How Often Are We in a Recession or Bear Market?

A Wealth of Common Sense

JANUARY 21, 2025

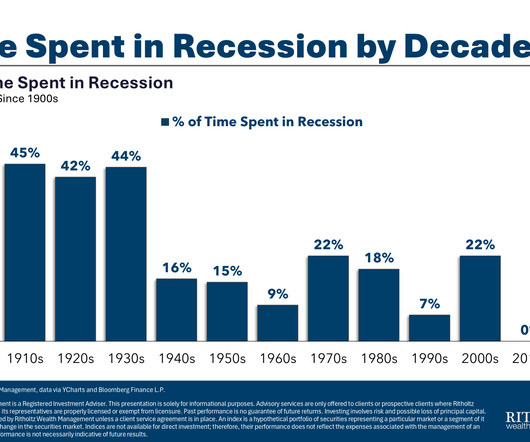

One of my favorite ongoing economic stats is the fact that the U.S. economy has been in a recession for just two months out of the past 15-and-a-half years. We’ve been in a recession just 1% of the time since the end of the Great Financial Crisis in the summer of 2009. Sure, there have been some bumps along the way but the U.S. economy has been remarkably resilient throughout the 2010s and 2020s.

Let's personalize your content