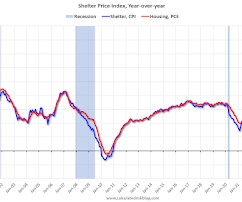

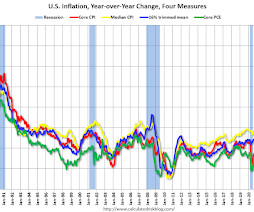

YoY Measures of Inflation: Services, Goods and Shelter

Calculated Risk

MAY 10, 2023

Here a few measures of inflation: The first graph is the one Fed Chair Powell has been mentioning. Click on graph for larger image. This graph shows the YoY price change for Services and Services less rent of shelter through March 2023. Services were up 6.8% YoY as of April 2023, down from 7.2% YoY in March. Services less rent of shelter was up 5.2% YoY in April, down from 6.1% YoY in March.

Let's personalize your content