Aretha Franklin's Will Drama Is Over

Wealth Management

JULY 14, 2023

A Michigan jury deemed a handwritten document found in between Aretha’s couch cushions a valid will.

Wealth Management

JULY 14, 2023

A Michigan jury deemed a handwritten document found in between Aretha’s couch cushions a valid will.

Nerd's Eye View

JULY 14, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that while the new social media app Threads, designed to compete with Twitter, has surpassed 100 million users in its first week alone, its potential utility for advisors remains unclear and has raised compliance concerns for advisors whose social media archiving tools do not yet cover the new app.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 14, 2023

Advisors must think like their clients and to think like them they need to know what they are experiencing.

The Big Picture

JULY 14, 2023

Jim Reid of Deutsche Bank notes the pattern of gradual downgrades before earnings season begins is back to normal. As the rest of the quarterly earnings roll out, we should expect earnings to improve as we roll deeper into earnings season and as “later estimate beats” come in. This quarterly earnings pattern is shown above in the chart from his colleague Binky Chadha.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JULY 14, 2023

Focus Financial shareholders voted overwhelmingly to approve a take-private sale to private equity firm CD&R but were less enthusiastic about executive compensation.

The Big Picture

JULY 14, 2023

My end-of-week morning offsite reads: • Google’s AI Blunders Rival Xerox’s PC Mistakes : The “T” technology behind ChatGPT was devised at Google but languished there. Sound familiar? ( Bloomberg ) • Wall Street’s Recession Warning Is Flashing. Some Wonder if It’s Wrong. The yield curve has been suggesting since last year that the economy was headed for a slump. ( New York Times ) see also Dude, Where’s My Recession?

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 14, 2023

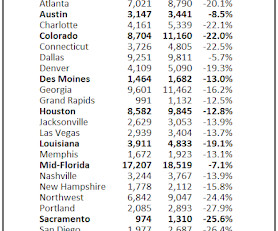

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in June A brief excerpt: This is the third look at local markets in June. I’m tracking a sample of about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Wealth Management

JULY 14, 2023

Beyond Hightower's expansion, no less than five other deals were announced this week along with a handful of RIA executive moves.

Calculated Risk

JULY 14, 2023

From BofA: Data since our last weekly publication moved up our 2Q GDP tracking estimate from 1.4% q/q saar to 1.5%. [July 14th estimate] emphasis added From Goldman: We boosted our Q2 GDP tracking estimate by one tenth to +2.3% (qoq ar). Our Q2 domestic final sales growth forecast stands at +2.6%. [July 10th estimate] And from the Altanta Fed: GDPNow The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 2.3 percent on July 10, up from 2.

Wealth Management

JULY 14, 2023

Emphasize data portability, not retention, within your tech strategy.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Reformed Broker

JULY 14, 2023

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Michael Cembalest, and Downtown Josh Brown discuss the economy, AI stocks, the worst experiment in capital markets, the biggest risks to the market, the 2024 election, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

Wealth Management

JULY 14, 2023

Advisors have no financial incentive to transition their clients to off-the-rack ETF offerings.

NAIFA Advisor Today

JULY 14, 2023

Iris Nance, LUTCF , got into the insurance and financial services industry because of a postcard. In 1997, she was working as a Real Estate Finance Credit Analyst at a local bank after more than 10 years as a Bank Examiner with the Federal Deposit Insurance Corporation (FDIC). While exploring other career opportunities that would allow quality time with her twin daughters, she received a postcard in the mail from Farmers Insurance , and the rest is history.

A Wealth of Common Sense

JULY 14, 2023

With inflation falling it’s looking more likely that we could see a soft landing in the U.S. economy.1 So now all of the economic pundits are fighting over who gets to take credit for it. My stance is no one gets to take credit because everyone was predicting a recession and there are no counterfactuals. You can’t say inflation was transitory because the Fed hiked rates so aggressively.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

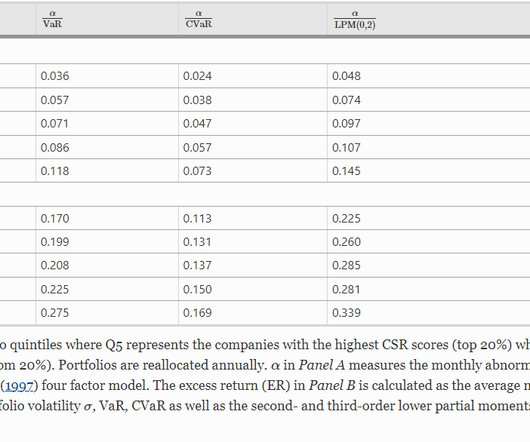

Alpha Architect

JULY 14, 2023

Academic research has demonstrated that the higher risk associated with less sustainable firms should be compensated by higher returns. It also has shown that more sustainable firms have less investment risk. Are Sustainable Investors Compensated Adequately? was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Trade Brains

JULY 14, 2023

Best Dividend Stocks Under Rs 500 : Most long-term investors get disappointed, as they do not get the right value for their time and money invested in the stock market. After holding a security for a long period they may receive less capital appreciation. But, no more worries! You can earn a good return for both your time as well as money invested. One such way of earning more is through investing in dividend stocks.

Advisor Perspectives

JULY 14, 2023

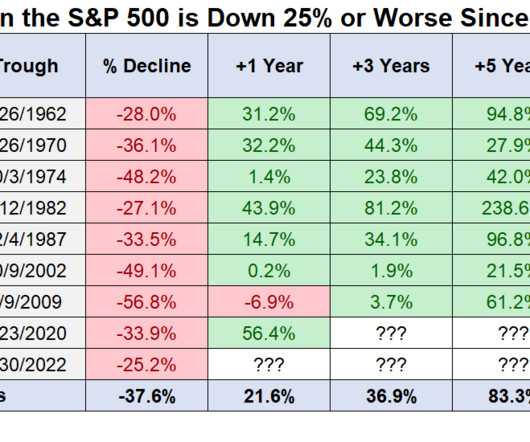

The S&P 500 bounced back this week amidst cooling inflation data from the CPI and PPI reports. Despite Friday's small setback, the index finished the week up 2.4% and crossed the 4500 threshold for the first time in 15 months. The index is currently up 17.82% year t o date and is 6.07% below its record close from January 3, 2022.

Random Roger's Retirement Planning

JULY 14, 2023

Much has been made this year of the incredibly narrow leadership in the S&P 500's performance year to date, the NASDAQ too for that matter. The 'Magnificent Seven' of Amazon, Microsoft, Meta, Nvidia, Apple, Alphabet and Tesla account for the vast majority of the gain in the S&P 500 so far. This group recently grew to 30% of the index so if you don't have 30% of your portfolio in those names, you are very likely lagging behind the index.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

JULY 14, 2023

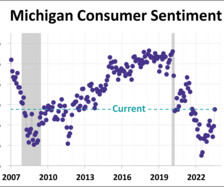

The July preliminary report for the Michigan Consumer Sentiment Index came in at 72.6, up 8.2 (12.7%) from the June final. This morning's reading was well above the forecast of 65.5. Since its beginning in 1978, consumer sentiment is 14.7% below its average reading (arithmetic mean) and 13.6% below its geometric mean.

ModernAdvisor

JULY 14, 2023

Commentary The second quarter of 2023 saw confidence return to the US banking system with volatility receding, putting the spotlight back on inflation and central bank rate increases. The Bank of Canada (BoC) increased the benchmark interest rate in June by 0.25% after holding steady in March and April. Many had expected the rate rises to end at 4.75% but […] The post Q2 2023 Update appeared first on ModernAdvisor Blog.

Advisor Perspectives

JULY 14, 2023

I've updated this series to include the June release of the consumer price index as the deflator and the monthly employment update. The latest hypothetical real (inflation-adjusted) annual earnings are at $48,723, down 7.9% from 50 years ago. Hourly earnings are below their all-time high after adjusting for inflation.

Tobias Financial

JULY 14, 2023

We are thrilled to announce that our CEO Marianela Collado has been appointed to the Association of International Certified Professional Accountants (AICPA) Personal Financial Planning (PFP) Executive Committee. Marianela’s appointment is a testament of her knowledge, dedication, and commitment to advancing the field of financial planning. The AICPA PFP Executive Committee is dedicated to broadening the competency of CPA financial planners.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

JULY 14, 2023

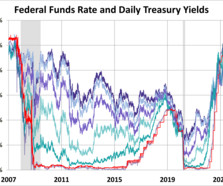

The yield on the 10-year note ended July 14, 2023 at 3.83%, the 2-year note ended at 4.74%, and the 30-year at 3.93%.

Calculated Risk

JULY 14, 2023

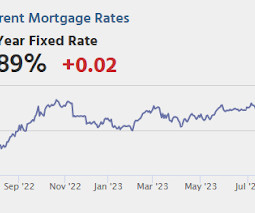

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Due to changes at the CDC, weekly cases are no longer updated. After the first few weeks, the pandemic low for weekly deaths had been the week of July 7, 2021, at 1,690 deaths (until recently). For COVID hospitalizations, the previous low was 9,821 (until recently). The last few months have seen a positive trend.

Advisor Perspectives

JULY 14, 2023

Portfolio manager Shuntaro Takeuchi says Japanese equities, for so long a market of false dawns, may now be stirring up investment opportunities that finally present Japan as a long-term growth market.

Abnormal Returns

JULY 14, 2023

The biz The Masters in Business podcast just hit 500 episodes. (ritholtz.com) 20 years in, has podcasting already peaked? (insidehook.com) AI Russ Roberts talks AI with Marc Andreessen. (econtalk.org) Ezra Klein talks with Demis Hassabis who is the CEO of Google DeepMind about what AI has already solved. (nytimes.com) Finance Michael Lewis talks distressed investing with Andy Mitchell of Lantern Asset Management.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

JULY 14, 2023

Now that short-term Treasury yields have reached 5%, further upside is likely to be limited.

Integrity Financial Planning

JULY 14, 2023

Summer is here, and it’s a great time to kick back with a good book and enjoy some reading. If you’re looking for some relaxing books to get into during your retirement, here are some great options! A Man Called Ove by Fredrik Backman A Man Called Ove is a heartwarming and humorous tale of an unlikely friendship between an endearing curmudgeon and his lively new neighbors.

Advisor Perspectives

JULY 14, 2023

While this is a market estimate and in no way guaranteed, let’s just pretend for a minute that there is a 100% chance of this coming true and the FOMC is going to raise the Fed Funds rate by an additional 50 basis points.

Advisor Perspectives

JULY 14, 2023

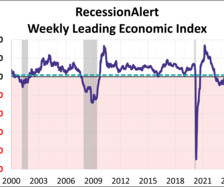

The weekly leading economic index (WLEI) is a composite for the U.S economy that draws from over 20 time-series and groups them into the following six broad categories which are then used to construct an equally weighted average. As of June 30th, the index was at 5.394, up 1.165 from the previous week.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content