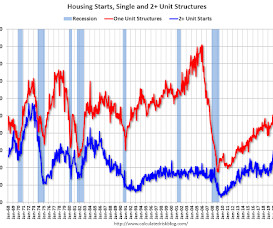

Housing Starts Increased to 1.450 million Annual Rate in February

Calculated Risk

MARCH 16, 2023

From the Census Bureau: Permits, Starts and Completions Housing Starts: Privately‐owned housing starts in February were at a seasonally adjusted annual rate of 1,450,000. This is 9.8 percent above the revised January estimate of 1,321,000, but is 18.4 percent below the February 2022 rate of 1,777,000. Single‐family housing starts in February were at a rate of 830,000; this is 1.1 percent above the revised January figure of 821,000.

Let's personalize your content