Taiko Debuts Strategy Gallery

Wealth Management

MARCH 31, 2023

The OCIO for financial advisors, which launched in November 2022, built the new feature to source investment options.

Wealth Management

MARCH 31, 2023

The OCIO for financial advisors, which launched in November 2022, built the new feature to source investment options.

Calculated Risk

MARCH 31, 2023

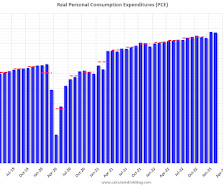

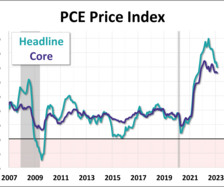

The BEA released the Personal Income and Outlays report for February: Personal income increased $72.9 billion (0.3 percent) in February , according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $89.9 billion (0.5 percent) and personal consumption expenditures (PCE) increased $27.9 billion (0.2 percent).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MARCH 31, 2023

Setting the stage for the end of the Tax Cuts and Jobs Act?

Calculated Risk

MARCH 31, 2023

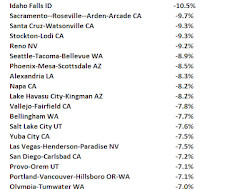

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Declines for 8th Consecutive Month in February A brief excerpt: Freddie Mac reported that its “National” Home Price Index (FMHPI) declined for the eighth consecutive month on a seasonally adjusted basis in February, putting the National FMHPI down 2.5% from its June 2022 peak, and down 4.7% Not Seasonally Adjusted (NSA) from the peak.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

MARCH 31, 2023

Launched in 2019, the firm encountered challenges landing enough customers and additional capital.

Nerd's Eye View

MARCH 31, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that, according to a recent survey, RIAs are considering metrics for growth other than assets under management, from the number of clients to diversifying the services they offer. And given that growth can create additional time burdens for advisors, many advisors are looking to automation as a way to gain efficiencies as they scale.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Reformed Broker

MARCH 31, 2023

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Jurrien Timmer, and Downtown Josh Brown discuss what’s going on with banks, what’s changed since Jurrien’s 2022 TCAF appearance, the Fed and the market, S&P technicals, gold, Bitcoin, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

Wealth Management

MARCH 31, 2023

Also, PureFacts acquires Xtiva Financial Systems, Elements offers a money-back guarantee, Lion Street partners with Pontera and Luminant announces a $3.5M seed funding round.

Calculated Risk

MARCH 31, 2023

From BofA: Personal income rose by a larger-than-expected 0.3% m/m in February, after a 0.6% m/m print in January. Personal spending rose by 0.2% m/m in nominal terms with sizeable upward revisions to January, both in nominal and real terms. This increased our 1Q PCE tracking estimate. Overall, today's personal income and outlays print pushed up our 1Q US GDP tracking estimate from 0.8% q/q saar to 1.5% q/q saar.

Wealth Management

MARCH 31, 2023

Jason Periera details how every part of the client experience and business management can be enhanced and made more efficient through digitization and automation.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Big Picture

MARCH 31, 2023

I had some fun last week chatting with Howard Lindzon, whom I previously had on MiB. And he is part of my conversation about my worst trades. Here is Howard: “I’m excited to have my good friend Barry Ritholtz back on the show. Barry is the Chairman and CIO of Rithotz Wealth Management, an author, a newspaper columnist, and the host of the Bloomberg Podcast Masters in Business.

Wealth Management

MARCH 31, 2023

Shares of the firm have plunged 34% in March, set to be their biggest drop since October 1987.

A Wealth of Common Sense

MARCH 31, 2023

There are many different ways to succeed as an investor. If there were only one approach that worked, everyone would do that.1 I know plenty of investors with completely different styles that have found success in the markets over the years. But there are only a handful of ways investors fail in the markets: Allowing your emotions to get the best of you.

Wealth Management

MARCH 31, 2023

Assets in SCHI have surged more than ten-fold from the end of last week, racking up the largest inflows among US ETFs tracked by Bloomberg over that period.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Abnormal Returns

MARCH 31, 2023

Markets The stock market is on track for a good quarter. (allstarcharts.com) Money market mutual funds have seen a surge of inflows. (ft.com) Books On the benefits of reading older books. (collabfund.com) Lessons learned from "The Panic of 1907" by Robert J. Bruner and Sean D. Carr. (novelinvestor.com) Finance Times are tough these days for investment bankers.

Wealth Management

MARCH 31, 2023

Thematic ETFs that launched to target the buzziest market themes of the past two years are closing at a rapid pace, as rising interest rates hammer performance and send investors in search of safer options.

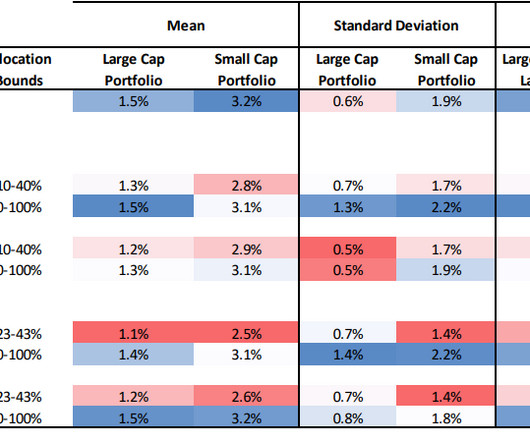

Alpha Architect

MARCH 31, 2023

A simple 1/N factor diversification strategy will likely be at least as efficient as more “sophisticated” versions. <strong>Is a Naive 1/N Diversification Strategy Efficient?</strong> was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

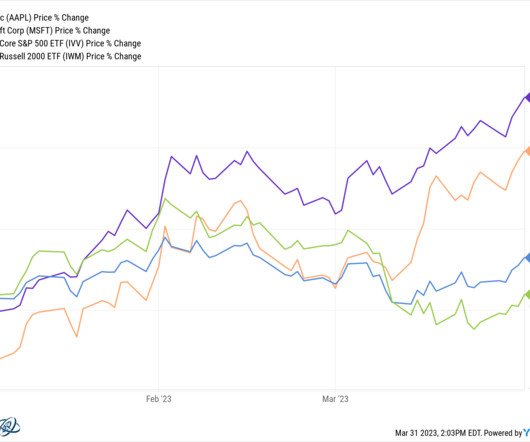

MARCH 31, 2023

With just a handful of highfliers driving the S&P 500 into positive territory this quarter, dreams of a new bull market need a reality check.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

MARCH 31, 2023

The BEA's Personal Income and Outlays report for February was published on this morning by the Bureau of Economic Analysis. The latest headline PCE price index was up 0.3% month-over-month (MoM) and is up 5.0% year-over-year (YoY). Core PCE dropped to 4.6% YoY, still well above the Fed's 2% target rate, and is up 0.3% MoM. All readings were below their respective Investing.com forecasts.

Your Richest Life

MARCH 31, 2023

March 2023 marked a historic month for U.S. banking. Two major banks, the Silicon Valley Bank and Signature Bank, closed within a couple days of each other, marking the second and third largest bank failures in U.S. history. (The top spot belongs to the 2008 Lehman Brothers collapse.) The markets responded erratically to these collapses, and are still very up and down.

Darrow Wealth Management

MARCH 31, 2023

There are many financial planning considerations before, during, and after a divorce. A key part of the process from a financial standpoint is dividing the assets. Generally, couples split the value of their assets 50-50 (though not always). But that doesn’t mean the actual assets are just split down the middle, and some assets are much more favorable from a tax perspective than others.

MarketWatch

MARCH 31, 2023

An AI researcher at Alphabet Inc.’s GOOGLGOOG Google resigned because he discovered data from its Bard chatbot came from OpenAI’s ChatGPT, which powers Microsoft Corp.’s MSFT Bing Chat search features. According to a report in The Information, researcher Jacob Devlin has since joined OpenAI after discovering Google relied “heavily” on data from ShareGPT, a website that parses conversations made with OpenAI’s chat models.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

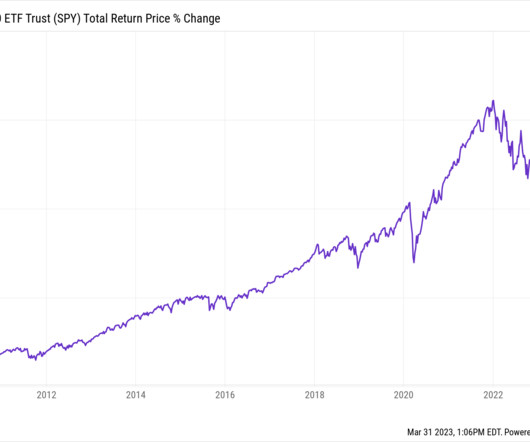

Advisor Perspectives

MARCH 31, 2023

Valid until the market close on April 30, 2023. The S&P 500 closed March with a monthly gain of 3.51%, after a loss of 2.61% in February. At this point, after close on the last day of the month, two of five Ivy portfolio ETFs — Vanguard Real Estate ETF (VNQ) and Invesco DB Commodity Index Tracking Fund (DBC) — are signaling "cash," a decrease from last month's final triple "cash" signal.

NAIFA Advisor Today

MARCH 31, 2023

Kathleen Owings is the Principal and Financial Advisor of Westbilt Financial Group , an independent financial advisory firm providing comprehensive planning for clients wanting to achieve personal goals. In 2007, Kathleen began her career in the financial services industry with New England Financial. Her licensure is in life and health insurance and she maintains Series 6, 7, 63, and 65 securities registrations.

Advisor Perspectives

MARCH 31, 2023

Early signs of economic unraveling are appearing. The federal corporation that insures bank deposits is woefully underfunded. The Fed is under pressure to pivot away from its inflation fight.

MarketWatch

MARCH 31, 2023

Kentucky Gov. Andy Beshear said he plans to sign into law Friday a medical cannabis bill passed by the state Senate and General Assembly, according to his Twitter account. “Today the General Assembly finally took action and passed a bill to legalize medical cannabis,” Gov. Beshear said late Thursday. “I am thankful this progress has been made and I will proudly sign this bill into law tomorrow.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

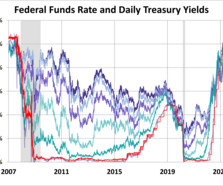

Advisor Perspectives

MARCH 31, 2023

The yield on the 10-year note ended March 31, 2023 at 3.48%, the two-year note ended at 4.06%, and the 30-year at 3.67%.

MarketWatch

MARCH 31, 2023

The attorneys general of California, Maryland, New Jersey and North Carolina on Friday joined an antitrust lawsuit to block JetBlue’s JBLU proposed $3.8 billion purchase of Spirit Airlines SAVE. The four attorneys general are joining a suit by the U.S. Department of Justice and the attorneys general of Massachusetts, New York and Washington, D.C., that was filed earlier this month.

Advisor Perspectives

MARCH 31, 2023

With the release of this morning's report on February's personal incomes and outlays, we can now take a closer look at "real" disposable personal income per capita. At two decimal places, the nominal 0.43% month-over-month change in disposable income comes to 0.16% when we adjust for inflation. This is a steep decline from last month's 2.00% nominal and 1.42% real change.

MarketWatch

MARCH 31, 2023

U.S. stocks rallied on Friday to end a rocky month higher, while the Nasdaq Composite also posted its best quarterly gain since 2020. The Dow Jones Industrial Average DJIA jumped about 414 points, or 1.3%, ending near 33,273 on Friday and up 1.9% for the month, according to preliminary FactSet figures. The S&P 500 index SPX and Nasdaq Composite Index COMP posted higher daily gains of 1.4% and 1.7%, respectively, which elevated their monthly gains to 3.5% and 6.7%.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content