FinanceHQ Emerges From Stealth Mode

Wealth Management

OCTOBER 17, 2023

Digital lead generation provider FinanceHQ is banking on its proprietary technology to stand out in a crowded field.

Wealth Management

OCTOBER 17, 2023

Digital lead generation provider FinanceHQ is banking on its proprietary technology to stand out in a crowded field.

Calculated Risk

OCTOBER 17, 2023

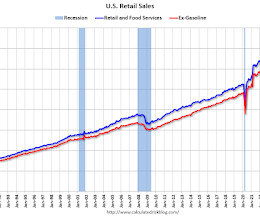

On a monthly basis, retail sales were up 0.7% from August to September (seasonally adjusted), and sales were up 3.8 percent from September 2022. From the Census Bureau report : Advance estimates of U.S. retail and food services sales for September 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $704.9 billion, up 0.7 percent from the previous month, and up 3.8 percent above September 2022.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 17, 2023

The new Fidelity Independence Hub offers information and tools for advisors thinking about striking out on their own.

The Reformed Broker

OCTOBER 17, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Earnings – “Average commercial and consumer loans were both down from the second quarter as higher rates and a slowing economy have weakened loan demand, and we’ve continued to take some credit tighteni.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

OCTOBER 17, 2023

The superstar is on the cusp of becoming ultra-wealthy, which is an opportunity to think about how to honor the sensibilities and economic realities of her young fanbase on an ambitious scale.

Abnormal Returns

OCTOBER 17, 2023

Trend following The case for medium-term trend signals. (mrzepczynski.blogspot.com) The problem with trend following systems: an abundance of parameters. (priceactionlab.com) Research On the corporate bond factor zoo. (papers.ssrn.com) There is still no good explanation for momentum. (alphaarchitect.com) Why post-earnings drift happens. (klementoninvesting.substack.com) Does private credit have a return smoothing problem?

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

OCTOBER 17, 2023

Markets How war affects the markets, largely through higher inflation. (ofdollarsanddata.com) Why TIPS now merit 'serious consideration.' (morningstar.com) Fund management An overview of the short term bond fund space. (morningstar.com) Do investors really understand the return profile of options-writing funds? (etf.com) Private credit Smoothed returns have generated a lot of interest in private credit funds.

Wealth Management

OCTOBER 17, 2023

Several customization and collaboration enhancements to the Decision Center, including full, unlimited editing, are now available, with more on the way.

Calculated Risk

OCTOBER 17, 2023

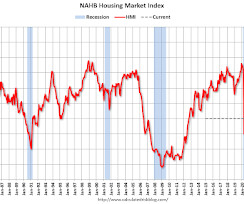

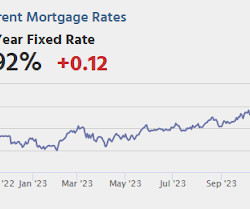

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 40, down from 44 last month. Any number below 50 indicates that more builders view sales conditions as poor than good. From the NAHB: Mortgage Rates Well Above 7% Continue to Hammer Builder Confidence Stubbornly high mortgage rates that have climbed to a 23-year high and have remained above 7% for the past two months continue to take a heavy toll on builder confidence, as sentiment levels have dropped

Wealth Management

OCTOBER 17, 2023

Charles Schwab execs say RIA asset attrition ahead of the Labor Day conversion was less than expected, even with a “substantial” number of RIAs actively booted in the TD Ameritrade merger.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

OCTOBER 17, 2023

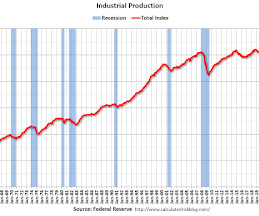

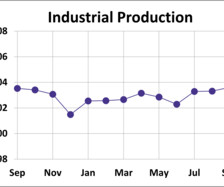

From the Fed: Industrial Production and Capacity Utilization Industrial production increased 0.3 percent in September and advanced at an annual rate of 2.5 percent in the third quarter. Manufacturing output rose 0.4 percent in September, the index for mining moved up 0.4 percent, and the index for utilities decreased 0.3 percent. At 103.6 percent of its 2017 average, total industrial production in September was 0.1 percent above its year-earlier level.

Wealth Management

OCTOBER 17, 2023

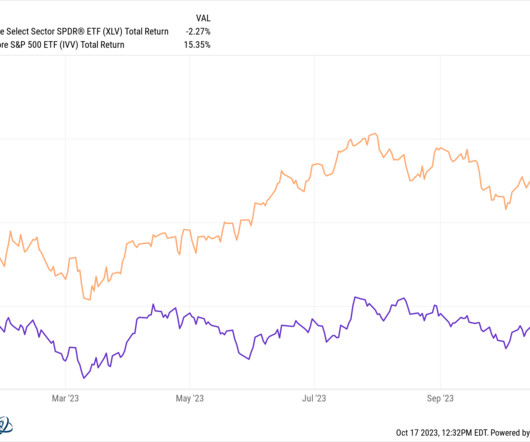

Zephyr Market Strategist Ryan Nauman reviews the current investment environment.

Calculated Risk

OCTOBER 17, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:30 AM, Housing Starts for September. The consensus is for 1.405 million SAAR, up from 1.283 million SAAR. • During the day, The AIA/Deltek's Architecture Billings Index for September (a leading indicator for commercial real estate). • At 2:00 PM, the Federal Reserve Beig

Wealth Management

OCTOBER 17, 2023

Choice Hotels International offered $9.8 billion in stock and debt assumption to buy out Wyndham Hotels & Resorts, reports CoStar News. Cohen & Steers looked at what the September selloff in publicly-traded REITs said about the market. These are among today’s must reads from around the commercial real estate industry.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

OCTOBER 17, 2023

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in September A brief excerpt: From housing economist Tom Lawler: Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.00 million in September , down 1.0% from August’s preliminary pace and down 14.5% from last September’s seas

Wealth Management

OCTOBER 17, 2023

Snowden Lane Partners: A calibrated blend of autonomy and support.

Nerd's Eye View

OCTOBER 17, 2023

Welcome back to the 355th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Brad Arends. Brad is the Co-Founder & CEO of Intellicents, an independent RIA with 12 offices across the country and headquartered in Albert Lea, Minnesota, that oversees $6 billion in assets under management for more than 3,000 client households.

Wealth Management

OCTOBER 17, 2023

An erroneous report that BlackRock had won approval to launch a spot ETF rapidly sent the largest digital asset to $30,002 on Monday, the highest price since August.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

A Wealth of Common Sense

OCTOBER 17, 2023

Like many retirees, Henry Flagler decided to spend his later years on the sunny beaches of Florida. However, Flagler wasn’t there to relax and drink Pina Coladas. No, the former oil tycoon was there to build up the coastlines, railroads, and cities before Florida was even a destination. Flagler was a partner of John Rockefeller’s at Standard Oil.

Wealth Management

OCTOBER 17, 2023

When markets are performing poorly, clients’ portfolio values can decline, giving clients the sense that they aren’t making progress toward goals and those goals seem harder to achieve.

Million Dollar Round Table (MDRT)

OCTOBER 17, 2023

By Corey Williams I used to create my annual goals in January, but it always felt like it was the end of January before I was kicking into it. So, I pulled my annual goals back from doing them in January to December, but it still felt like I was lagging in the new year. Now, I plan my goals in October or November for the upcoming year. When I start earlier, I feel like I’m getting ahead of the game and getting a good run into things.

Wealth Management

OCTOBER 17, 2023

“By selling United Capital and by selling PFM … it allows us to take the resources and the investment we might’ve geared toward growing that and add it to our investment in ultra-high-net-worth growth,” said Goldman CEO David Solomon.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

NAIFA Advisor Today

OCTOBER 17, 2023

NAIFA's Chapter Excellence Award (CEA) was launched this year to recognize the success of those Chapters that have excelled in providing a quality member experience to their members, as determined by their Chapter Agreement Compliance, their Chapter Health Rating, and membership growth. Congratulations to this year's Chapter Excellence Award winners!

Wealth Management

OCTOBER 17, 2023

Merrill added about 33,500 net new client relationships year-to-date, according to the firm's third quarter earnings. Wells Fargo also announced earnings this week, with mixed results for its wealth management business.

Trade Brains

OCTOBER 17, 2023

Best Multibagger Stocks in the Last 10 Years : Multibagger stocks are those that have returned 100% or more in a specific time period. Meaning, if you invested Rs. 1 lakh into a Multibagger it would return 2 lakh or more within that specified time period. Best Multibagger Stocks in the Last 10 Years In this article about Best Multibagger Stocks in the Last 10 Years, we shall see the stock fundamentals, and their 10year returns Best Multibagger Stocks in the Last 10 Years #1 – The Fertiliz

Wealth Management

OCTOBER 17, 2023

Monday, November 06, 2023 | 2:00 PM ET

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Trade Brains

OCTOBER 17, 2023

On Door Concepts IPO Review : On Door concepts is coming up with its Initial public offering. This is an SME (small and medium-sized enterprise) which is going to be listed on NSE SME. The IPO will be open for subscription on 23rd October 2023 and closes on 27th October 2023. This article about On Door Concepts IPO Review, including an in-depth analysis of the company’s financials and the strengths and weaknesses of On Door concepts.

The Irrelevant Investor

OCTOBER 17, 2023

Today’s Animal Spirits is brought to you by iShares and Kaplan See here for more information on investing in the iShares Semiconductor ETF See here for more information on Kaplans Chartered Retirement Plan Specialist designation program On today’s show, we discuss: The Fed is pleased with recent inflation data What was the cost of the COVID stimulus?

Advisor Perspectives

OCTOBER 17, 2023

Industrial production rose for a third straight month in September, surpassing expectations yet again. On a monthly basis, industrial production rose 0.3%, outpacing the projected 0.1% growth. Additionally, compared to one year ago, industrial production showed an increase of 0.08%.

Carson Wealth

OCTOBER 17, 2023

Carson Groups’ Ryan Detrick shares key events we saw in the past quarter and how we think they’ll affect markets in the rest of 2023. Contact us to speak with a financial advisor. The post 2023 Highlights: Q4 Update appeared first on Carson Wealth.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content