Your End-of-Year Roadmap: Staying Ahead in the Home Stretch

Wealth Management

AUGUST 24, 2023

Don’t look now, but we’re already more than halfway through 2023. And the rest of the year will sail past in a heartbeat if you’re not careful.

Wealth Management

AUGUST 24, 2023

Don’t look now, but we’re already more than halfway through 2023. And the rest of the year will sail past in a heartbeat if you’re not careful.

The Big Picture

AUGUST 24, 2023

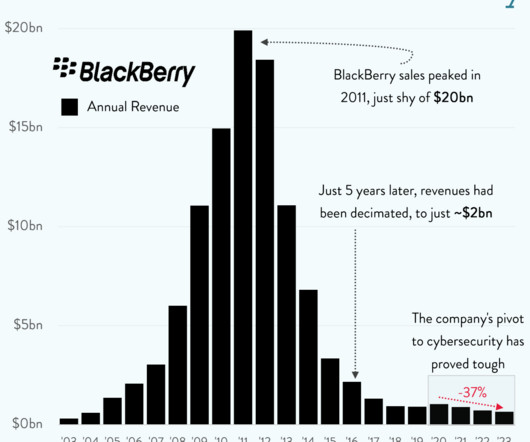

How little do we know about the future? A great way to figure that out is to look to our past, to see what we previously thought about what the future will hold. To wit: 26 years ago, the image above came from the cover story of Fortune magazine: “There’s a lot of buzz in the smartphone business lately, with Apple’s (AAPL) iPhone turning the mobile world upside down and Nokia’s (NOK) upcoming phone announcement providing a new challenge.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 24, 2023

Thursday, September 21, 2023 | 2:00 PM ET

Nerd's Eye View

AUGUST 24, 2023

For many next-gen financial advisors who start with or move their careers to an established firm, eventually earning an equity stake in that firm can be an exciting prospect and is often a major career goal that many advisors aspire to achieve. However, when these aspirations are delayed or blocked by senior advisory firm partners who choose to delay their retirement plans, it can leave younger advisors frustrated and in a place of uncertainty about their futures with their firm.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 24, 2023

The transition of 2,600 advisors and more than $50 billion in assets is expected to take more than a year and increase LPL’s earnings by $60 million

Abnormal Returns

AUGUST 24, 2023

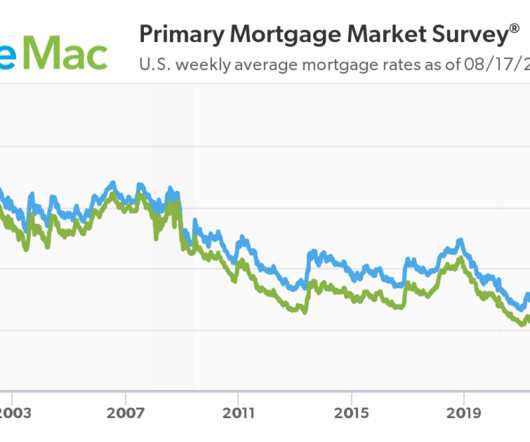

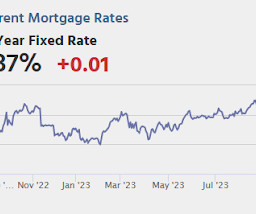

Rates It's hard to overstate the sea change that has occurred with interest rates. (theirrelevantinvestor.com) Higher real rates are to blame for the rise in interest rates. (wsj.com) The yield curve has flattened a little bit, but remains highly inverted. (axios.com) Finance Multi-strategy hedge funds continue to take mind (and wallet) share. (ft.com) Higher interest rates continue to drag down smaller banks.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 24, 2023

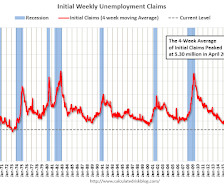

The DOL reported : In the week ending August 19, the advance figure for seasonally adjusted initial claims was 230,000 , a decrease of 10,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 239,000 to 240,000. The 4-week moving average was 236,750, an increase of 2,250 from the previous week's revised average.

Wealth Management

AUGUST 24, 2023

Now in its fourth year, the virtual advisor technology conference AdviceTech.Live is run by Asset-Map, features 10-minute presentations from 20 companies and will be free to attend for the first time.

Calculated Risk

AUGUST 24, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 10:00 AM ET,: University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 71.2.

Wealth Management

AUGUST 24, 2023

The AIA/Deltek Architecture Billings Index reported stable conditions for July of this year. WeWork has been assembling a team of consultants, including lawyers and real estate advisors, to avoid bankruptcy, reported Bisnow. These are among today’s must reads from around the commercial real estate industry.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

AUGUST 24, 2023

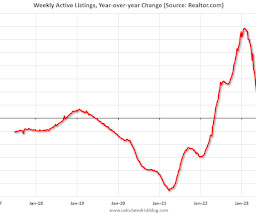

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Sabrina Speianu: Weekly Housing Trends View — Data Week Ending Aug 19, 2023 • Active inventory declined, with for-sale homes lagging behind year ago levels by 7.2%. This past week marked the 9th consecutive decline in the number of homes actively for sale compared to the prior year, however the gap narrowed slightly compared to the previous week’s -8.6% figure.

Wealth Management

AUGUST 24, 2023

If RIA leaders can redirect their focus towards cultivating and maintaining a corporate culture that focuses on systematic issue resolution as opposed to mere crisis containment the prospect of emerging successfully from challenging circumstances becomes more promising.

The Reformed Broker

AUGUST 24, 2023

Final Trades: Cheniere Energy, B&G Foods, & more from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

AUGUST 24, 2023

Mark Pasierb, newly appointed president of Kingbird Investment Management, talks about how the current market might be a good time for those willing to work with distressed situations.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

AUGUST 24, 2023

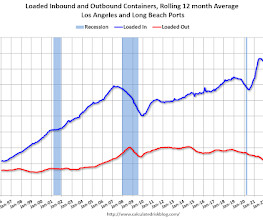

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago ), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast. Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

Wealth Management

AUGUST 24, 2023

Evan Mayer started in the bank channel and, over time, came to the realization that he could do more to support his clients and grow the business in the independent model.

Abnormal Returns

AUGUST 24, 2023

Books An excerpt from "Quiet Street: On American Privilege" by Nick McDonell. (theatlantic.com) A Q&A with Karen Pinchin author of "Kings of Their Own Ocean: Tuna, Obsession, and the Future of Our Seas." (insidehook.com) An excerpt from "Kingdom Quarterback: Patrick Mahomes, the Kansas City Chiefs, and How a Once Swingin' Cow Town Chased the Ultimate Comeback" by Mark Dent and Rustin Dodd.

Wealth Management

AUGUST 24, 2023

The US economy has not yet slowed enough to put inflation on a sustainable trajectory downward.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

AUGUST 24, 2023

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in July A brief excerpt: Each month I track closed sales, new listings and active inventory in a sample of local markets around the country (over 40 local housing markets) in the US to get an early sense of changes in the housing market. In addition, we can look for regional differences.

NAIFA Advisor Today

AUGUST 24, 2023

Three best-in-class associations will integrate operations to amplify their impact on advocacy and education for financial service professionals and promote financial wellness for American consumers. The National Association of Insurance and Financial Advisors (NAIFA), the Society of Financial Service Professionals (FSP), and Life Happens announced plans to come together as one organization, pending membership approval.

A Wealth of Common Sense

AUGUST 24, 2023

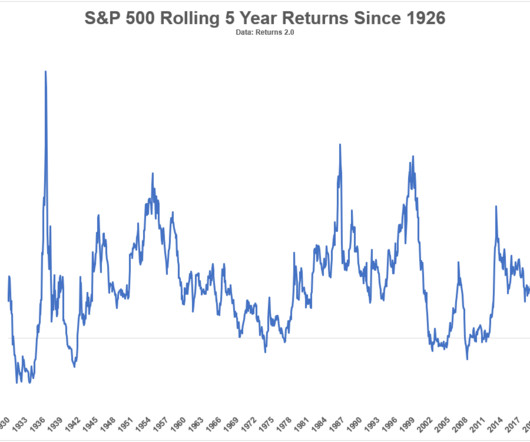

A reader asks: I’m anticipating needing to replace both the roof on my house and a car five years from now. I would like to have $100,000 set aside for these expenses. Five years out feels like an investment no man’s land. Stocks seem to be a bit risky at that time frame, and high interest savings, while attractive now, will likely have rates dropped if the Fed drops interest rates in the future.

Alpha Architect

AUGUST 24, 2023

This piece outlines the high-level benefits of the ETF structure, which boils down to market access, tax efficiency, and transparency. It covers the considerations for a 351 tax-free conversion and the mechanics and tax consequences of a 351 conversion. The case for the tax-free conversion of SMAs into an ETF via Section 351 was originally published at Alpha Architect.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

MainStreet Financial Planning

AUGUST 24, 2023

So I just dropped my son off at Kindergarten. After 5 and 2/3 years working with him by my side almost every day, now I am here in the quiet. It is surreal. Before his existence was known, I knew I wanted to avoid sending him to daycare. I wanted him to grow up more like I did, with a stay-at-home mom. In today’s world, that is a rarity if not downright impossible for many.

Fintoo

AUGUST 24, 2023

Highlights Issue Size – 3,12,00,000 shares Issue Open/Close – Aug 24/Aug 28, 2023 Price Band (Rs.) 94 – 99 Issue Size- Rs 2,932 mn – Rs 3,088 mn Face Value (Rs) 10 Lot Size (shares) 150 Vishnu Prakash R Punglia Limited (VPRPL) is an integrated engineering, procurement, and construction (EPC) company. It also has ISO […] The post Vishnu Prakash R Punglia Limited IPO appeared first on Fintoo Blog.

Advisor Perspectives

AUGUST 24, 2023

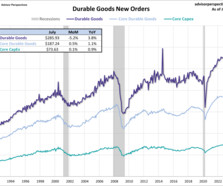

New orders for manufactured durable goods fell for the first time in February, coming in at $285.93B in July. This is a 5.2% decrease from the previous month and is worse than the expected 4.0% decline. The series is up 3.8% year-over-year (YoY). If we exclude transportation, "core" durable goods were up 0.5% from the previous month and up 1.1% from one year ago.

The Irrelevant Investor

AUGUST 24, 2023

Today’s Compound and Friends is brought to you by Public: Visit public.com/compound for more information on how to earn 5+% interest with a treasury account on public. On today’s show, we discuss: The Education of a Value Investor These two men paid over $650,000 for lunch with Warren Buffett – here are 3 things they learned Warren Buffet wisdom: 15 genius things I Learned at lunch with ‘The.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

AUGUST 24, 2023

Until recently, I thought rising interest rates were — on balance — bad for businesses. In fact, many big companies are benefiting from the fastest rate-hiking cycle in decades, at least in purely financial terms.

Trade Brains

AUGUST 24, 2023

Fundamental Analysis of SJVN: Recently government stocks made headlines with the Honorable Prime Minister Narendra Modi advocating them as attractive investments. You might be inclined to dismiss it as a casual statement. But various government companies are heavily investing for the future. One such company is SJVN, a mid-cap power producer with a high government holding of 86.8%.

Advisor Perspectives

AUGUST 24, 2023

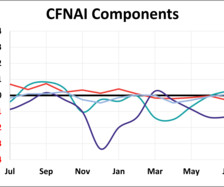

The Chicago Fed's National Activity Index is based on 85 economic indicators drawn from four broad categories of data. Two of the four broad categories of indicators used to construct the index increased from June. Two of the four categories made positive contributions in July.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content