FDIC Changes Insurance Coverage of Trust Bank Accounts

Wealth Management

AUGUST 21, 2023

Soon, accounts held by trust may be insured by the FDIC for up to $1,250,000, rather than the current $250,000 limit on many individual accounts.

Wealth Management

AUGUST 21, 2023

Soon, accounts held by trust may be insured by the FDIC for up to $1,250,000, rather than the current $250,000 limit on many individual accounts.

Abnormal Returns

AUGUST 21, 2023

Asset allocation Asset allocation is not a science. (obliviousinvestor.com) Diversification reduces the risk of adverse outcomes. (barrons.com) Strategy Everyone and everything ends up underperforming at some point. (awealthofcommonsense.com) Brett Steenbarger, "Over time, unique returns cannot come from consensus thinking." (traderfeed.blogspot.com) Companies Public benefit corporations wear their values on their sleeves.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 21, 2023

The Wall Street Journal looked at how the retail real estate sector has bounced back from some of the troubles it experienced the past decade. The cost of backing WeWork’s IPO may come back to hurt some other big real estate firms, reports Bisnow. These are among the must reads from around the real estate investment kick off the new week.

The Reformed Broker

AUGUST 21, 2023

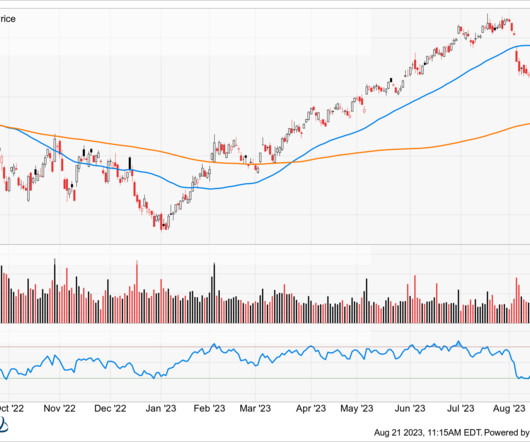

The Relative Strength Index or RSI is typically expressed as a 14-day reading to determine the degree to which a stock or an index is overbought or oversold, if at all. It was created in 1978 by J. Welles Wilder Jr. (here’s the book) who was a mechanical engineer by trade before turning his mathematical mind to stock and commodity trading, subsequently developing some of the most widely traded tools in technical ana.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 21, 2023

The tightening of real estate capital markets could fuel further activity among immigrant investors.

The Big Picture

AUGUST 21, 2023

Source: Adam Khoo , Twitter A preface before we get into this: Michael Burry has proven himself to be a rare fund manager. He has a great ability to identify a variant perception versus the Wall Street consensus and express that view in a deeply researched market position. As we learned in Michael Lewis’ book The Big Short , he had the courage of his conviction to stay with his position even as lots of others opposed it.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

AUGUST 21, 2023

Many financial advisors start their own firm because of an entrepreneurial itch, a desire to work with a specific type of client, or perhaps because they want to have more control over their work life. But typically, the opportunity to create and implement a marketing strategy is not one of these reasons. In fact, data from the latest Kitces Research study, How Financial Planners Actually Market Their Services, shows that many advisors find marketing to be difficult and not very effective.

Wealth Management

AUGUST 21, 2023

Editor in Chief Susan R. Lipp discusses this month's issue.

The Big Picture

AUGUST 21, 2023

My back-to-work morning train WFH reads: • The Legendary, Wildly Profitable QQQ Fund Makes No Money for Its Owner : An historical artifact prevents Invesco from profiting from its flagship ETF. The company’s Q-themed offshoots are finally solving that problem. ( Businessweek ) • The New York Fed President Sees Interest Rates Coming Down With Inflation : In a wide-ranging interview with The New York Times, John C.

Wealth Management

AUGUST 21, 2023

Executive Vice President Bill St. Louis will take over from interim director Christopher Kelly.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

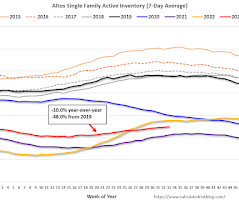

Calculated Risk

AUGUST 21, 2023

Altos reports that active single-family inventory was up 0.9% week-over-week. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of August 18th, inventory was at 497 thousand (7-day average), compared to 492 thousand the prior week. Year-to-date, inventory is up 1.2%. And inventory is up 22.5% from the seasonal bottom 18 weeks ago.

Wealth Management

AUGUST 21, 2023

New York-based fintech advisor Titan Global Capital Management will pay more than $1 million to settle charges it made misleading statements concerning hypothetical performance metrics for its crypto strategy.

Calculated Risk

AUGUST 21, 2023

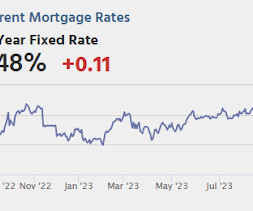

From Matthew Graham at Mortgage News Daily: Another Day in The New, Higher Rate Reality "Higher for longer," they said. And they weren't kidding. There have been some complicating factors over the past 2 weeks, but rising rate momentum is still mostly about the economy. As such, it's the economy that will need to demonstrate a shift before we see meaningful relief.

Wealth Management

AUGUST 21, 2023

Martin M. Shenkman and Joy Matak give advice for explaining to clients the importance of and complexities in filing gift tax returns.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

AUGUST 21, 2023

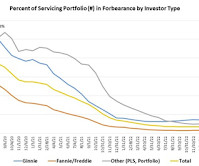

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.39% in July The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31, 2023. According to MBA’s estimate, 195,000 homeowners are in forbearance plans.

Wealth Management

AUGUST 21, 2023

Christopher P. Woehrle looks at the emergence of tax-exempt NIL collectives that operate independently from affiliated universities and colleges.

Calculated Risk

AUGUST 21, 2023

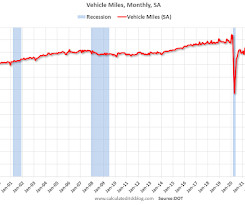

This is something I check occasionally. The Department of Transportation (DOT) reported : Travel on all roads and streets changed by +3.1% (+8.4 billion vehicle miles) for June 2023 as compared with June 2022. Travel for the month is estimated to be 283.0 billion vehicle miles. The seasonally adjusted vehicle miles traveled for June 2023 is 268.9 billion miles, a 2.8% (7.4 billion vehicle miles) change over June 2022.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

AUGUST 21, 2023

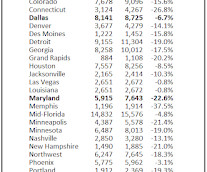

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in July A brief excerpt: Note: The National Association of Realtors (NAR) is scheduled to release July existing home sales tomorrow, Tuesday, August 22nd, at 10:00 AM ET. The consensus is for 4.15 million SAAR, down from 4.16 million last month. Housing economist Tom Lawler expects the NAR to report sales of 4.06 million SAAR for July.

Wealth Management

AUGUST 21, 2023

FiComm has hired Mary Kate Gulick as its new executive vice president of marketing.

Abnormal Returns

AUGUST 21, 2023

Podcasts Jason Wenk and Dasarte Yarnway talk with Michael Kitces about advisor tech and practice management. (altruist.com) Brendan Frazier talks with Libby Greime about creating systems and processes to scale the human-to-human connection. (wiredplanning.com) Michael Kitces talks with Jim Ludwick about turning prospects into clients. (kitces.com) Crypto Securitize is buying Onramp.

Wealth Management

AUGUST 21, 2023

Leverage AI for enhanced client experiences and operational efficiency.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

The Irrelevant Investor

AUGUST 21, 2023

We got an email in response to Ben’s excellent post, You Probably Need Less Money Than You Think For Retirement, that is worth sharing. re : retirees underspending. I retired at 36 and turn 60 next year, and am of course a latedad with a 7 and 5 year old. I estimate I live off 1/3rd of my cash flow, and of course some of my assets are also appreciating.

Wealth Management

AUGUST 21, 2023

And how it could affect advisors.

A Wealth of Common Sense

AUGUST 21, 2023

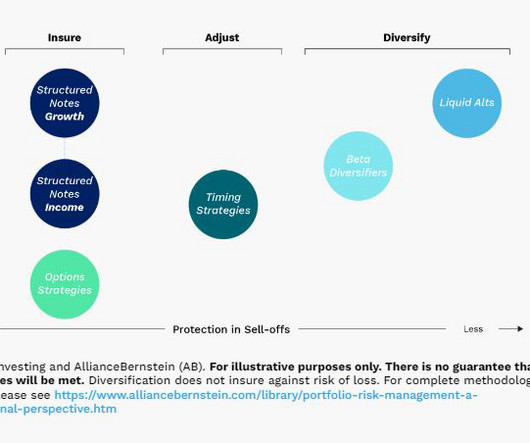

Today’s Animal Spirits is brought to you by Halo Investing: See here for more information on investing with Halo. We had Matt Radgowski, CEO of Halo Investing to discuss an update on structured products. On today’s show, we discuss: Why structured products are more popular internationally Investment trends and structured products Customizing your own assets How advisors are utilizing structured notes in 2023.

Wealth Management

AUGUST 21, 2023

The deal to acquire CTB Financial Services will bring more tax-focused investment strategies to Creative Planning’s client base.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Fintoo

AUGUST 21, 2023

Highlights Issue Size – 32,500,000 shares Issue Open/Close – Aug 22 / Aug 24, 2023 Price Band (Rs.) 102-108 Issue Size- Rs 3,510 mn Face Value (Rs) 2 Lot Size (shares) 130 Aeroflex Industries Ltd (AIL), a subsidiary of SAT Industries manufactures and supplies environment-friendly metallic flexible flow solution products like multiple varieties of hoses, […] The post Aeroflex Industries Ltd IPO (Subscribe) appeared first on Fintoo Blog.

Wealth Management

AUGUST 21, 2023

The acquisition was part of a plan to broaden the firm’s revenue beyond a traditional focus on ultra-wealthy individuals.

Advisor Perspectives

AUGUST 21, 2023

Here are five ways to take your COI relationships to the next level – and maximize your business along the way.

Wealth Management

AUGUST 21, 2023

Evaluation of planning opportunities and potential pitfalls.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content