Debt Management in Estate Planning

Wealth Management

NOVEMBER 10, 2023

What if a client burdened with substantial debts or liabilities from their business unexpectedly passes away?

Wealth Management

NOVEMBER 10, 2023

What if a client burdened with substantial debts or liabilities from their business unexpectedly passes away?

Calculated Risk

NOVEMBER 10, 2023

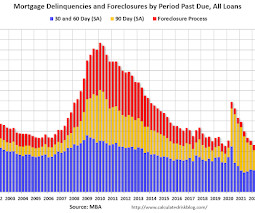

From the MBA: Mortgage Delinquencies Increase in the Third Quarter of 2023 The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.62 percent of all loans outstanding at the end of the third quarter of 2023 , according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

NOVEMBER 10, 2023

Many individual investors have seen the value of their holdings drop, and are looking to bail out, drawing hedge funds.

Abnormal Returns

NOVEMBER 10, 2023

Strategy The 40 of the 60/40 portfolio is finally earning people something. (awealthofcommonsense.com) There's still no sign of a turn in the trend favoring U.S. vs. international equities. (allstarcharts.com) The case for bonds. (blogs.cfainstitute.org) Energy Solar panel manufacturing is finally on the rise in the U.S. (nytimes.com) Why the cancellation of the NuScale, small modular reactor, project is such a bummer.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

NOVEMBER 10, 2023

Adopting an advice-centric engagement model places the decision-making authority squarely in the hands of those with the most vested interest—the clients themselves.

The Reformed Broker

NOVEMBER 10, 2023

OK, we’re trying something new next week for registered financial advisors only. It’s a brand new show we’ve created and you can be there virtually to watch the pilot episode live. As an advisor, you’re going to spend time, money and energy implementing new technology and asset management solutions into your practice. You may as well get good at it.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

NOVEMBER 10, 2023

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in October A brief excerpt: NOTE: Starting next month, I’ll add some comparisons to 2019 (pre-pandemic)! This is the second look at several early reporting local markets in October. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas.

Wealth Management

NOVEMBER 10, 2023

Trevor Hicks, chief technology officer at Wetherby Asset Management and Laird Norton Wealth Management, provides an honest assessment of the technology tools used by the $14 billion AUM firms to work with clients and drive business.

Calculated Risk

NOVEMBER 10, 2023

From BofA: Overall, data since our last weekly publication pushed up our 3Q US GDP tracking estimate from 5.1% q/q saar to 5.2% q/q saar. [W]e will start our 4Q US GDP tracker with the retail sales print [Nov 10th] emphasis added From Goldman: We boosted our past-quarter GDP tracking estimate for Q3 to +5.2% and left our Q4 GDP tracking estimate unchanged at +1.6%.

Wealth Management

NOVEMBER 10, 2023

A host of ‘strategic’ hires and promotions were announced this week, as firms continue to focus on growth.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Reformed Broker

NOVEMBER 10, 2023

On episode 117 of The Compound and Friends, Michael Batnick and Downtown Josh Brown are joined by Callie Cox and Malcolm Ethridge to discuss: market sentiment, Robinhood earnings, Warren Buffett and his cash, interest rates, the yield curve, recession calls, weight loss drugs, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

Wealth Management

NOVEMBER 10, 2023

Advisor attrition dropped by 30% in the quarter to 4.5%, the company announced.

The Big Picture

NOVEMBER 10, 2023

I was recently asked how many Masters in Business guests have won a Nobel Prize. The list appears to be mostly (but not exclusively) behavioral finance types; here is the short-list of laurates, plus a few related columns of Nobel Winners: Danny Kahneman on Noise (May 15, 2021) Paul Krugman on Zombie Ideas (February 15, 2020) Gene Fama (with David Booth) on Efficient Markets (November 9, 2019) Michael Spence, on the Dynamics of Information Signaling (October 26, 2019) Robert Shiller on Narrative

Wealth Management

NOVEMBER 10, 2023

Hightower, Robertson Stephens, Wealth Enhancement Group, Hub International and Sikitch all announced M&A deals this week.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Alpha Architect

NOVEMBER 10, 2023

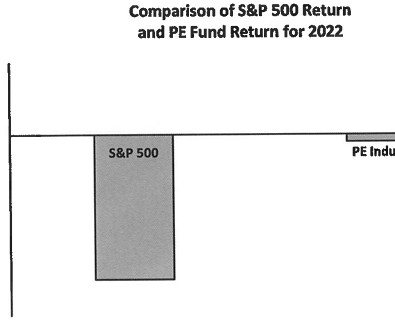

The claims of superior risk-adjusted performance by the PE industry are exaggerated. Given their lack of liquidity, opaqueness, and greater use of leverage, it seems logical that investors should demand something like a 3-4% IRR premium. Yet, there is no evidence that the industry overall has been able to deliver that. The Performance of Major Private Equity/LBO Firms was originally published at Alpha Architect.

Wealth Management

NOVEMBER 10, 2023

Advisor attrition dropped by 30% in the quarter to 4.5%, the company announced.

The Big Picture

NOVEMBER 10, 2023

My end-of-week morning train WFH reads: • What the US got right that Europe did not : America’s post-pandemic recovery has left Europe in the dust. ( Financial Times ) • The Land Where Inflation Is Good News : Food and energy price increases triggered by the pandemic and the Ukraine war are helping end the long, bleak era of Japanification. ( Wall Street Journal ) • The Real Reason So Many Asset Managers Are Struggling in China : The world’s second-biggest economy has its own rules of engagement

Wealth Management

NOVEMBER 10, 2023

AllianceBernstein is offering funding to lenders — enabling the banks to keep their most prestigious clients sweet — in return for a cut of the fees and access to their client contact books.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

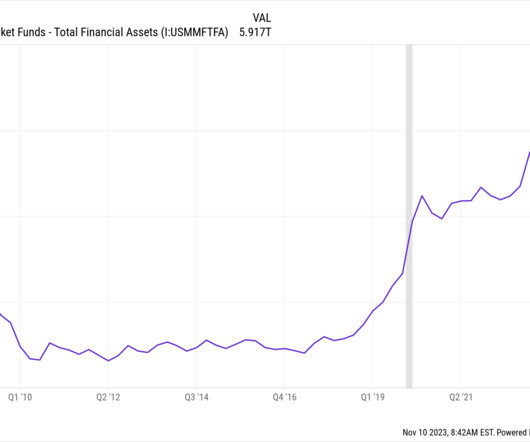

A Wealth of Common Sense

NOVEMBER 10, 2023

Boring old money market funds are the hottest thing in fund flows this year. Just look at the massive amount of money that has poured into these things: There’s a good reason these funds saw stagnating asset growth in the 2010s — there was no yield. Now there is. Bloomberg’s Eric Balchunas and Jeff Seyffart show how banks and fund companies across the board are vacuuming up money now that money market f.

Wealth Management

NOVEMBER 10, 2023

With nearly 40 ETFs, and thanks to inflows and fund conversions, Dimensional is among the top 10 largest US issuers in the $7.3 trillion industry.

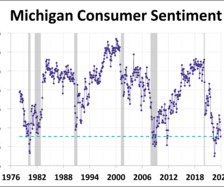

Advisor Perspectives

NOVEMBER 10, 2023

Consumer sentiment fell to a six month low in November according to the preliminary report for the Michigan Consumer Sentiment Index. The index came in at 60.4, down 3.4 points (-5.3%) from the October final. This morning's reading was below the forecast of 63.7.

Trade Brains

NOVEMBER 10, 2023

Fundamental Analysis of Castrol India : The world of Automotive Engineering is filled with numerous mechanical parts. When we fire up a vehicle’s engine, these parts move in tandem at super high speed generating a lot of friction as they rub against each other. This generates a lot of heat, which could eventually lead to wear & tear on your machine.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

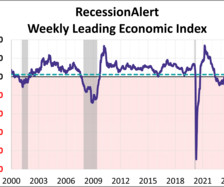

Advisor Perspectives

NOVEMBER 10, 2023

The weekly leading economic index (WLEI) is a composite for the U.S economy that draws from over 20 time-series and groups them into the following six broad categories which are then used to construct an equally weighted average. As of October 27th, the index was at 7.007, down 3.512 from the previous week.

Brown Advisory

NOVEMBER 10, 2023

Sustainable Small-Cap Core Strategy: Reporting on the impact of our investment decisions 2022 bgregorio Fri, 11/10/2023 - 13:26 Download the Report A Letter of Introduction From The Portfolio Managers Brown Advisory has made a deep commitment to sustainable investing across a wide range of its equity and fixed income strategies. We firmly believe that there does not have to be a trade-off between strong performance and investments that seek to address society’s environmental and social challen

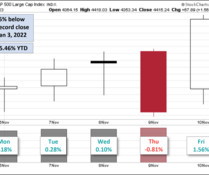

Advisor Perspectives

NOVEMBER 10, 2023

The S&P 500 rose for a second consecutive week, finishing Friday up 1.3% from the previous week. The index has now posted daily gains for 7 of the 8 trading days in November thus far. The index is currently up 15.46% year to date and is 7.95% below its record close from January 3, 2022.

Validea

NOVEMBER 10, 2023

In this episode, we speak with 3Fourteen Research founders Warren Pies and Fernando Vidal. We discuss 3Fourteen’s systematic macro process and how they are using it to analyze the current challenging environment. We also cover a wide range of macro topics, including the importance of the duration of treasury issuance, Fed policy, the changing correlation dynamics of stocks and bonds, their unique drawdown prediction model and their outlook for housing.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Steve Sanduski

NOVEMBER 10, 2023

RIA owners often tell me how frustrated they are that the associate advisors at their firms avoid business development work and seem to plateau. Despite giving their associate advisors opportunities, leads, referral strategies, and help crafting business development plans, they rarely see big results from all that motivating, inspiring, and yes, cajoling.

Carson Wealth

NOVEMBER 10, 2023

We just had one of the best weekly rallies we’ve seen in years. Carson Group’s Chief Market Strategist Ryan Detrick and VP, Global Macro Strategist Sonu Varghese discuss why we might be in for a major rally. Here are a few highlights: The Fed decided to keep rates steady and is likely done hiking Used cars dropped 2% last month Gasoline prices are the lowest we’ve seen all year We still don’t see signs of a recession Looking for more investment insights and market analysis?

Advisor Perspectives

NOVEMBER 10, 2023

If you're close to retiring, beware of the little-known sequence-of-returns risk that could take a huge slice out of your retirement income.

Abnormal Returns

NOVEMBER 10, 2023

Economy Kyla Scanlon talks with David Dayen about the gap between the economy and consumer sentiment. (youtube.com) Justin Carbonneau and Jack Forehand talk all things macro with 3Fourteen Research founders Warren Pies and Fernando Vidal. (youtube.com) Business Matt Reustle talks with Staley Cates about the history of FedEx ($FDX). (joincolossus.com) Jordan Harbinger talks with Chris Miller author of "Chip War: The Fight for the World's Most Critical Technology.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content