Podcast links: creating and learning

Abnormal Returns

OCTOBER 27, 2023

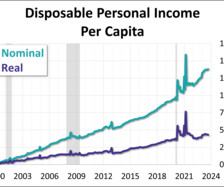

Economy Barry Ritholtz talks with Bethany McLean, co-author of "The Big Fail: What the Pandemic Revealed About Who America Protects and Who It Leaves." (ritholtz.com) Eric Golden talks 'greedflation' and more with Samuel Rines who is the managing director of Corbu LLC. (joincolossus.com) Venture capital Rick Buhrman and Paul Buser talk with Ho Nam who is the co-founder of Altos Ventures.

Let's personalize your content