vehicle, according to Coller Capital.

NAIFA Advisor Today

JUNE 11, 2024

Earlier this year, I encountered a remarkable AI tool with transformative capabilities. This tool can seamlessly import various documents, such as a PDF of an IUL illustration, and then empower users to enact changes effortlessly. With just a simple click of a button labeled "Analyze with AI," it initiates a swift process of recalculations, adjusting parameters like premium, face amount, load amount, and credit rating.

Advisor Perspectives

JUNE 11, 2024

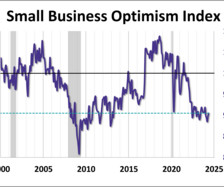

The headline number for the NFIB Small Business Optimism Index rose to 90.5 in May, the index's highest level of 2024. The latest reading was better than the forecast of 89.8 but marked the 29th straight month the index has been below the series average of 97.9.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Investing Caffeine

JUNE 11, 2024

Wed, Jun 19, 2024, 12:00 PM – 1:00 PM The Dow Jones Industrial Average recently reached the 40,000 milestone, but what does that mean for investors? There are plenty of questions to explore. With the looming elections, elevated inflation, and a cryptic Federal Reserve, should you be running for cover, or jumping on the bull market bandwagon? Sidoxia Capital Management Founder, Wade W.

Advisor Perspectives

JUNE 11, 2024

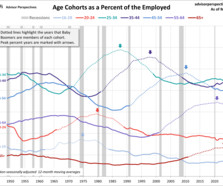

The 20th century Baby Boom was one of the most powerful demographic events in the history of the United States. We've created a series of charts to show seven age cohorts of the employed population from 1948 to the present.

SEI

JUNE 11, 2024

Our May 2024 monthly market commentary.

Advisor Perspectives

JUNE 11, 2024

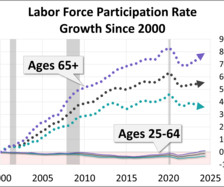

The labor force participation rate (LFPR) is a simple computation: You take the civilian labor force (people aged 16 and over employed or seeking employment) and divide it by the civilian non-institutional population (those 16 and over not in the military and or committed to an institution). As of May, the labor force participation rate is at 62.5%, down from 62.7% the previous month.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content