This Week on TRB

The Reformed Broker

FEBRUARY 4, 2023

And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. . The post This Week on TRB appeared first on The Reformed Broker.

The Reformed Broker

FEBRUARY 4, 2023

And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. . The post This Week on TRB appeared first on The Reformed Broker.

The Big Picture

FEBRUARY 4, 2023

This week, we speak with financial journalist William D. Cohan, who is the bestselling author of Money and Power: How Goldman Sachs Came to Rule the World, House of Cards: A Tale of Hubris and Wretched Excess on Wall Street, and The Last Tycoons: The Secret History of Lazard Frères & Co., among other books. A former Wall Street M&A investment banker for 17 years, Cohan is also a founding partner at the media company Puck.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

FEBRUARY 4, 2023

Autos Toyota ($TM) is hedging its bet on EVs. (wsj.com) Automakers are lining up to cash in on battery manufacturing incentives. (axios.com) Car subscriptions raises more questions than it answers. (insidehook.com) More cities are questioning the impact of parking garages. (arstechnica.com) Why it's time to start taxing cars by weight. (slate.com) Air transport Americans are unhappy with the flying experience and its not just about Southwest ($LUV).

Calculated Risk

FEBRUARY 4, 2023

At the Calculated Risk Real Estate Newsletter this week: • Case-Shiller: National House Price Index "Continued to Decline" to 7.7% year-over-year increase in November • Rents Continue to Decline; "Apartment Market Loosens" • Inflation Adjusted House Prices 3.6% Below Peak • Lawler: Net Home Orders and Sales Cancellations of Large Publicly-Traded Home Builders • Lawler: D.R.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Irrelevant Investor

FEBRUARY 4, 2023

Articles Since last June, GDP and other hard indicators of economic activity have consistently outperformed business surveys (By Sam Ro) 11 things that were only possible thanks to 0% interest rates. (By Jack Raines) Measured in today’s values, the Liberty Bonds issued during World War I raised a staggering $5 Trillion. (By Jamie Catherwood) There’s nothing wrong with the Vix (By Robin Wigglesworth) Nothing is as de.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

FEBRUARY 4, 2023

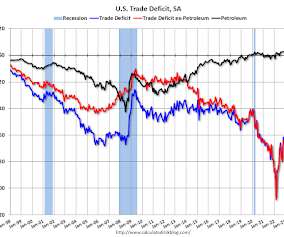

This will be light week for economic data. The key report this week is the December trade deficit. -- Monday, February 6th -- No major economic releases scheduled. -- Tuesday, February 7th -- 8:00 AM ET: Corelogic House Price index for December. 8:30 AM: Trade Balance report for December from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report.

Advisor Perspectives

FEBRUARY 4, 2023

Technology bellwethers Apple Inc., Amazon.com Inc. and Alphabet Inc. posted results Thursday that show an economic slowdown is throttling demand for everything from electronics and e-commerce to cloud computing and digital advertising.

The Big Picture

FEBRUARY 4, 2023

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • How Stockpickers Finally Beat the Index Funds : With less riding on slumping tech stocks such as Amazon, Tesla and Microsoft, many active fund managers finally surpassed their benchmarks in 2022. ( Bloomberg ) • An alleged $500 million Ponzi scheme preyed on Mormons.

Advisor Perspectives

FEBRUARY 4, 2023

The cost of insuring emerging-market nations against default fell to the lowest in nearly a year as the dollar weakens and investors bet that less aggressive US tightening will bring relief to developing borrowers.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Advisor Perspectives

FEBRUARY 4, 2023

Bullish markets are increasingly pricing in a second-half reversal of the global monetary tightening wave, making it tougher for central bankers to vanquish inflation once and for all.

Advisor Perspectives

FEBRUARY 4, 2023

As a rout in the price of food commodities from wheat to cooking oil deepens, the cost of products on grocery shelves continues to rise.

Advisor Perspectives

FEBRUARY 4, 2023

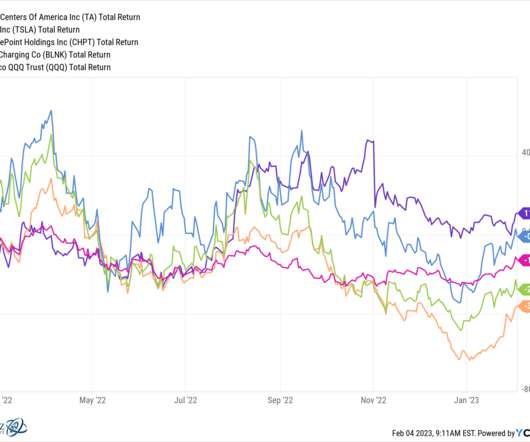

Cathie Wood’s funds had a scorching start to the year and she wants investors to know it.

Let's personalize your content